Canada Project Logistics Market Size

| Study Period | 2019 - 2028 |

| Base Year For Estimation | 2021 |

| Forecast Data Period | 2024 - 2028 |

| Historical Data Period | 2019 - 2020 |

| CAGR | > 2.50 % |

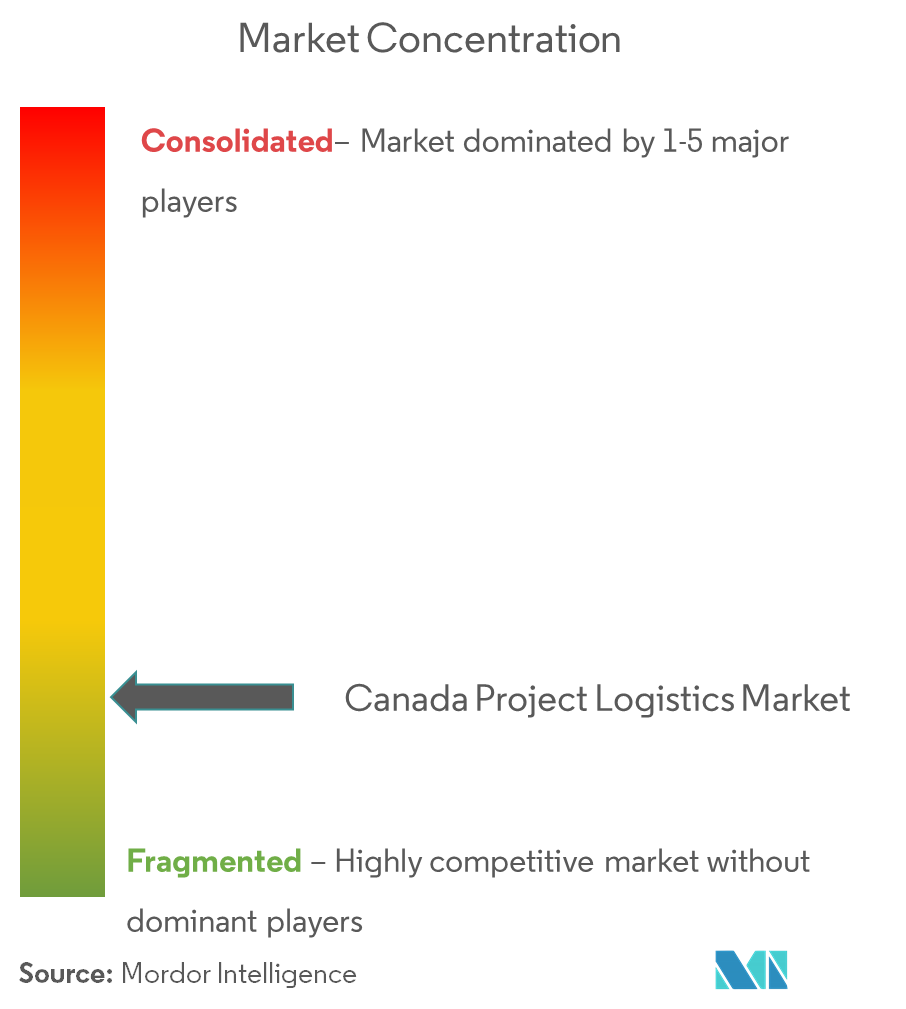

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Canada Project Logistics Market Analysis

The market for Project logistics in Canada is anticipated to grow at a CAGR of more than 2.5% during the forecast period (2019-2024).

- Canada is the second largest country in the world and offers a vast source of natural resources which drive the economy of the nation. These natural resources include energy sources such as oil & gas, coal, renewables, minerals such as gold, silver, etc. New projects for extracting these natural resources and expansion of large projects requires shipping of heavy project cargo in the country.

- Western Canada is an important source for these natural resources and has a lot of major projects. Alberta is home to large amount of Oil Sands and also has one of the best over-sized load transport corridors in the world. On the other hand, the Eastern Canada has a lot of infrastructure developments. Among the infrastructure projects, the construction of bridges especially requires transportation of over-sized cargo. Hauling a larger-than-usual load involves logistical as well as legal challenges.

- As the world is becoming more digitized every day, communication is becoming instant. The companies involved in project cargo business needs to adapt digital technologies such as a mobile app or a software to communicate easily with engineering firms and project owners.

