North America Aviation Infrastructure Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2021 |

| Forecast Data Period | 2024 - 2028 |

| Historical Data Period | 2018 - 2020 |

| Fastest Growing Market | United States |

| Largest Market | United States |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

North America Aviation Infrastructure Market Analysis

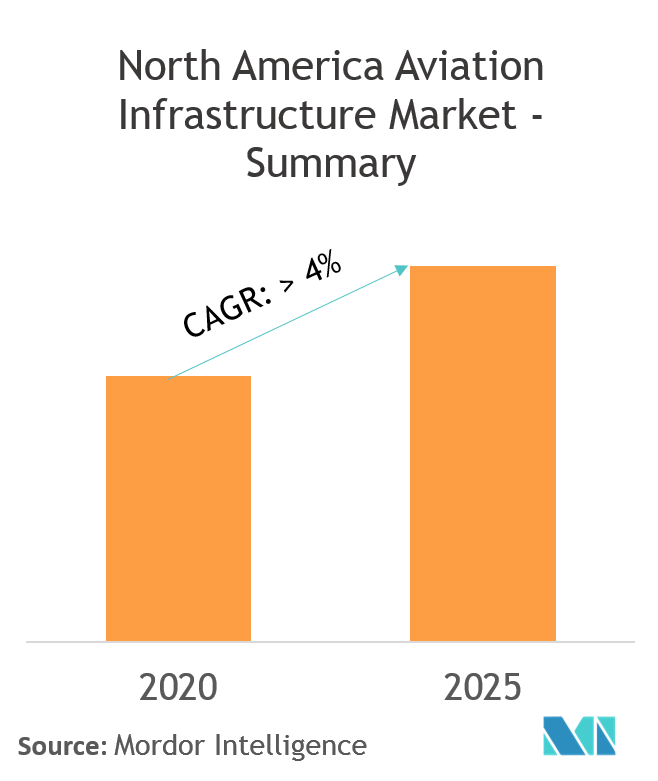

The North America Aviation Infrastructure Market is anticipated to register a CAGR of over 4% during the forecast period.

- The air passenger traffic at airports in North America is experiencing accelerating growth which is generating the need for improvement and expansion of the existing airport infrastructure. Airport operators, in order to increase their passenger handling capacity, are investing in advanced systems and ground equipment for improved airport operations.

- Funding from the Federal Aviation Administration (FAA) to improve airport infrastructure is also supporting the growth of the market.

- Technological advancement and growing focus to shift towards smart airports will drive the market growth over the next decade.

North America Aviation Infrastructure Market Trends

This section covers the major market trends shaping the North America Aviation Infrastructure Market according to our research experts:

Growing Demand for Significant Investment Due to Increasing Air Passenger Traffic in North America

