Cloud CDN Market Size

| Study Period | 2018 - 2028 |

| Market Size (2023) | USD 8.81 Billion |

| Market Size (2028) | USD 26.10 Billion |

| CAGR (2023 - 2028) | 24.27 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Cloud CDN Market Analysis

The Cloud CDN Market size is expected to grow from USD 8.81 billion in 2023 to USD 26.10 billion by 2028, at a CAGR of 24.27% during the forecast period (2023-2028).

The cloud platforms allow users to provide services such as distributed denial-of-service (DDoS) protection, streaming video, web application firewalls, and e-commerce optimization.

- The increased dependence on cloud services, integration of IT applications and services, and a proliferation of mobile and connected devices coupled with the shift of content and advertising to the online world are some factors that would contribute to the growth of the Cloud CDN market over the forecast period.

- The rising demand for content delivery at higher speeds became one of the prominent factors fueling the growth of the Cloud CDN market.

- With the internet now being the basic necessity for an individual, the growing volume of data consumption over the internet opened up a potential opportunity for Cloud CDN providers, thereby boosting the market during the forecast period.

- Furthermore, the adoption of cloud in enterprises is primarily due to flexibility, scalability, and cost-effectiveness.

- Since the COVID-19 outbreak and subsequent lockdowns, the network provider saw unprecedented growth in traffic volumes. There were many efforts from communications service providers (CSPs) to ramp up network capacity and connectivity, while video streaming providers downgraded video to SD quality to decrease the bandwidth needs.

Cloud CDN Market Trends

E-Commerce Segment is Expected to Hold the Significant Share

- The E-Commerce segment highly depends on content delivery to its end customers. The speeds at which the content is delivered and the user experience, amongst others, are some of the important factors contributing to the growth of an E-commerce segment. It makes it imperative for them to go for solutions like Cloud CDN, thereby boosting the market over the forecast period.

- Some prominent players in the market, such as SalesForce, enable digital customers with Salesforce Commerce Cloud, an embedded content delivery network (eCDN). It allows them to increase site speed access and content delivery, allowing the end user a reliable and secure online shopping experience.

- The increasing dependence of the end customers on online shopping increased retail e-commerce sales. It is thereby making it imperative for the retail e-commerce providers to further enhance the user experience, subsequently fueling the growth of the Cloud CDN over the forecast period.

- During festive seasons or occasions, e-commerce players witness large website traffic. Therefore, catering to such traffic is of prime importance for the providers to ensure that the content on their site is delivered to the traffic immediately without any delay. Therefore a Cloud CDN becomes a viable option for these players to cater to such needs, fueling the market's growth over the forecast period.

North America is Expected to Hold the Largest Share

- North America includes the highest internet penetration rate, which is expected to fuel the growth of the Cloud CDN market over the forecast period. It is also possible due to some major regional players, enabling it to maintain its dominance throughout the forecast period.

- The shift of trend from traditional retail shopping to online E-commerce website sales made it of prime importance for E-commerce providers. It is to enhance their user experience through faster content delivery, hassle-free interaction with the website, and many more. It is expected to boost market growth over the forecast period.

- The increase in viewing online media content in the region is also one of the factors contributing to the growth of the Cloud CDN market throughout the forecast period.

- DigitalOcean is an American cloud hosting company that pushed the idea of using a Solid State Drive (SSD) to create a developer-friendly platform that allows customers to transfer projects and increase production easily and efficiently. The company’s enterprise customers can easily leverage the benefits of scale by executing projects across multiple platforms without worrying about performance.

