India Structural Steel Fabrication Market Size

| Study Period | 2019 - 2028 |

| Base Year For Estimation | 2021 |

| Forecast Data Period | 2024 - 2028 |

| Historical Data Period | 2019 - 2020 |

| CAGR | 9.60 % |

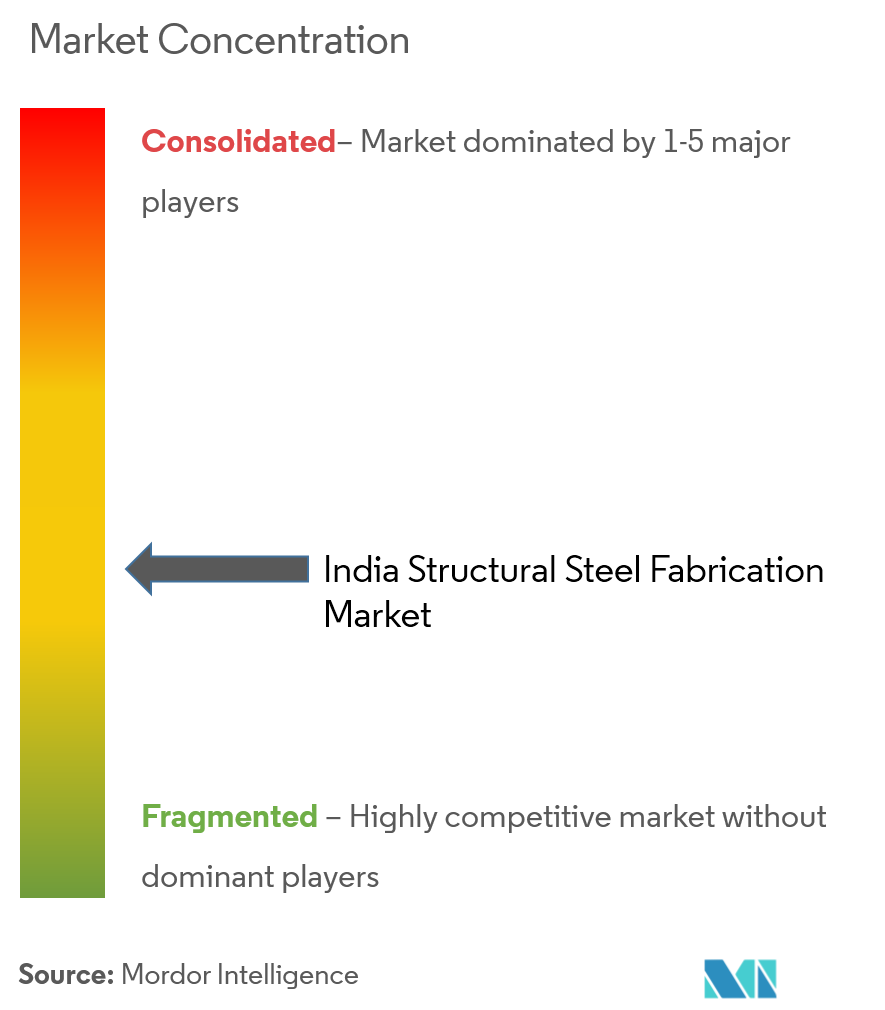

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

India Structural Steel Fabrication Market Analysis

The Indian structural steel fabrication market is expected to register a CAGR of 5.5% over the forecast period of 2019-2024.

- The Indian structural steel market is expected witness significant growth during the forecast period, owing to factors, such as the increasing demand from manufacturing sector, the rising preference toward pre-engineered buildings and components, and government initiatives for infrastructure development activities.

- The expected increase in steel prices due to the increase in the price of coking coal (primary raw material used to manufacture steel) and the governmental regulations and restrictions on the manufacturing of steels to reduce adverse effects on the environment have been identified to be few of the major challenges faced by the structural steel fabrication market in India.

- Additionally, the booming commercial building sector, along with Indian government’s initiatives, such as increasing the construction of green buildings, smart cities, and make in India scheme, is expected to boost the structural steel fabrication market in India.

India Structural Steel Fabrication Market Trends

This section covers the major market trends shaping the India Structural Steel Fabrication Market according to our research experts:

Rising Demand for Pre-engineered Buildings and Components

- Structural steel is one of the major raw materials used in the construction of pre-engineered buildings. The pre-engineered buildings market in India is expected to register a CAGR of 11%-15%, from 2017 to 2020, as the industry had been experiencing an increased focus from various end-user segments, such as automotive, power, logistics, pharmaceuticals, FMCG, and retail.

