Aircraft Galley Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2021 |

| CAGR | 4.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

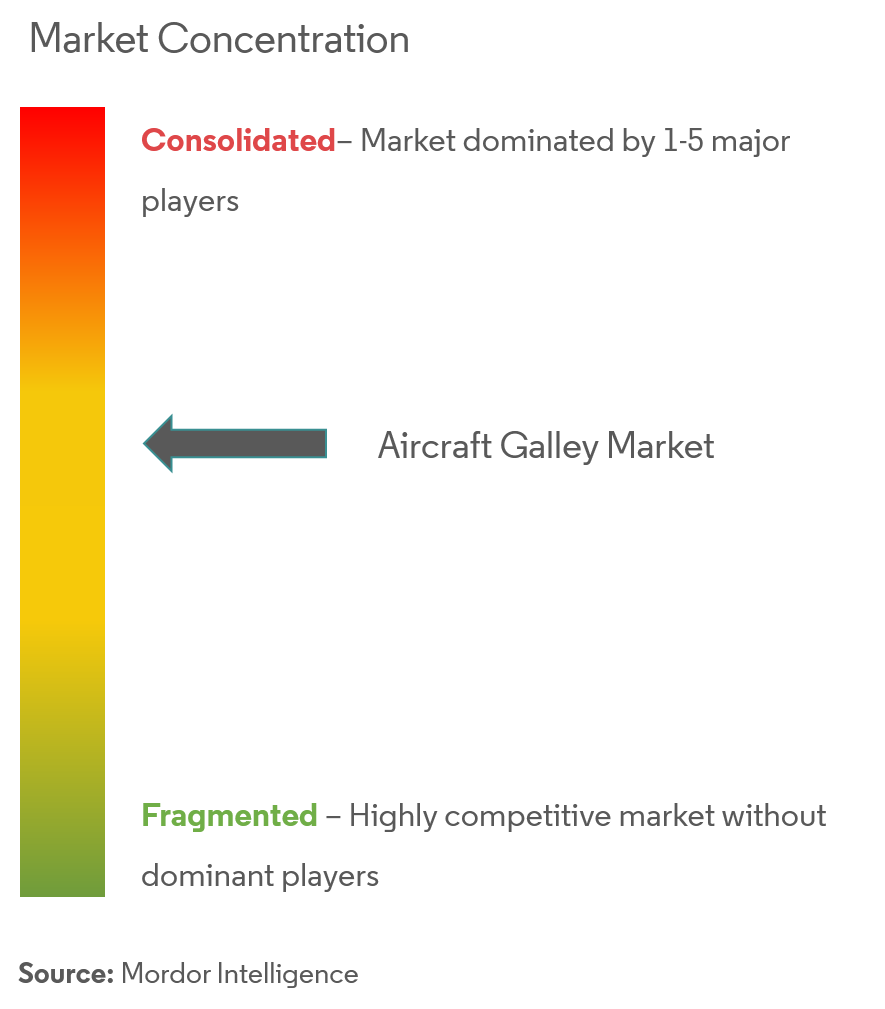

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Aircraft Galley Market Analysis

The aircraft galley market is poised to grow at a CAGR of 4% during the forecast period 2022-2027. An aircraft galley is crucial for facilitating the services offered to the passengers by the cabin crew. Aircraft galleys significantly enhance the airline's flight experience in terms of the plethora of meal options served to the onboard passengers during a flight.

Due to the COVID pandemic, there had been a decline in new aircraft deliveries in 2020, resulting in a significant decrease in the aircraft galley demand. Fleet modernization and upkeep to meet COVID-19 regulations for operations by airlines during 2020 and 2021 have helped keep the market alive. In 2021 commercial aviation saw a significant restoration of air travel and resumption of aircraft deliveries, resulting in improved market expectations.

The low-cost carrier (LCC) model focuses on increasing the number of onboard passengers while providing limited services as pay-per-demand. The increasing global market penetration of LCCs has resulted in design challenges to adjust to space constraints inside an aircraft, forcing the galley designers to reduce the size and weight of the galley equipment. Technological and design complexity are certain challenges for the manufacturers of the aircraft galley market.

