Europe Agricultural Tires Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2021 |

| Forecast Data Period | 2024 - 2028 |

| Historical Data Period | 2018 - 2020 |

| CAGR | 5.32 % |

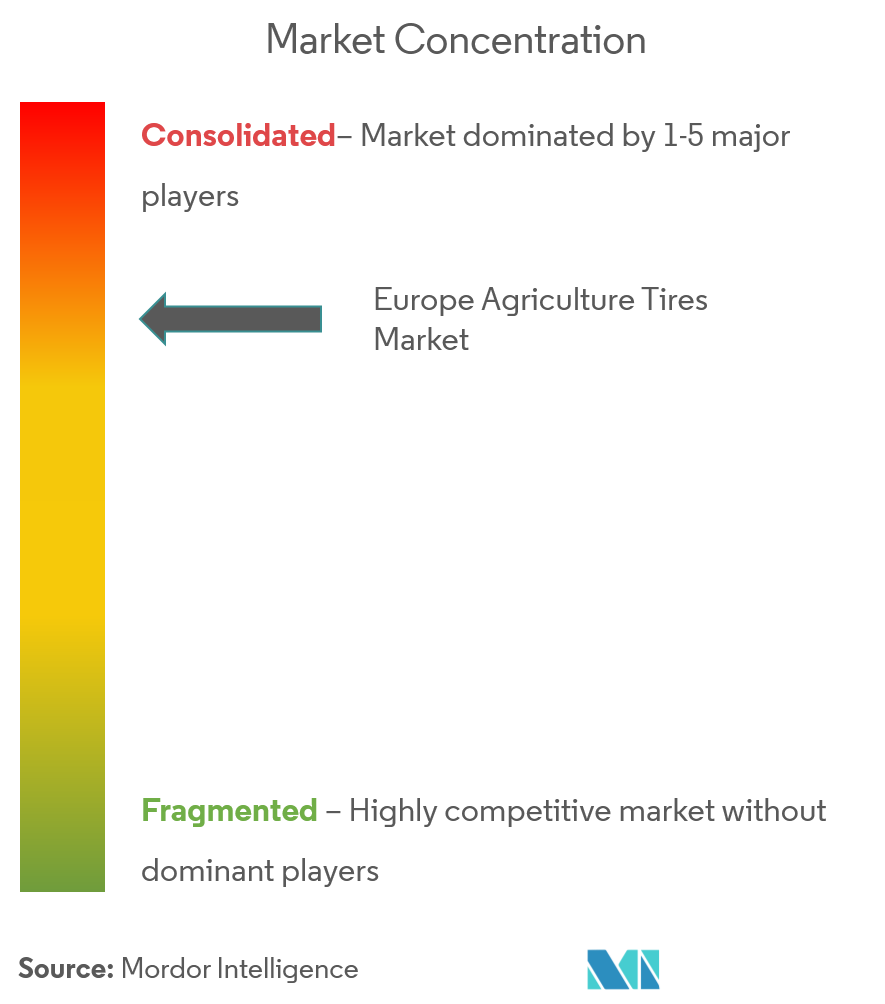

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Europe Agricultural Tires Market Analysis

The European agriculture tires market was valued at USD 1.96 billion in 2021 and expected to surpass a net valuation of USD 3.72 billion by 2027 end, registering a solid CAGR growth of 5.32% during the forecast period.

Although, during covid-19 demand for agricultural supplies including equipment and components remained halted amid the rising covid-19 cases. In addition, the region even witnessed a steady decline in overall agriculture outputs which muted the demand for agriculture tires as well. Moreover, soon after 2021, the industry has taken a rapid growth phase to showcase post-covid-19 recovery, maintaining a strong agriculture throughput across EU nations. The recovery of the agricultural machinery market in Europe, during 2021-2022, after a slump in 2020, aided in driving the demand for agriculture tires. The demand for seed drills, fertilizer spreaders, and plant protection equipment has increased all over Europe, specifically in the growing markets, like France, Romania, Ukraine, and Poland.

Over the medium term, agricultural sector of European has been one of the key land users and thus shapes maximum landscapes in several rural areas. In addition, agricultural land plays the most pivotal role in land use patterns across all the countries of the European Union with total grassland and cropland making up an aggregate 39 % of total Europe's land cover.

