Chocolate Market Size

| Study Period | 2017-2027 |

| Market Size (2023) | USD 111.97 Billion |

| Market Size (2028) | USD 133.18 Billion |

| CAGR (2023 - 2028) | 3.53 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Europe |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Chocolate Market Analysis

The Chocolate Market size is expected to grow from USD 111.97 billion in 2023 to USD 133.18 billion by 2028, at a CAGR of 3.53% during the forecast period (2023-2028).

- The market's key factors include growing demand for organic, vegan, sugar-free, and gluten-free chocolates. With increasing awareness about the negative effects of synthetic products on health and the environment, most health-conscious and informed consumers have started using organic products. Furthermore, seasonal demand plays an important role in the sales of premium chocolates. Various companies launch a wide range of chocolate varieties during Easter, Christmas, and other occasions. Additionally, functional chocolates for health-conscious customers are gaining popularity among consumers.

- For instance, in March 2022, the 'Functional Chocolate Company' launched vegan dark chocolate along with a combination of condition-specific nutraceuticals, including vitamins, minerals, botanicals, and amino acids, to assist in addressing a variety of everyday health concerns, such as sleep, energy, stress, and attention.

- One of the trends in the chocolate market is the increase in demand for artisanal chocolates, with some companies opening their own shops and using them to promote their brands. The unique flavor of cocoa beans is emphasized as the trend moves toward quality. Fresh cocoa beans are used to make these items, which are then carved into chocolates by small-scale chocolatiers. Companies hire artisans to work with cocoa farmers to compete with other players in the market to choose the desired quality beans, which are then roasted, ground, and polished into chocolate.

Chocolate Market Trends

This section covers the major market trends shaping the Chocolate Market according to our research experts:

Increasing Demand for Single-Origin and Certified Chocolate

- The demand for fine flavour cocoa in regions like Europe and North America is experiencing substantial growth. Ultra and high-end beans are used for gourmet chocolates. Regular and low-fine beans are used for regular premium chocolates, especially in countries like the United Kingdom, Brazil, the United States, China, India, the Netherlands, Germany, and Switzerland. This development is driven by the health trend and the quest for more exclusive products. The premium cocoa market, with sustainability certification and single-origin, accelerates the market's overall growth.

- In response to the propelling demand, manufacturers are introducing their single-origin and premium chocolate line-ups. These strategies are helping brands gain more profit margins and grow with a more positive brand image. For instance, according to a news published by 'New Foundland & Labor, Canada, in 2022, the first bean-to-bar chocolate firm in Canada was born out of a tiny venture that started as an idea and involved plenty of chocolate sampling.

- Jacobean Studio Inc., a Mount Pearl, Canada, is expected to benefit from the provincial government's support as it works to improve its marketing and production operations. Jacobean creates a variety of goods using cacao from Mexico and Peru, such as inclusion bars with Newfoundland and Labrador berries and single-origin bars.

Europe Dominates the Market

- European consumers place greater emphasis on the quality of chocolates, owing to increasing health concerns involving cheaper chocolates in the region and a surge in the popularity of fine cocoa. Therefore, European consumers are willing to pay more for chocolate products that meet their demands.

- The European consumer’s paradigm shift toward high-quality chocolate products (such as single-origin chocolates, organic chocolates, handmade chocolates, artisan chocolates, etc.) is a significant factor driving the chocolate market in the region. There is a tremendous demand for dark chocolates, as they have lower amounts of sugar paired with the rich bitter taste of concentrated cocoa.

- The UK market is one of the significant chocolate-consuming markets in Europe. Plain chocolate is the most popular choice. However, premium chocolates are gaining traction, with consumer preference growing toward premium dark chocolate. In addition, Britain’s confectionery sales have been on the rise, with an increase in the demand for chocolate targeted toward a specific set of consumers.

- Companies also focus on developing free-from and vegan chocolates to capture the growing demand. For instance, Godessi Limited offers premium chocolates in different flavors, such as walnut and cinnamon, orange and cinnamon, peppermint, and raspberry and almonds. The chocolates are gluten-free, dairy-free, soy-free, and vegan and, thus, meet the special dietary needs of the consumers.

