Mobile Commerce Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2021 |

| CAGR | 27.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Mobile Commerce Market Analysis

The mobile commerce market is expected to register a CAGR of 27% by 2021-2026. According to a study of over 45,000 shoppers conducted by the Harvard Bussiness Review, only 7% were online-only shoppers, and 73% of shoppers used multiple channels for shopping. This trend shows that customer experience is consistent across M-commerce, desktop commerce, and brick-and-mortar store channels.

· Many payments have been mobile compatible, and applications for various activities such as funds transfer and bill payments have been deployed. This trend further aids in the growth of mobile commerce globally.

· Advancements in integrated electronics enable the availability of many technologies, like broadband Internet, Handsets, and supporting service networks. All these developments open up the possibility of offering the user many services of unprecedented nature.

· In one way or the other, the goal of all the services has to be the generation of revenues. This factor represents an ever-increasing scope of Mobile Commerce or m-commerce as a subset of the more generic Electronic Commerce or e-commerce, which has been booming with the increasing popularity of the Internet.

· The factors driving the M-Commerce market are increasing adoption of smart devices, better broadband connectivity, cheaper services, social adoption of M-Commerce services, etc. However, there are certain challenges regarding dependency on internet networks, monetization of the user base, and fierce competition.

Mobile Commerce Market Trends

This section covers the major market trends shaping the Mobile Commerce Market according to our research experts:

Growth of Smartphones and Internet Penetration Drive the M-commerce Market

· The overall structure of the IT industry is being reorganized, and competition in the industry is expanding and diversifying. The introduction of smartphones has spurred the creation of limitless IT-related markets such as the e-book, tablet PC, and notebook markets.

· The growing internet penetration among many developing countries is also one of the prime factors for market growth. Many developing nations have now adopted m-payments services, online wallets, etc. Many governmental programs have popularized services such as m-wallets, such as demonetization. This trend has increased the revenue traffic in the e-commerce market.