Canada Project Logistics Market Trends

This section covers the major market trends shaping the Canada Project Logistics Market according to our research experts:

Need for high load corridors is rising

The inland transport of heavy cargo is very complicated and the vast distances from port to door, coupled with weather conditions and road restrictions during the spring makes it challenging for companies to move out-of-gauge loads. The Ports of Montreal, Vancouver, and Halifax are the major ports for general cargo in Canada. According to industrial sources, most of the project cargo is observed in the ports of Vancouver and Halifax. However, super-loads destined for Canada are generally observed in the ports of Houston, Tacoma, and Baltimore in US.

A coalition of transport organizations and ports in Pacific Northwest are working to entice heavy cargo to Pacific Northwest ports. A fund of approximately USD 500,000 has been raised by them for a proposed 1,300-mile multimodal high, wide, and heavy transport corridor. Most of the cargo imported from Asia and destined to western North America is imported via US Gulf ports, the proposed transport corridor eases the transit of energy and infrastructure project cargoes. A feasibility study was produced for moving mega-loads of up to 500 tons from Columbia River inland ports to Montana, which is the major port of entry into Canada. The proposed inland route could save nearly 1000 miles on US-Canada leg alone. The cargo discharged at Pacific Northwest ports is as much as 28 days and 6,209 miles closer to Canadian destinations than cargo shipped through the Panama Canal and discharged at Houston or other Gulf ports. This could save the transportation costs for heavy cargo transported to western Canada as well as can boost the project cargo movement through the port of Vancouver. As per the estimates of the coalition, the savings in transportation and other logistics costs could reach USD 5 million per shipment.

Some of the areas in the country face challenges in transport over-sized cargo due to lack of a dedicated road network able to handle such loads and it also results in high transportation costs. For instance, Ontario lacks a permanent highway network that can transport large equipment and fabricated components without lifting power lines or making detours to avoid standard-sized bridges. According to a study in 2015, over-sized cargo can be supplied faster from international locations such as South Korea through Houston to Fort McMurray on a permanent over-dimension corridor than from a location near Toronto.

Oil & Gas Project Logistics in Canada

The project cargo market across the globe is expected to be boosted by rise in oil prices through the short-term. However, the oil prices are expected to decrease over the long-term which leads to decline in new project investments. Canada has the world’s third-largest crude oil reserves, after Venezuela and Saudi Arabia, more than 95% of which are comprised of oil sands reserves in Alberta and Saskatchewan. The provinces of Alberta, Saskatchewan, and British Columbia share the sedimentary basin for natural gas production in Canada. The oil and natural gas industry is a key driving force in the Canadian economy that accounts for approximately 7% of Canada’s GDP and employs more than 500,000 people. The nation’s oil and gas and mining sectors are premier export markets for the US providers of machinery, equipment and related supply chain goods and services.

Alberta remains as the top region, followed by Saskatchewan. Across the North, the oil and gas industry is far less active. Production is in long-term decline in the Northwest Territories and remains minimal in Yukon. Canada’s oil sands resources exist in three major deposits in Alberta: Athabasca, Cold Lake, and Peace River. Athabasca, the largest in size and resource, is home to the surface mineable region. All other bitumen must be produced in situ or by drilling. The projects in the oil & gas sector requires transportation of large structures such as pump boxes, pressure vessels, storage tanks, and other related components.