Chocolate Industry Overview

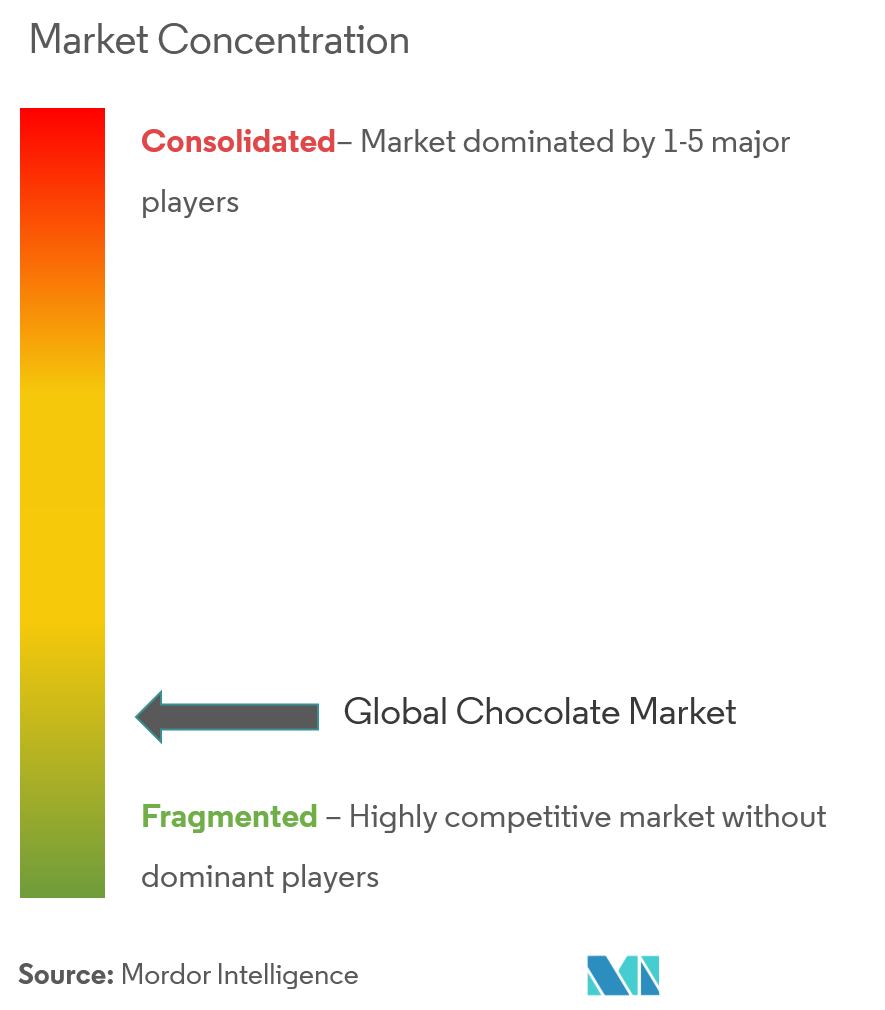

The chocolate market is fragmented with the presence of both regional and international players such as Mars Incorporated, Yildiz Holdings, and Ferrero International SA. The major players continuously focus on product innovation with the launch of premium chocolates worldwide. Furthermore, manufacturers in the market studied have been largely focusing on chocolates for special occasions, such as Valentine's Day, Easter, and Christmas, by offering special chocolates in different colors and shapes, matching the theme of the celebration.

Chocolate Market Leaders

Mars, Incorporated

The Hershey Company

Mondelez International

Nestle SA

Ferrero International S.A.

*Disclaimer: Major Players sorted in no particular order

Chocolate Market News

- In February 2022, Hershey’s created a chocolate bar to celebrate All Women and Girls. This limited edition was named "Celebrate SHE" bars. The brand highlighted 'SHE' at the center of the milk chocolate bar.

- In February 2022 Lindt Japan released new Sakura and Cream Lindor chocolate balls for sale in Japan. These chocolates are made with white chocolate

- In September 2021, Ferrero launched a new version of its products, 'Ferrero Rocher Tablets' into the travel-retail channel in partnership with Lagardère.

Chocolate Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Deliverables and Study Assumptions

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 Type

5.1.1 Dark Chocolate

5.1.2 Milk and White Chocolate

5.2 Distribution Channel

5.2.1 Supermarkets/Hypermarkets

5.2.2 Convenience Stores

5.2.3 Online Stores

5.2.4 Other Distribution Channels

5.3 Geography

5.3.1 North America

5.3.1.1 United States

5.3.1.2 Canada

5.3.1.3 Mexico

5.3.1.4 Rest of North America

5.3.2 Europe

5.3.2.1 Spain

5.3.2.2 United Kingdom

5.3.2.3 Germany

5.3.2.4 France

5.3.2.5 Italy

5.3.2.6 Russia

5.3.2.7 Rest of Europe

5.3.3 Asia Pacific

5.3.3.1 China

5.3.3.2 Japan

5.3.3.3 India

5.3.3.4 Australia

5.3.3.5 Rest of Asia-Pacific

5.3.4 South America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.4.3 Rest of South America

5.3.5 Middle East & Africa

5.3.5.1 South Africa

5.3.5.2 United Arab Emirates

5.3.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

6.1 Market Share Analysis

6.2 Most Adopted Strategies

6.3 Company Profiles

6.3.1 Mars Incorporated

6.3.2 Ferrero International SA

6.3.3 Mondalez International

6.3.4 The Hershey Company

6.3.5 Nestle SA

6.3.6 Yildiz Holding

6.3.7 Chocoladenfabriken Lindt & Sprungli AG

6.3.8 Grupo Arcor

6.3.9 Meiji Holdings Co. Ltd

6.3.10 Lake Champlain Chocolates

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. DISCLAIMER

Chocolate Industry Segmentation

Chocolate, extracted from the roasted cacao seeds, is primarily used in confectioneries and bakery products.

The global chocolate market is segmented by product type, distribution channel, and geography. Based on product type, the market is segmented into white/milk chocolate and dark chocolate. Based on the distribution channel, the market is segmented into hypermarkets/supermarkets, convenience stores, online retail stores, and other distribution channels. The report also provides an analysis of the emerging and established economies across the global market, including regions like North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

For each segment, the market sizing and forecasts have been done on the basis of value (in USD million).

| Type | |

| Dark Chocolate | |

| Milk and White Chocolate |

| Distribution Channel | |

| Supermarkets/Hypermarkets | |

| Convenience Stores | |

| Online Stores | |

| Other Distribution Channels |

| Geography | |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

|

Chocolate Market Research FAQs

How big is the Chocolate Market?

The Chocolate Market size is expected to reach USD 111,968.34 million in 2023 and grow at a CAGR of 3.53% to reach USD 133,176.10 million by 2028.

What is the current Chocolate Market size?

In 2023, the Chocolate Market size is expected to reach USD 111,968.34 million.

Who are the key players in Chocolate Market?

Mars, Incorporated, The Hershey Company, Mondelez International, Nestle SA and Ferrero International S.A. are the major companies operating in the Chocolate Market.

Which is the fastest growing region in Chocolate Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2027).

Which region has the biggest share in Chocolate Market?

In 2023, the Europe accounts for the largest market share in the Chocolate Market.

Chocolate Industry Report

Statistics for the 2023 Chocolate market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Chocolate analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.