- This increasing focus is primarily due to the significant cost benefits and reduction in construction time of manufacturing plants, warehouses, etc., compared to that of the traditional construction model.

- The rising demand for the pre-engineered buildings is expected to drive the market for structural steel fabrication during the forecast period.

- The awareness among the Indian construction companies to use structural steel in various commercial and residential construction activities is on the rise.

- The increasing importance for green building construction is also an important factor that contributes to the growth of PEB in India. Pre-engineered construction has a comparatively smaller impact on the environment compared to that of the conventional construction model.

- Additionally, the production method of steel used for these structures helps in substantially reducing greenhouse gas emission. Moreover, after demolition, pre-engineered buildings and components, which are 90% recyclable, do not have a significant impact on the environment to that of wastages, like asphalt, concrete, brick, and dust.

Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India

- The rising demand in India, combined with the fact that global manufacturing companies’ focus to diversify their production by setting-up low-cost plants in countries other than China, is expected to drive the India’s manufacturing sector to grow more than six times by 2025, to USD 1 trillion. This increase in the Indian manufacturing sector had increased the number of manufacturing. Thus, this is driving the demand in the structural steel fabrication market in the country.

- For instance, the number of mobile manufacturing plants that were setup in India had increased more than 60 times since 2014. This shows the increasing demand for structural steel fabrication, which is due to the increasing number of manufacturing units in the country.