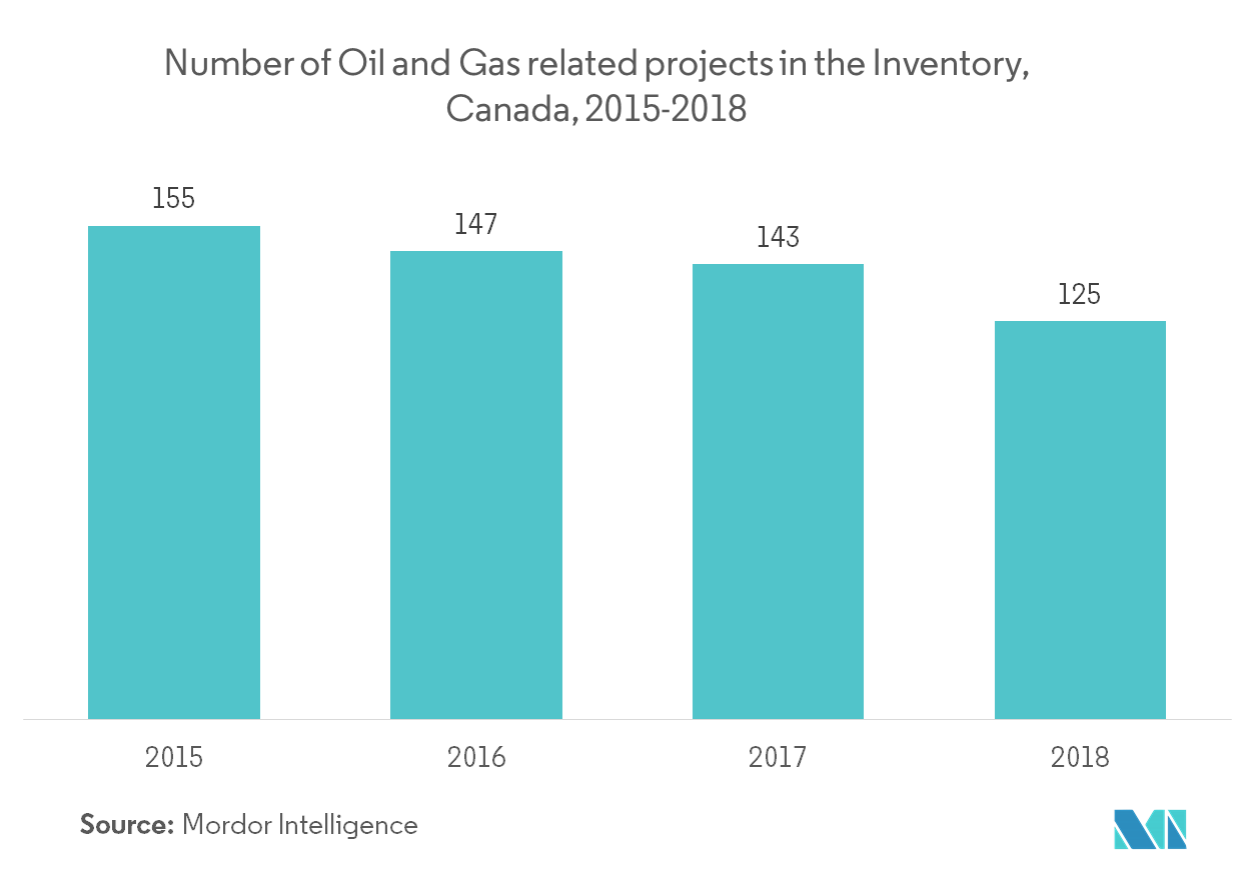

As of June 2018, there are 125 oil and gas projects in the inventory with a combined capital cost of CAD 393 billion, which represents the projects that are either under construction or planned in the next 10 years. The total energy sector projects are valued at CAD 510 billion, which includes electricity and other projects. Oil and gas accounts for 77% of the total value of energy projects in the inventory. Out of the total 125 projects in the oil and gas sector, there are 51 oil sands-related projects (e.g., in situ, mining, upgrading and refining) in the inventory, representing CAD 137 billion in potential investment.

Canada Project Logistics Industry Overview

The project logistics market in Canada is fragmented in nature due to presence of a large number of players involved in provision of project cargo services. Consolidation is the current trend being focused by the logistics provider in order to expand the presence and services offered. Similar trends were also observed in Canadian logistics market as well as in specific to project logistics.

For instance, Germany based Rhenus Group has expanded to Canada by acquiring Canadian logistics provider Rodair in March 2019. Rodair is specialized in providing customized logistics solutions and the core businesses of the company include international freight forwarding, project logistics, courier services, warehousing and distribution, third-party logistics services, and e-commerce solutions. In April 2018, one of the largest heavy-hauling and oversized transportation consortiums was formed in Eastern Canada by three prominent enterprises in Quebec. Quebec Stevedoring Limited (QSL), Groupe Robert (Watson and Sycamore) and Express Mondor together signed an agreement to create Mondor-Watson, which targets markets in both the United States and Canada. QSL is the majority shareholder of the new entity, while Mondor runs daily operations.