Aircraft Galley Market Trends

This section covers the major market trends shaping the Aircraft Galley Market according to our research experts:

Growth in Air Passenger Traffic Resulting in Procurement of Aircraft

After the travel restrictions, which were placed due to the COVID pandemic in 2020, were lifted partially, there was significant growth in air passenger traffic in 2021 compared to 2020. In 2022 air passenger traffic has increased with the complete lifting of restrictions. According to recent reports by the International Air Transport Association(IATA), the air passenger traffic in March 2022 was more than 76% compared to that in March 2021. With the increased air passenger traffic, many airlines increased their fleet size and modernized the existing aircraft.

In 2021 Airbus delivered a total of 611 commercial aircraft, more than in the preceding year, 2020. Boeing delivered 340 commercial aircraft in 2021, which is almost double the aircraft the company delivered in 2020, which are 157. Galleys installed onboard these aircraft are utilized to cater to the passengers' wide range of food and drinks preferences. Hence, the inserts of a modern galley include several luxurious types of equipment, such as espresso machines and wine chiller inserts.

Since airlines perceive differentiated service as a means to enhance their market presence and brand image, the procurement of new-generation aircraft would drive the integration of aircraft galleys, thereby driving the business prospects of the aircraft galley market.

Increasing Demand from Asia-Pacific

The robust economic growth, favorable population, and demographic profiles of the populace in developing countries in the Asia-Pacific region are driving the air passenger traffic in the region. The region has seen a significant increase in air passenger traffic during the past decade, mostly due to the tourist destinations in the region and the ease of access to air travel, which is expected to continue during the forecast period.

According to Boeing Commercial Market Outlook, China is expected to account for 20% of the total commercial aircraft deliveries by 2040. According to Airbus, the region would require more than 17,600 new aircraft by 2040, given the passenger growth in the region, which according to Airbus, will be 5.3% yearly.

30% of the total deliveries made by Airbus in 2021 were made to the Asia-Pacific region, the largest share of aircraft deliveries worldwide. The Qantas Group in Australia has started operating in new routes, increasing the demand for new aircraft. New regional airlines such as Akasa Air in India and Bonza in Australia have increased demand for new aircraft.

Akasa Air had placed an order for 72 new aircraft in November 2021, of which 1 aircraft was delivered in June 2022. By 2027, China is forecasted to become the world's largest aviation market in terms of air traffic, and India is forecasted to develop into the world's third-largest aviation market, while other countries such as Indonesia and Thailand are forecasted to enter the top 10 global markets. Such favorable trends are anticipated to drive the demand for aircraft galleys in the region.

Aircraft Galley Industry Overview

The aircraft galley market is characterized by the presence of a limited number of dominant vendors operating at a global level. The market is highly competitive, with players competing to gain the largest market share. Constraints associated with the design and weight of aircraft galley and cancellation of aircraft orders due to macroeconomic factors impede the growth of the market. It is crucial for vendors to provide advanced systems to aircraft OEMs to survive in an intensely competitive market environment.

The dominant market players include United Technologies Corporation, JAMCO Corporation, Safran SA, Diehl Stiftung & Co. KG, and AIM Altitude. These players mainly compete based on their in-house manufacturing capabilities, global footprint network, product offerings, R&D investments, and a strong client base.

The increased aircraft procurement rate due to the rapid increase in air passenger traffic is expected to fuel the market growth during the forecast period. The competitive environment in the market is likely to intensify further due to an increase in product/service extensions and technological innovations.

Aircraft Galley Market Leaders

JAMCO Corporation

Safran SA

Diehl Stiftung & Co. KG

AIM Altitude

Raytheon Technologies Corporation

*Disclaimer: Major Players sorted in no particular order

Aircraft Galley Market News

In March 2022, TCI Turkish Cabin Interior signed an agreement with Lynx Air, Canada's affordable airline, to design and manufacture interior products, including galleys in their fleet of 40 Boeing 737 MAX 8 aircraft.