Furthermore, the European government has been implementing CEMA AgriTech 2030 plans for bringing batter advancement in the Europe agriculture industry. The AgriTech 2030 which was issued by the government in 2019, maps out its focus on witnessing the future of Europe’s industry for its advanced agricultural machinery and solutions towards 2030 end. Under the plans, the government shall remain consistent with CEMA’s mission in order to bring better-shared expertise and further shape the EU legislation for benefiting sustainable farming and the agricultural machinery sector.

Owing to a number of economic and environmental factors (direct and indirect impact on the environment, due to different production methods and subsidies provided by the European Union to the farmers), high farm consolidation activities in the past few years, affected the agricultural machinery market to a significant extent, especially in Europe, driving the demand for agricultural tires. Farm consolidation necessitates the use of fertilizing and planting machinery, to obtain sufficient and proper fertilizing of the crops in larger land structures, thereby, facilitating the demand for agricultural tires.

Europe Agricultural Tires Market Trends

This section covers the major market trends shaping the Europe Agricultural Tires Market according to our research experts:

Replacement Tires to Gain Momentum Over the Forecast Period

The replacement tire segment is expected to constitute a majority of the share in the European tire market, due to the inherent demand from the aftermarket segment. The market is characterized by a significant amount of R&D in the tire manufacturing process, driven by the presence of the largest agricultural machinery and equipment research in the region. Also, the increasing adoption of modern farming techniques with agricultural machinery and using suitable tire sizes and patterns for specific crops is expected to drive the growth of the agricultural tire market in the region during the forecast period.

Replacement/aftermarket agricultural tires are cost-effective when compared to OEM tires. Due to their cheaper price, aftermarket agricultural tires are widespread in the market. Despite being less innovative, aftermarket consumers opt for this category due to its ease of availability and customized selection. In the case of OEM tires, after the warranty expiration, it is difficult for farmers to buy them due to the higher price and absence of a wide range of tire portfolios. The tires can be bought both online and through retail stores. Price fluctuation may vary drastically, either depending on the quantity ordered/purchased online or retail stores.

Players have are entering into agricultural tires are offering both OEM and aftermarket to keep wider horizon of growth owing to consumer preferences. For instance:

- In May 2022, Maxam Tires Europe got the approval for its Agrixtra range of agricultural tires on new selected Holland T5, T6 and T7 SWB and LWB tractors. The approval shall fuel the company's potential in grow both OEM and aftermarket replacement segment.

With changing consumer preferences in terms of cost economy and reliability, consumers are shifting toward adoption of aftermarket as well. These aftermarket tires are readily available and can be customized based on the consumer requirements, whereas OEM tires are offered based on specific parameters which are always kept constant. Thus keeping the consumer preferences at forefront these aftermarket tires are expected to witness traction during the forecast period.

Germany is Expected to Dominate the Market During the Forecast Period

Germany is the largest exporter of agricultural machinery, the largest manufacturer of agricultural machinery, and the second-largest consumer of agricultural machinery across the world. The high ability and sophisticated design of machinery, coupled with high production efficiency and machining precision are driving the demand for agricultural machinery in the country. Germany's agricultural machinery manufacturing industry output accounts for 10% of the global output, and the machinery exports from Germany accounted for more than 70%.

France and Germany continued to portray their dominance over agriculture machinery with occupying the largest agricultural tractor markets in Europe. In addition, these two nations are accounting for nearly four of every ten agricultural tractors which are registered in Europe

In Germany, there were in total 34,472 new registrations for agricultural tractors in 2021. In addition, in comparison to the previous year’s figures, this represents an increase of 8.6% in total. Tractors with a power output of more than 50 horsepower made up nearly three-quarters of the registered vehicles. When compared to the previous year, the growth in this power class is modest. On the other hand, tractors with less than 50 horsepower displayed a substantial increase over the year.

Moreover, manufacturers in the Germany are offering different variants of tractors to witness improved sales in the market. For instance, in January 2022, John Dheere revealed its fully autonomous tractor meant for agriculture applications. The tractor is equipped with several added features and as GPS and advance technologies.

Thus, based on the developments, and the recovery of the agricultural sector in the country, the demand for agricultural tires is expected to witness growth in the coming years.