Apart from just transporting the heavy cargo, the companies should be capable of handling multiple tasks such as securing transport clearances, securing trained personnel, obtaining lifting and securing certified equipment, co-ordination with multiple contractors throughout the project.

Canada Project Logistics Market Leaders

Cole International Inc.

Challenger Motor Freight Inc.

ENTREC Corporation

Ex Trans Cargo Inc.

Sea Cargo Air Cargo Logistics Inc. (SCACLI)

*Disclaimer: Major Players sorted in no particular order

Canada Project Logistics Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

2.1 Analysis Methodology

-

2.2 Research Phases

-

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS AND INSIGHTS

-

4.1 Current Market Scenario

-

4.2 Market Dynamics

-

4.2.1 Drivers

-

4.2.2 Restraints

-

4.2.3 Opportunities

-

-

4.3 Industry Attractiveness - Porter's Five Force Analysis

-

4.4 Value Chain / Supply Chain Analysis

-

4.5 Government Regulations and Initiatives

-

4.6 Technological Trends

-

4.7 Insights on Steel Industry in Canada

-

4.8 Brief on Metal Fabrication Industry in Canada

-

4.9 Spotlight - Effect of shift from NAFTA to USMCA on Canadian Logistics Industry

-

4.10 Elaboration on Risks Involved in Project Cargo Movement

-

-

5. MARKET SEGMENTATION

-

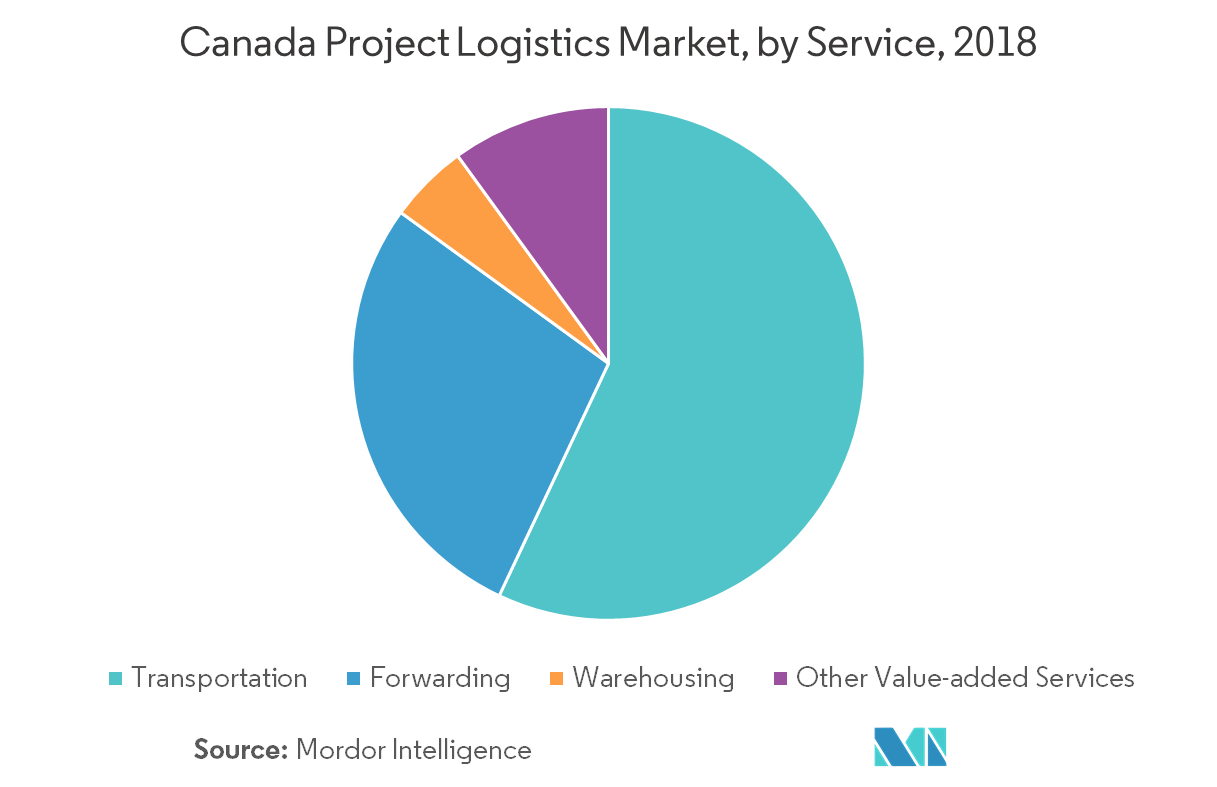

5.1 By Service

-

5.1.1 Transportation

-

5.1.2 Forwarding

-

5.1.3 Warehousing

-

5.1.4 Other Value-added Services

-

-

5.2 By End-user

-

5.2.1 Oil and Gas, Petrochemical

-

5.2.2 Mining and Quarrying

-

5.2.3 Energy and Power

-

5.2.4 Construction

-

5.2.5 Manufacturing

-

5.2.6 Other End-Users (Aerospace & Defense, Automotive, etc.)

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Overview (Market Concentration, Major Players)

-

6.2 Company Profiles (including Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements)

-

6.2.1 Logistics Companies

-

6.2.1.1 Agility Logistics Pvt. Ltd.

-

6.2.1.2 Cole International Inc.

-

6.2.1.3 Convoy Logistics Providers Ltd.

-

6.2.1.4 Sea Cargo Air Cargo Logistics Inc. (SCACLI)

-

6.2.1.5 Canaan Group

-

6.2.1.6 Yusen Logistics Co. Ltd.

-

6.2.1.7 Ex Trans Cargo Inc.

-

6.2.1.8 T-Lane Nation

-

6.2.1.9 Challenger Motor Freight Inc.

-

6.2.1.10 ENTREC Corporation*

-

-

6.2.2 Engineering/EPC Companies

-

6.2.2.1 Stantec Inc.

-

6.2.2.2 SNC-Lavalin Group Inc.

-

6.2.2.3 WSP Global Inc.

-

6.2.2.4 PCL Construction