Cloud CDN Industry Overview

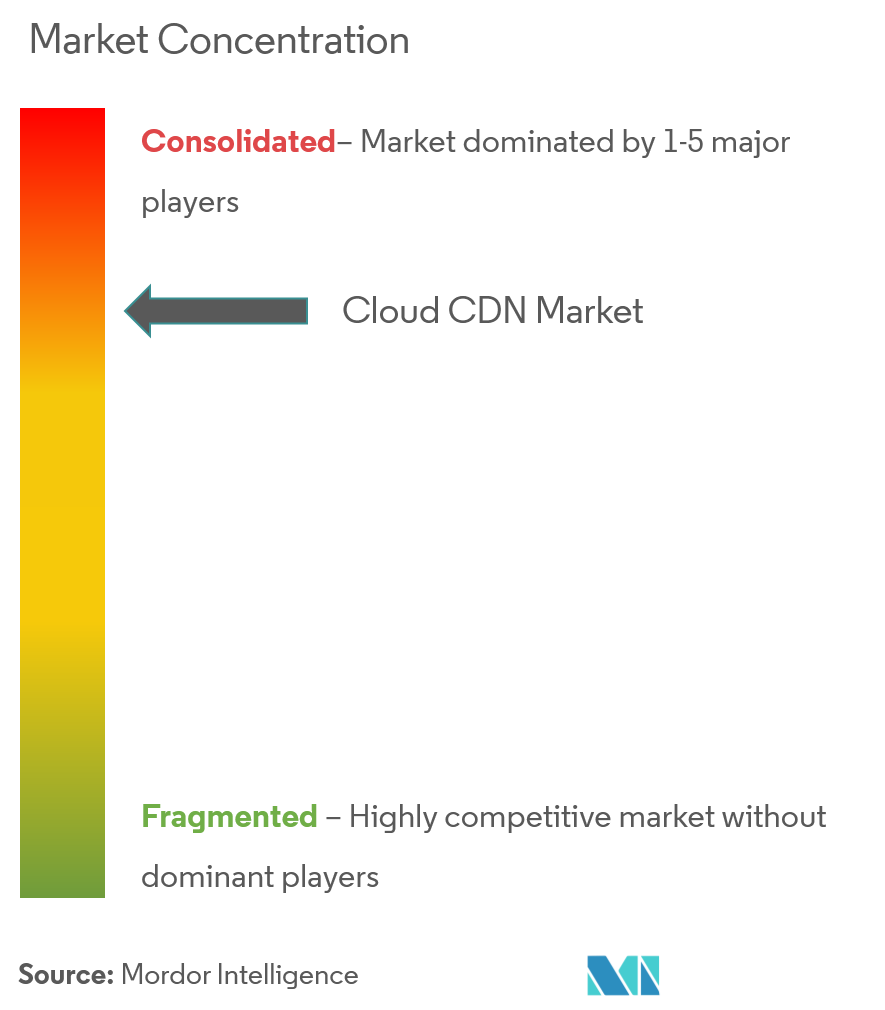

Due to key players like Google Inc., Amazon Web Services (AWS), and many more, the competitive rivalry in the Cloud CDN is high. With the help of strategic partnerships, mergers, and acquisitions, these players can maintain a strong foothold in the market. Hefty investments in research and development activities allowed these players to maintain a competitive advantage over their competitors.

- September 2022- Bharti Airtel (Airtel) entered the new content delivery network (CDN) market by launching Edge CDN under its Edge Cloud Portfolio. In line with this launch, the company collaborated with CDN enabler Qwilt to deploy Edge CDN.

- April 2022- Google Cloud launched a new media and content delivery network (CDN) platform called Media CDN that allows large media and streaming customers to tap into Google’s global YouTube network.

Cloud CDN Market Leaders

Akamai Technologies, Inc.

Google, Inc.

Amazon Web Services, Inc.

Cloudflare, Inc.

Alibaba Group Holding Limited

*Disclaimer: Major Players sorted in no particular order

Cloud CDN Market News

- September 2022: Microsoft launched a private enterprise-grade Content Delivery Network (CDN) solution. The company's new solution would be leveraging private infrastructure to deliver content and optimizing the network performance for live video streaming and distribution within an enterprise to reduce the load on the corporate network.

- August 2022: Tencent Cloud upgraded its edge cloud service with the launch of Tencent Cloud EdgeOne to add security services to its product RT-ONE. The solution allows users to benefit from high-quality network performance without jeopardizing their security. The new platform provides cutting-edge security, resulting in integrated services that satisfy organizations' needs for network speed and security features.