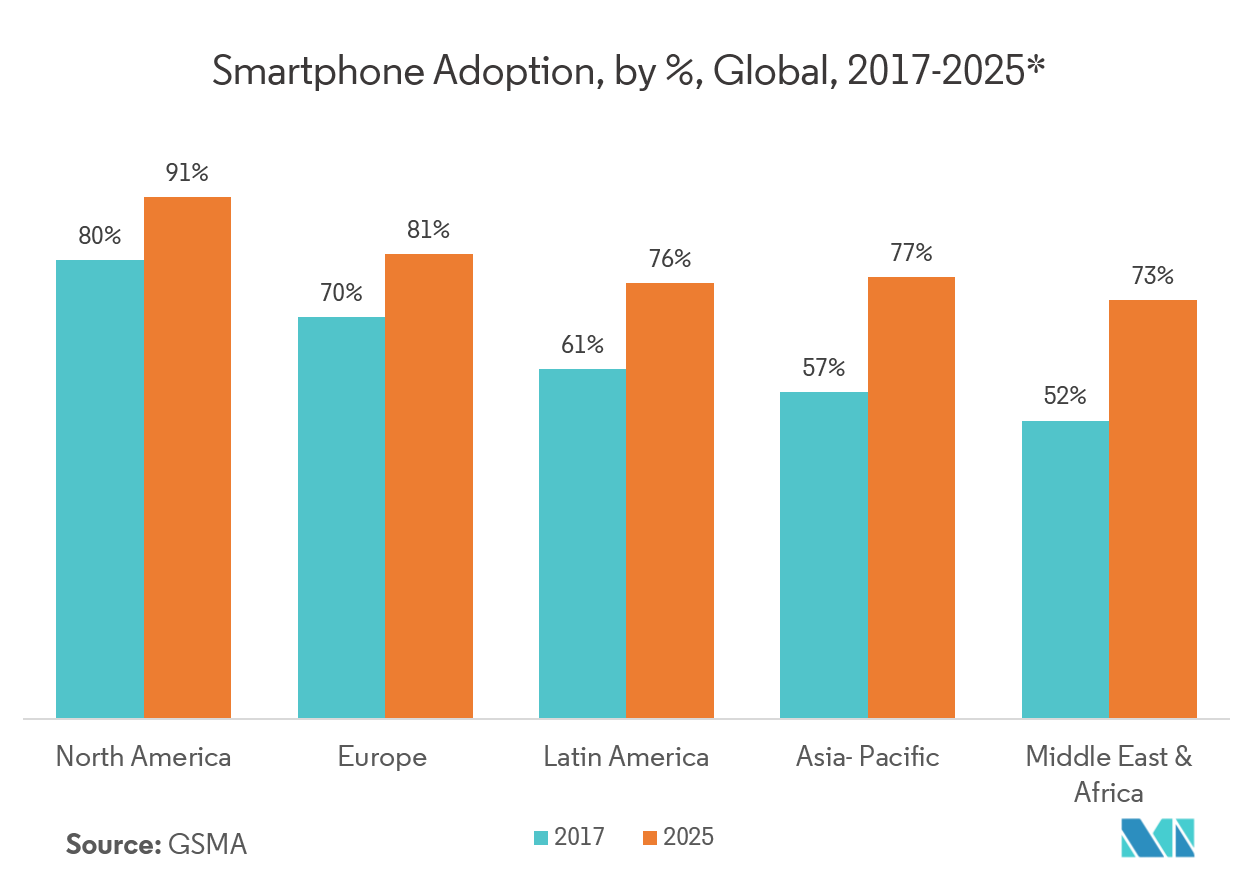

· Moreover, in the next five-year the smartphone market worldwide will burgeon due to the adaption of smartphones and penetration of the internet. However, North America will lead the market, followed by Europe and the Asia - Pacific but Asia- Pacific will be the fastest growing market.