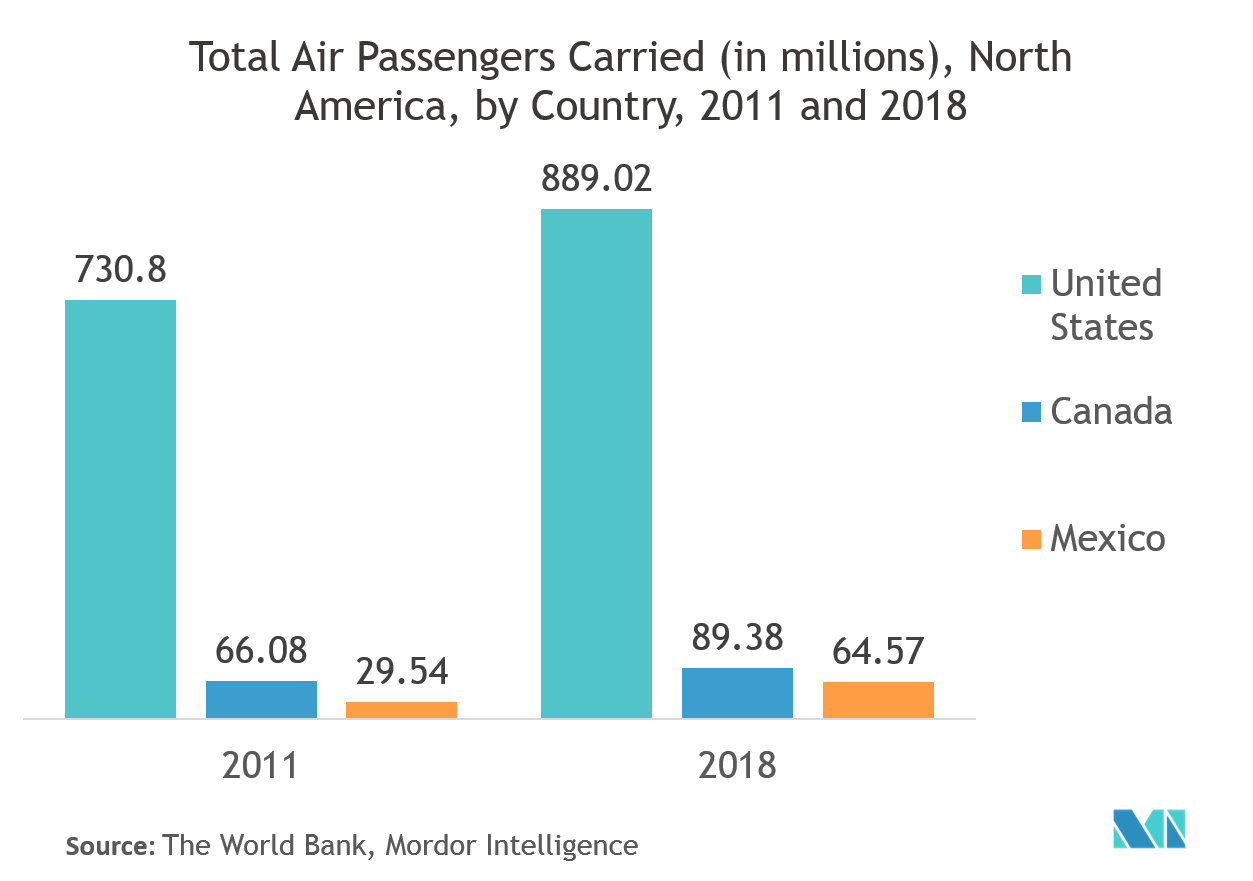

The total air passenger traffic across North America increased by over 25% between 2011 and 2018. In 2018, the United States, Canada, and Mexico recorded total air passengers carried as 889.02 million, 89.4 million, and 64.6 million, respectively. Several airports in the US are among the world’s busiest airports and handle millions of domestic and international passengers every year. However, over the past two decades, there has been no new airport construction in the US due to several factors. This has resulted in increased pressure on airport operators in handling the passenger traffic. Airports in the US contribute over 7% towards the country’s GDP and hence is in a state of immediate attention for the past five years. Recently, the U.S. Department of Transportation announced that FAA has planned to award USD 840 million in airport infrastructure grants. The investment in airport improvements will be focused on construction and rehabilitation projects across the US. According to the U.S DoT, the 432 grants will fund infrastructure projects at 381 airports across the US and will include the maintenance of taxiways, aprons, and terminals; construction of firefighting facilities, and runway reconstruction and rehabilitation among others. Airports in the US will receive AIP entitlement funding each year based on project needs as well as discretionary funding if the project needs to exceed their available entitlement funds. However, the extent of investment necessary to cope up with the increasing air passenger traffic is much higher compared to the funding offered by the FAA. Hence, many airports are expected to collaborate with private-sector partners as a source for alternative funding.