-

6.2.2.5 Hatch Ltd.

-

6.2.2.6 Bantrel Co.

-

6.2.2.7 Golder Associates Inc.

-

6.2.2.8 CIMA+*

-

-

6.2.3 Other companies (Key Information/Overview)

-

6.2.3.1 Deutsche Post DHL Group (DHL Global Forwarding), DB Schenker, Pantos Logistics Canada Inc., Rohde & Liesenfeld Canada Inc., Falcon International Inc., Rhenus Logistics (Rodair Group), Mammoet, Express Mondor, Manitoulin Group of Companies, Mullen Group, Rohlig Logistics, PF Collins, FLS Transportation Services, Pantos Co. Ltd., ACE Express Canada Logistics Inc., Ambercor Shipping Inc., Conceptum Logistics GmbH, Deugro (Canada) Inc., ITN Logistics, Golden Freight Forwarding and Marketing Inc., TH Logistics Inc./Landstar Canada, Canadian National Railway Company, Protos Shipping Limited*

-

-

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

-

8. APPENDIX

-

8.1 GDP Distribution, by Activity and Region

-

8.2 Insights on Capital Flows

-

8.3 Economic Statistics - Transport and Storage Sector, Contribution to Economy

-

8.4 External Trade Statistics - Export and Import, by Product and by destination

-

8.5 List of major upcoming and ongoing projects in Canada

-

Canada Project Logistics Industry Segmentation

A complete background analysis of Canada project logistics market, market overview, market size estimation for key segments and emerging trends by segments, and market dynamics are covered in the report.

| By Service | |

| Transportation | |

| Forwarding | |

| Warehousing | |

| Other Value-added Services |

| By End-user | |

| Oil and Gas, Petrochemical | |

| Mining and Quarrying | |

| Energy and Power | |

| Construction | |

| Manufacturing | |

| Other End-Users (Aerospace & Defense, Automotive, etc.) |

Canada Project Logistics Market Research FAQs

What is the current Canada Project Logistics Market size?

The Canada Project Logistics Market is projected to register a CAGR of greater than 2.5% during the forecast period (2023-2028).

Who are the key players in Canada Project Logistics Market?

Cole International Inc., Challenger Motor Freight Inc., ENTREC Corporation, Ex Trans Cargo Inc. and Sea Cargo Air Cargo Logistics Inc. (SCACLI) are the major companies operating in the Canada Project Logistics Market.

Canada Project Logistics Industry Report

Statistics for the 2023 Canada Project Logistics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Canada Project Logistics analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.