Europe Agricultural Tires Industry Overview

The Europe Agricultural Tires market was highly consolidated one owing to developmental strategies and their presence in the market. Major players in the European agricultural tire market are Bridgestone, Michelin, Continental, ATG tires, Titan, etc. Other companies in the industry include Trelleborg AB, Nokian Tyres, etc. To maintain market dominance, major companies are focusing on product innovation and customization, to keep the overall product line, with robust offerings to the European agricultural tire market.

OEM is seen keeping strategic forefront including mergers, acquisitions, and product launches to maintain a competitive edge in the market. For instance,

- In March 2022, Yokohama acquired Trelleborg Wheel System for deal worth EUR 2.1 billion. The expansion is expected tp fuel Yokahama off-road and agriculture tire segment.

- In April 2021, Michelin launched its Agribib Row Crop IF (improved flexion) agriculture tires, specially crafted for self-propelled and trailed sprayers, which allow higher load capacity, improved traction, and reduced soil contraction.

Europe Agricultural Tires Market Leaders

Bridgestone Corporation

Continental Tires

Titan International Inc.

Michelin

YOKOHAMA

*Disclaimer: Major Players sorted in no particular order

Europe Agricultural Tires Market News

- In April 2022, Bridgestone’s VX-TRACTOR patterned tires have now got their approval for selected New Holland T6 and T7 Series tractors in Ireland and the United Kingdom. The company currently offers twenty-eight sizes from 28 to 42 inches.

- In November 2021, John Dheere the tractor manufacturing company announced its strategic partnership with Continental AG. Both companies have strengthened their partnership for agriculture tire TractorMaster and VF TractorMaster business for John Dheere 6M and 6R product line.

Europe Agricultural Tires Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Deliverables

1.2 Study Assumptions

1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Industry Attractiveness - Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size in Value USD Billion)

5.1 By Application Type

5.1.1 Tractors

5.1.2 Combine Harvester

5.1.3 Sprayers

5.1.4 Trailers

5.1.5 Loaders

5.1.6 Other Machinery

5.2 By Sales Channel

5.2.1 OEM

5.2.2 Replacement/Aftermarket

5.3 Geography

5.3.1 Europe

5.3.1.1 Germany

5.3.1.2 United Kingdom

5.3.1.3 France

5.3.1.4 Italy

5.3.1.5 Rest of Europe

6. COMPETITIVE LANDSCAPE

6.1 Vendor Market Share

6.2 Company Profiles

6.2.1 Bridgestone Corporation

6.2.2 Continental AG

6.2.3 Yokohama Rubber Co. Ltd.

6.2.4 Michelin Group

6.2.5 Nokian Tyres Oyji

6.2.6 Titan International Inc.

6.2.7 Balakrishna Industries Limited

6.2.8 Trelleborg AB

6.2.9 Prometeon Tyre Group

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Europe Agricultural Tires Industry Segmentation

The agricultural tires are the outer covering of tractors wheels which are in direct contact with land. In addition, these agriculture ties are designed to provide better soil compaction in order to reduce stress.

The European agricultural tire market has been segmented by application type, sales channel type, and country. By Application Type, the market has been segmented into tractors, combine harvesters, sprayers, trailers, loaders, and other machinery.

By sales channel, the market has been segmented into OEM and replacement/aftermarket and By Country, the market has been segmented into Germany, United Kingdom, France, Italy, and Rest of Europe. For each segment, the market sizing and forecasting are based on value (USD billion).

| By Application Type | |

| Tractors | |

| Combine Harvester | |

| Sprayers | |

| Trailers | |

| Loaders | |

| Other Machinery |

| By Sales Channel | |

| OEM | |

| Replacement/Aftermarket |

| Geography | |||||||

|

Europe Agricultural Tires Market Research FAQs

What is the current Europe Agricultural Tires Market size?

The Europe Agricultural Tires Market is projected to register a CAGR of 5.32% during the forecast period (2023-2028).

Who are the key players in Europe Agricultural Tires Market?

Bridgestone Corporation, Continental Tires, Titan International Inc., Michelin and YOKOHAMA are the major companies operating in the Europe Agricultural Tires Market.

Europe Agricultural Tires Industry Report

Statistics for the 2023 Europe Agricultural Tires market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Agricultural Tires analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.