In February 2022, Bucher shipped the first set of fully customized galleys and stowages to Airbus Toulouse for their integration into the new STARLUX A330-900neo.

In August 2021, Safran introduced the MaxFlex galley for the Boeing 737 family. MaxFlex galley provides maximum flexibility, infinite combinations, and easy maintenance. More than 2,000 MaxFlex galleys are installed in aircraft.

Aircraft Galley Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints

4.4 Industry Attractiveness - Porter's Five Forces Analysis

4.4.1 Threat of New Entrants

4.4.2 Bargaining Power of Buyers/Consumers

4.4.3 Bargaining Power of Suppliers

4.4.4 Threat of Substitute Products

4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 Aircraft Type

5.1.1 Single-aisle

5.1.2 Twin-aisle

5.1.3 Business Jets

5.2 Geography

5.2.1 North America

5.2.1.1 United States

5.2.1.2 Canada

5.2.2 Europe

5.2.2.1 Germany

5.2.2.2 United Kingdom

5.2.2.3 France

5.2.2.4 Rest of Europe

5.2.3 Asia-Pacific

5.2.3.1 China

5.2.3.2 Japan

5.2.3.3 India

5.2.3.4 Rest of Asia-Pacific

5.2.4 Latin America

5.2.4.1 Mexico

5.2.4.2 Brazil

5.2.4.3 Rest of Latin America

5.2.5 Middle-East and Africa

5.2.5.1 United Arab Emirates

5.2.5.2 Saudi Arabia

5.2.5.3 Egypt

5.2.5.4 Rest of Middle-East and Africa

6. COMPETITIVE LANDSCAPE

6.1 Vendor Market Share

6.2 Company Profiles

6.2.1 Aerolux Ltd.

6.2.2 AIM Altitude

6.2.3 United Technologies Corporation

6.2.4 Bucher Group

6.2.5 Commercial Aircraft Equipment

6.2.6 Diehl Stiftung & Co. KG

6.2.7 Dynamo Aviation Inc.

6.2.8 JAMCO Corporation

6.2.9 Korita Aviation

6.2.10 MAPCO & Miller Metal MFG

6.2.11 TCI Turkish Cabin Interior

6.2.12 Safran SA

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Aircraft Galley Industry Segmentation

The aircraft galley market considers the different companies that offer both electrical and non-electrical inserts of the galleys in order to provide a comprehensive qualitative outlook. Market estimates are based on linefit installations of galleys into the cabin of new generation aircraft being procured by airline operators around the globe and are exclusive of the retro fitment of individual galley inserts.

The aircraft galley market is segmented based on type and geography. By type, the market is segmented into single-aisle, twin-aisle, and business jets. The report also covers the market sizes and forecasts for the market in major countries across North America, Europe, Asia-Pacific, Latin America, and Middle-East and Africa. For each segment, the market sizing and forecasts have been represented based on value (USD million).

| Aircraft Type | |

| Single-aisle | |

| Twin-aisle | |

| Business Jets |

| Geography | ||||||

| ||||||

| ||||||

| ||||||

| ||||||

|

Aircraft Galley Market Research FAQs

What is the current Aircraft Galley Market size?

The Aircraft Galley Market is projected to register a CAGR of 4% during the forecast period (2023-2028).

Who are the key players in Aircraft Galley Market?

JAMCO Corporation, Safran SA, Diehl Stiftung & Co. KG, AIM Altitude and Raytheon Technologies Corporation are the major companies operating in the Aircraft Galley Market.

Which is the fastest growing region in Aircraft Galley Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2028).

Which region has the biggest share in Aircraft Galley Market?

In 2023, the North America accounts for the largest market share in the Aircraft Galley Market.

Aircraft Galley Industry Report

Statistics for the 2023 Aircraft Galley market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Aircraft Galley analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.