Cloud CDN Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

2.1 Research Framework

2.2 Secondary Research

2.3 Primary Research

2.4 Data Triangulation & Insight Generation

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS

4.1 Market Overview

4.2 Industry Attractiveness - Porter's Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of New Entrants

4.2.4 Threat of Substitutes

4.2.5 Degree of Competition

4.3 Impact of Covid-19 on The Market

5. MARKET DYNAMICS

5.1 Market Drivers

5.1.1 Increasing Data Consumption Over Internet

5.1.2 Increasing Demand for Faster Content Delivery

5.2 Market Restraints

5.2.1 Latency Issue

6. MARKET SEGMENTATION

6.1 Solutions & Services

6.1.1 Media Delivery

6.1.2 Cloud Security

6.1.3 Web Performance

6.2 Deployment

6.2.1 Public Cloud

6.2.2 Private Cloud

6.2.3 Hybrid Cloud

6.3 End-user Industry

6.3.1 Media & Entertainment

6.3.2 E-Commerce

6.3.3 IT and Telecom

6.3.4 Other End-user Industry

6.4 Geography

6.4.1 North America

6.4.1.1 United States

6.4.1.2 Canada

6.4.2 Europe

6.4.2.1 United Kingdom

6.4.2.2 Germany

6.4.2.3 France

6.4.2.4 Rest of Europe

6.4.3 Asia-Pacific

6.4.3.1 China

6.4.3.2 Japan

6.4.3.3 South Korea

6.4.3.4 Rest of Asia Pacific

6.4.4 Latin America

6.4.5 Middle East and Africa

7. COMPETITIVE LANDSCAPE

7.1 Company Profiles

7.1.1 Akamai Technologies, Inc.

7.1.2 Google, Inc

7.1.3 Amazon Web Services, Inc.

7.1.4 Telefonaktiebolaget LM Ericsson

7.1.5 Alibaba Group Holding Limited

7.1.6 Fastly, Inc.

7.1.7 Cloudflare, Inc.

7.1.8 Internap Corporation

7.1.9 Limelight Networks.

7.1.10 Verizon Communications, Inc.

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. FUTURE OF THE MARKET

Cloud CDN Industry Segmentation

Physically, a cloud content delivery network (CDN) is a network of servers spread across a geographical area. It is an amalgamation of servers distributed over specified geography to deliver faster content to users and allow the website managers to manage heavy traffic.

The Cloud CDN Market is segmented by solution and service (media delivery, cloud security, and web performance), deployment (public cloud, private cloud, and hybrid cloud), end-user industry (media & entertainment, e-commerce, IT and Telecom, and other end-user industry), and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The market sizes and forecasts are provided in value (USD).

| Solutions & Services | |

| Media Delivery | |

| Cloud Security | |

| Web Performance |

| Deployment | |

| Public Cloud | |

| Private Cloud | |

| Hybrid Cloud |

| End-user Industry | |

| Media & Entertainment | |

| E-Commerce | |

| IT and Telecom | |

| Other End-user Industry |

| Geography | ||||||

| ||||||

| ||||||

| ||||||

| Latin America | ||||||

| Middle East and Africa |

Cloud CDN Market Research FAQs

How big is the Cloud CDN Market?

The Cloud CDN Market size is expected to reach USD 8.81 billion in 2023 and grow at a CAGR of 24.27% to reach USD 26.10 billion by 2028.

What is the current Cloud CDN Market size?

In 2023, the Cloud CDN Market size is expected to reach USD 8.81 billion.

Who are the key players in Cloud CDN Market?

Akamai Technologies, Inc., Google, Inc., Amazon Web Services, Inc., Cloudflare, Inc. and Alibaba Group Holding Limited are the major companies operating in the Cloud CDN Market.

Which is the fastest growing region in Cloud CDN Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (20221-2028).

Which region has the biggest share in Cloud CDN Market?

In 20221, the North America accounts for the largest market share in Cloud CDN Market.

Cloud CDN Industry Report

Statistics for the 2023 Cloud CDN market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Cloud CDN analysis includes a market forecast outlook to for 2023 to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.