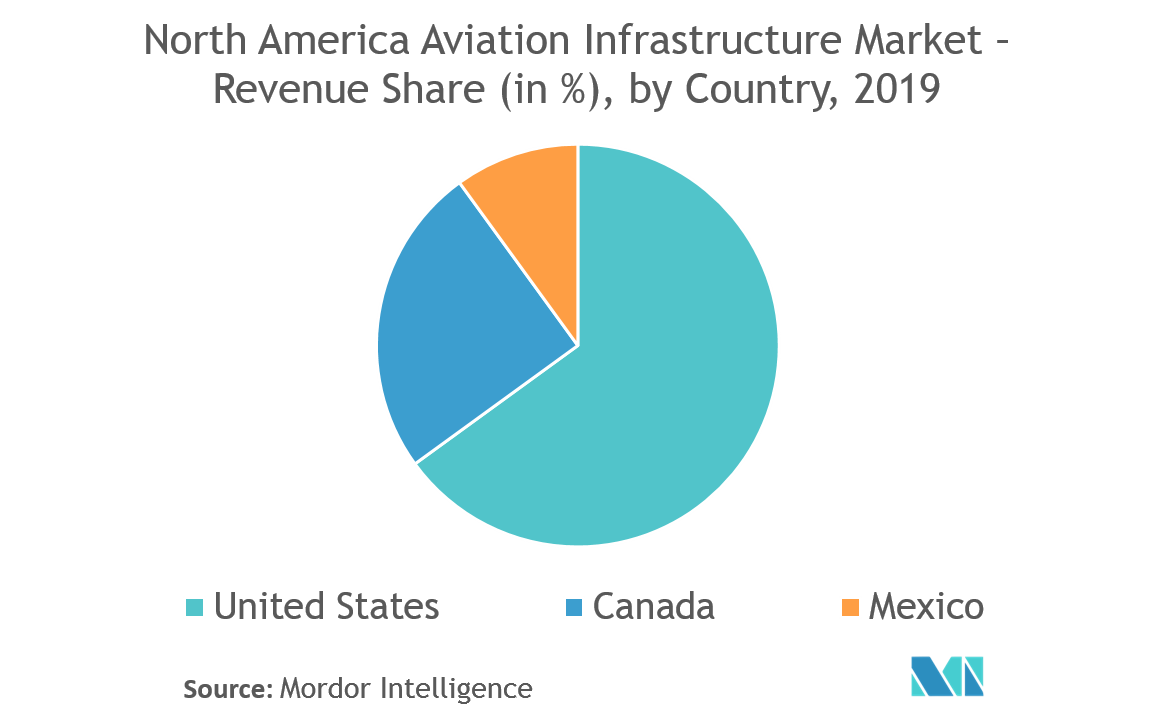

The US will Continue to Dominate the North America Aviation Infrastructure Market by 2025

Several airports across the US are in severe need of infrastructure enhancement in terms of construction and expansion of terminals, construction and repair of runways, improvement of taxiway and apron area, and installation of new aerobridges and ground support equipment among others. Airports such as Los Angeles International Airport, Chicago’s O’Hare Airport, John F. Kennedy International Airport, and LaGuardia International Airport are at the forefront in terms of infrastructure investments and modernization plans. The majority of the upcoming projects in the US are directed to increase the passenger handling capacity of these airports. The construction work of the new terminal at Louis Armstrong New Orleans International Airport started in January 2016 and is scheduled to open for the public before the end of 2019. The new terminal will feature 35 gates, three concourses, two new garages, and consolidated checkpoints for passengers. Likewise, earlier in April 2019, DFW Airport operators announced their plan for the construction of a new terminal at the airport which will be the sixth terminal. The construction of the new terminal is expected to be completed by 2025 and is estimated to cost over USD 3 billion. Operators also plan to enhance Terminal C at the airport which will cost an additional USD 3.5 billion. Some airports in Canada are also expected to undergo transformation in the next few years, as the government of Canada plans to increase its investment towards the enhancement of its aviation infrastructure. Such developments and construction plans will drive the North America aviation infrastructure market in the coming years.