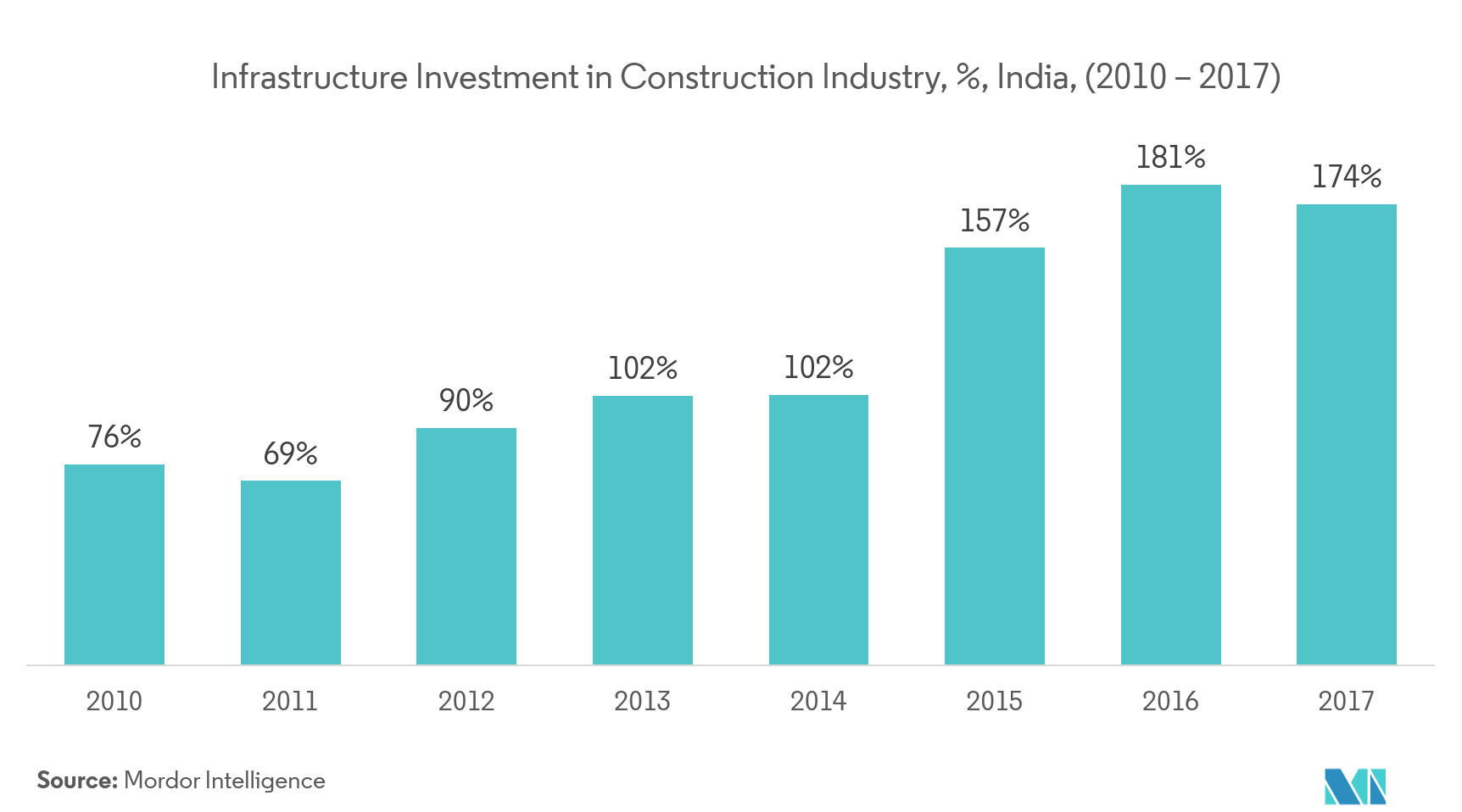

- The infrastructure development activities by the Government of India are the major driving factors that are expected to boost the Indian structural steel fabrication market over the next few years.

- Government initiatives, such as the construction of metro stations, new no frill airports, international terminals, industry corridors, power plants, and ports, require heavy steel structures. Thus, these factors are expected to drive the growth of the structural steel fabrication market in India.

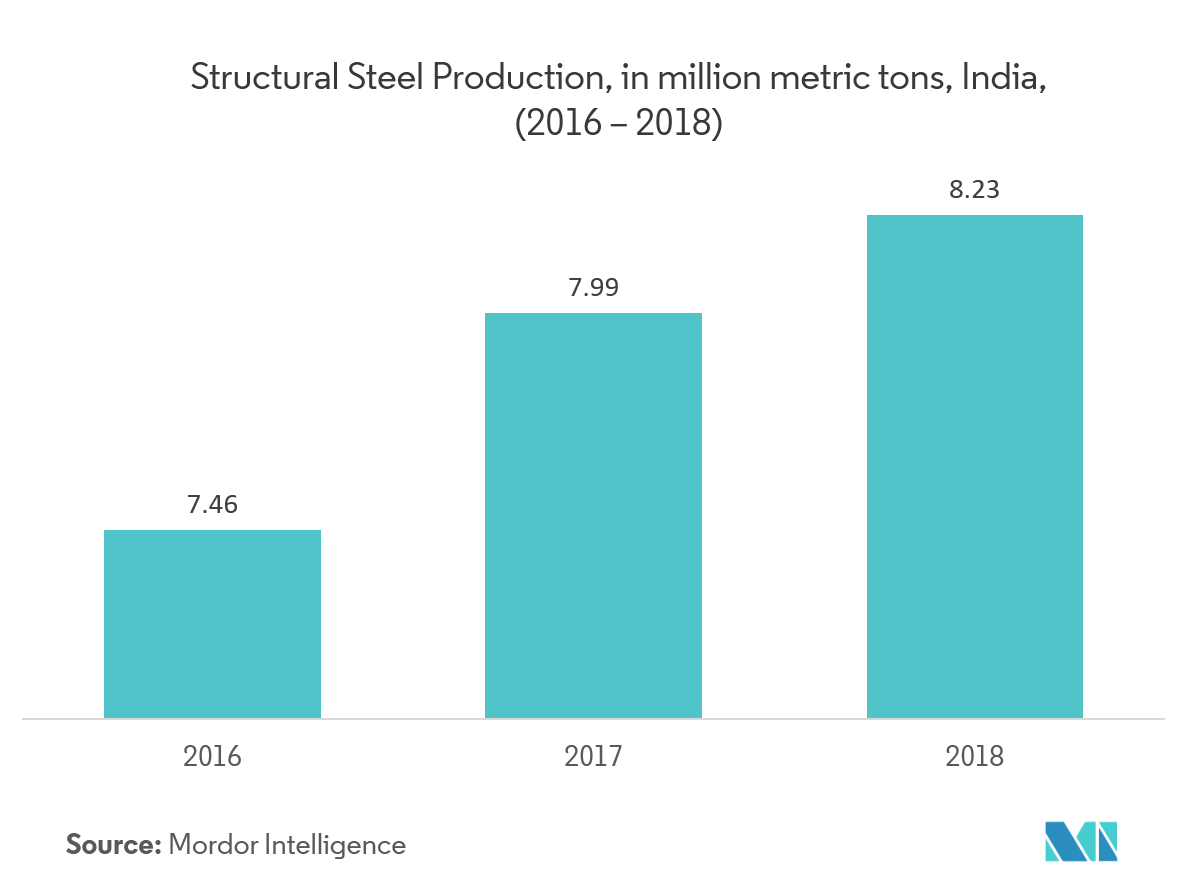

- Moreover, the construction and infrastructure sector is the largest end-user segment to consume steel in India. In 2016, the construction and infrastructure sector accounted for the major share of 62% of the overall Indian steel market.