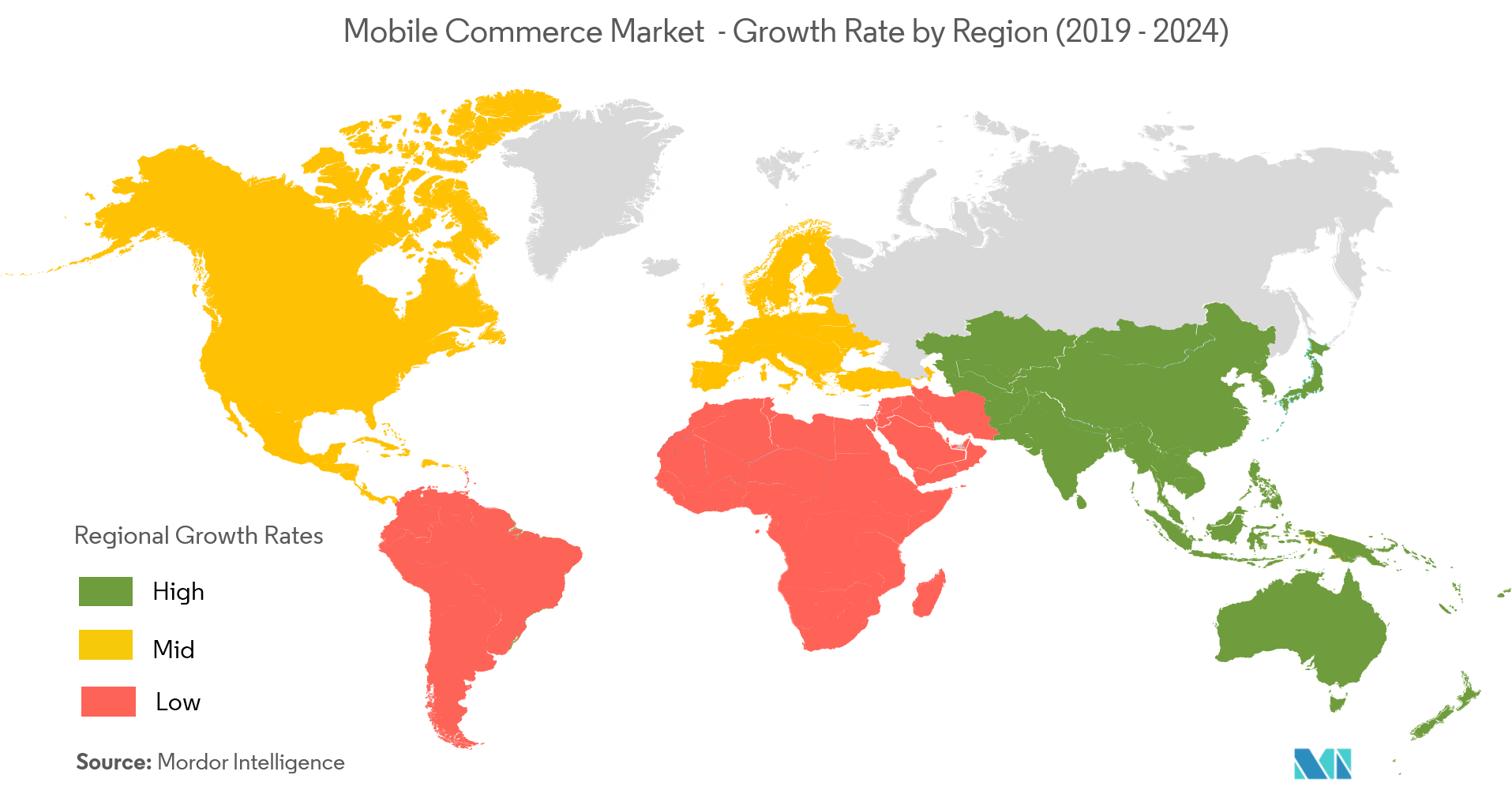

North America Holds the Largest Share

· M-Commerce is the next big phase in technology involvement following the E-commerce era. However, its adoption and level of use are high in the United States compared to other nations such as Sweden and Japan.

· Many major players are also present in the United States, and the region has high internet penetration rates, which aid in the growth of this trend. The growth of smartphones and other technology, such as wearables, has also contributed to the growth of smartphones in the region.

· On the contrary, there has been a growth in the number of cyber-attacks in the region, which could slow the growth of e-commerce.

· Moreover, the tech-savvy environment in the region will boost the growth of the M-commerce market in North America.

Mobile Commerce Industry Overview

The mobile commerce market is fragmented due to the growing adoption of digitization, e-commerce, and m-commerce, making people use these mediums more often, giving the players a wide scope to penetrate the market with technological innovation and developments. Some key players include Ericsson, Gemalto (Thales Company), Google Inc., IBM Corporation, Mastercard Inc., Paypal Holding, SAP SE, and Visa Inc., among others.

· April 2019 - Ericsson and ABB, the technology leader focused on digital industries, strengthened their collaboration to accelerate the industrial ecosystem for flexible wireless automation. The partnership will enable enhanced connected services, Industrial IoT, and artificial intelligence technologies in the future.

· March 2019 - Mastercard has agreed to acquire Ethoca, a global provider of technology solutions that help merchants and card issuers collaborate in real-time to quickly identify and resolve fraud in digital commerce. The Ethoca suite of products adds to Mastercard’s commitment to driving greater protection in the digital space, integrating with its robust suite of fraud management and security products.

Mobile Commerce Market Leaders

Google Inc.

Thales Group (Gemalto NV)

Mastercard Inc.

Paypal Holding Inc.

Visa Inc.

*Disclaimer: Major Players sorted in no particular order

Mobile Commerce Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Market Drivers

-

4.2.1 Increasing Penetration Rate of Smart Devices

-

4.2.2 Broader Reach Due to Mobility

-

-

4.3 Market Restraints

-

4.3.1 Lack of High Number Mobile Compatible Websites

-

-

4.4 Industry Attractiveness - Porter's Five Forces Analysis

-

4.4.1 Threat of New Entrants

-

4.4.2 Bargaining Power of Suppliers

-

4.4.3 Bargaining Power of Buyers/Consumers

-

4.4.4 Threat of Substitute Products

-

4.4.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Transaction Type

-

5.1.1 M Retailing

-

5.1.2 M Ticketing/Booking

-

5.1.3 M Billing

-

5.1.4 Other Transaction Types

-

-

5.2 By Payment Mode

-

5.2.1 Near Field Communication (NFC)

-

5.2.2 Premium SMS

-

5.2.3 Wireless Application Protocol (WAP)

-

5.2.4 Direct Carrier Billing

-

5.2.5 Other Payment Modes

-

-

5.3 Geography

-

5.3.1 North America

-

5.3.1.1 United States

-

5.3.1.2 Canada

-

-

5.3.2 Europe

-

5.3.2.1 United Kingdom

-

5.3.2.2 Germany

-

5.3.2.3 France

-

5.3.2.4 Rest of Europe

-

-

5.3.3 Asia-Pacific

-

5.3.3.1 China

-

5.3.3.2 Japan

-

5.3.3.3 India

-

5.3.3.4 Rest of Asia-Pacific

-

-

5.3.4 Latin America

-

5.3.4.1 Brazil

-

5.3.4.2 Argentina

-

5.3.4.3 Rest of Latin America

-

-

5.3.5 Middle-East and Africa

-

5.3.5.1 UAE

-

5.3.5.2 Saudi Arabia

-

5.3.5.3 Rest of Middle-East and Africa

-

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Mergers & Acquisitions

-

6.2 Company Profiles

-

6.2.1 Telefonaktiebolaget LM Ericsson

-

6.2.2 Thales Group (Gemalto NV)

-

6.2.3 Google Inc.

-

6.2.4 IBM Corporation

-

6.2.5 Mastercard Inc.

-

6.2.6 Mopay AG

-

6.2.7 Oxygen8

-

6.2.8 Paypal Holdings Inc.

-

6.2.9 SAP SE

-

6.2.10 Visa Inc.

-

- *List Not Exhaustive

-

-

7. INVESTMENT ANALYSIS

-

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

Mobile Commerce Industry Segmentation

Mobile commerce (m-commerce) is a sort of e-commerce where buying and selling of goods and services are conducted through wireless handheld mobile devices. It includes mobile phones, smartphones, smartwatches, tablets, and netbooks. M-commerce allows users to access online shopping platforms without needing a desktop computer. Examples of m-commerce include mobile banking, in-app purchasing, virtual marketplace apps like the Amazon mobile app, or digital wallets such as Google Pay, Apple Pay, Android Pay, and Samsung Pay.

| By Transaction Type | |

| M Retailing | |

| M Ticketing/Booking | |

| M Billing | |

| Other Transaction Types |

| By Payment Mode | |

| Near Field Communication (NFC) | |

| Premium SMS | |

| Wireless Application Protocol (WAP) | |

| Direct Carrier Billing | |

| Other Payment Modes |

| Geography | ||||||

| ||||||

| ||||||

| ||||||

| ||||||

|

Mobile Commerce Market Research FAQs

What is the current Mobile Commerce Market size?

The Mobile Commerce Market is projected to register a CAGR of 27% during the forecast period (2023-2028).

Who are the key players in Mobile Commerce Market?

Google Inc., Thales Group (Gemalto NV), Mastercard Inc., Paypal Holding Inc. and Visa Inc. are the major companies operating in the Mobile Commerce Market.

Which is the fastest growing region in Mobile Commerce Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2028).

Which region has the biggest share in Mobile Commerce Market?

In 2023, the North America accounts for the largest market share in the Mobile Commerce Market.

Mobile Commerce Industry Report

Statistics for the 2023 Mobile Commerce market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Mobile Commerce analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.