India Structural Steel Fabrication Industry Overview

The report covers the major players operating in the structural steel fabrication market in India. In terms of market share, the market is fragmented with the presence of large number of small- and medium- sized players.

India Structural Steel Fabrication Market Leaders

Salasar Techno Engineering Limited

Kirby Building Systems India Private Limited

Zamil Steel Buildings India Private Limited

Sujana Group

Apex Buildsys Limited

*Disclaimer: Major Players sorted in no particular order

India Structural Steel Fabrication Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

2.1 Analysis Methodology

-

2.2 Research Phases

-

-

3. MARKET INSIGHTS AND DYNAMICS

-

3.1 Market Overview

-

3.2 Market Growth Drivers

-

3.3 Market Challenges

-

3.4 Market Opportunities

-

3.5 Value Chain/Supply Chain Analysis

-

3.6 Industry Attractiveness - Porter's Five Forces Analysis

-

3.6.1 Threat of New Entrants

-

3.6.2 Bargaining Power of Buyers/Consumers

-

3.6.3 Bargaining Power of Suppliers

-

3.6.4 Threat of Substitute Products

-

3.6.5 Intensity of Competitive Rivalry

-

-

3.7 Technological Snapshot

-

3.8 Government Regulations and Key Initiatives in the Indian Steel Fabrication Market

-

-

4. MARKET SEGMENTATION

-

4.1 End-user Industry

-

4.1.1 Manufacturing

-

4.1.2 Power and Energy

-

4.1.3 Construction

-

4.1.4 Oil and Gas

-

4.1.5 Other End-user Industries

-

-

4.2 Product Type

-

4.2.1 Heavy Sectional Steel

-

4.2.2 Light Sectional Steel

-

4.2.3 Other Product Types

-

-

-

5. COMPETITVE LANDSCAPE

-

5.1 Market Competition Overview

-

5.2 Company Profiles

-

5.2.1 Salasar Techno Engineering Limited

-

5.2.2 Kirby Building Systems India Private Limited

-

5.2.3 Zamil Steel Buildings India Private Limited

-

5.2.4 Sujana Group

-

5.2.5 Apex Buildsys Limited

-

5.2.6 Karamtara Engineering Pvt Ltd

-

5.2.7 Pennar Engineered Building Systems Ltd

-

5.2.8 Novatech Projects (India) Pvt Ltd

-

5.2.9 Satec Envir Engineering Pvt Ltd

-

5.2.10 Usg Boral Building Products (India) Private Limited

-

-

-

6. INVESTMENT ANALYSIS

-

7. FUTURE OF THE MARKET

-

8. APPENDIX

-

9. Disclaimer

India Structural Steel Fabrication Industry Segmentation

This report aims to provide a detailed analysis on the Indian structural steel fabrication market. It focuses on the market dynamics, technological trends, and insights on various end-user industries and product types. Moreover, it analyses the major players and competitive landscape in the Indian structural steel fabrication market.

| End-user Industry | |

| Manufacturing | |

| Power and Energy | |

| Construction | |

| Oil and Gas | |

| Other End-user Industries |

| Product Type | |

| Heavy Sectional Steel | |

| Light Sectional Steel | |

| Other Product Types |

India Structural Steel Fabrication Market Research FAQs

What is the current India Structural Steel Fabrication Market size?

The India Structural Steel Fabrication Market is projected to register a CAGR of 0% during the forecast period (2023-2028).

Who are the key players in India Structural Steel Fabrication Market?

Salasar Techno Engineering Limited, Kirby Building Systems India Private Limited, Zamil Steel Buildings India Private Limited, Sujana Group and Apex Buildsys Limited are the major companies operating in the India Structural Steel Fabrication Market.

Structural Steel Fabrication in India Industry Report

Statistics for the 2023 Structural Steel Fabrication in India market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Structural Steel Fabrication in India analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.