North America Aviation Infrastructure Industry Overview

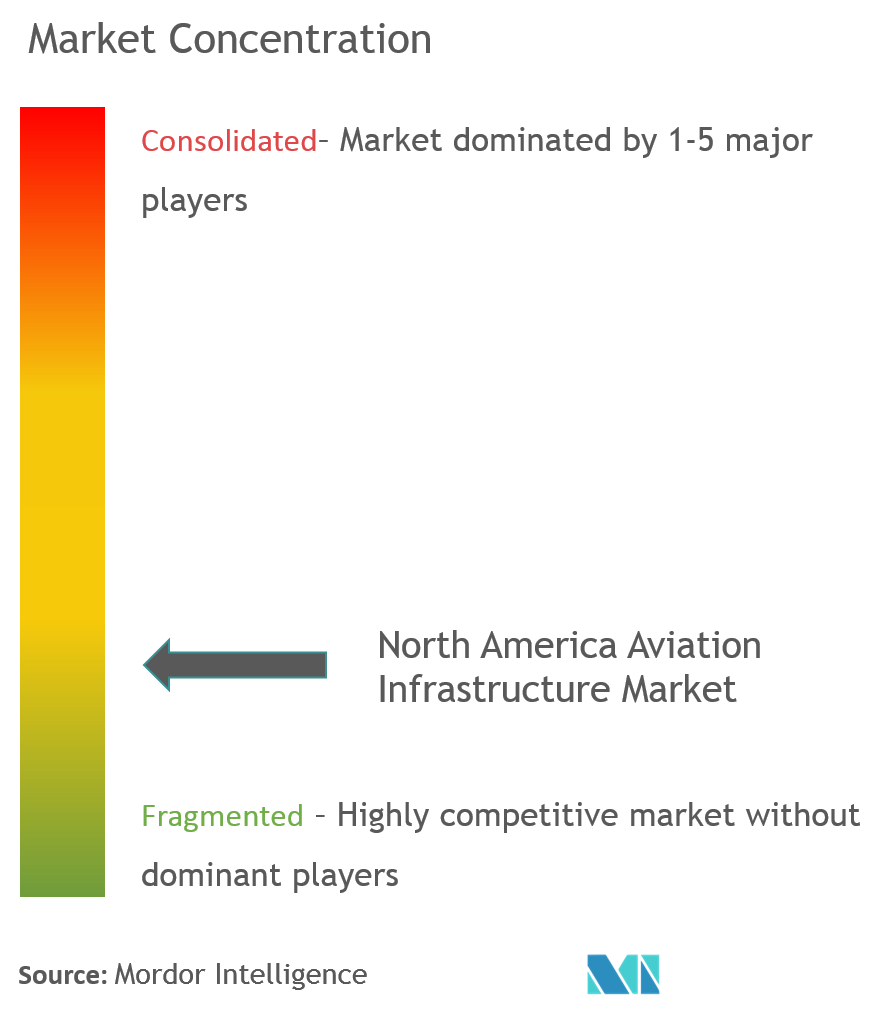

The North America aviation infrastructure market is highly competitive and fragmented. One of the growth strategies adopted by the players is to increase their workforce steadily to be able to complete projects on-time. Companies are also striving to increase their consulting and management services along with their construction capabilities to obtain new airport construction long-term contracts. Airport construction companies work closely with the airport authorities in understanding the requirements and barriers faced by the airports during operation. Construction companies are rapidly adopting advanced technologies like Augmented and Virtual Reality, and small drones among others that can help them in reducing the time required to approve design changes, and to better understand the constructability issues. Some of the prominent players in the North America aviation infrastructure market are Hensel Phelps, Turner Construction Company, Skanska, Austin Industries, and AECOM among others.

North America Aviation Infrastructure Market Leaders

Hensel Phelps

Turner Construction Company

Skanska

Austin Industries

AECOM

*Disclaimer: Major Players sorted in no particular order

North America Aviation Infrastructure Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Assumptions

-

1.2 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Market Drivers

-

4.3 Market Restraints

-

4.4 Industry Attractiveness - Porter's Five Forces Analysis

-

4.4.1 Threat of New Entrants

-

4.4.2 Bargaining Power of Buyers/Consumers

-

4.4.3 Bargaining Power of Suppliers

-

4.4.4 Threat of Substitute Products

-

4.4.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 Type

-

5.1.1 Terminal

-

5.1.2 Taxiway and Runway

-

5.1.3 Apron

-

5.1.4 Control Tower

-

5.1.5 Hangars

-

5.1.6 Others

-

-

5.2 Airport Type

-

5.2.1 Brownfield Airport

-

5.2.2 Greenfield Airport

-

-

5.3 Country

-

5.3.1 United States

-

5.3.2 Canada

-

5.3.3 Mexico

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

-

6.1.1 Hensel Phelps

-

6.1.2 Turner Construction Company

-

6.1.3 Skanska

-

6.1.4 Austin Industries

-

6.1.5 AECOM

-

6.1.6 The Walsh Group

-

6.1.7 McCarthy Building Companies, Inc.

-

6.1.8 JE Dunn Construction Group, Inc.

-

6.1.9 VRH Construction

-

6.1.10 Suffolk Construction

-

6.1.11 Clark Construction Group, LLC

-

6.1.12 Bechtel Corporation*

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

North America Aviation Infrastructure Industry Segmentation

The study considers the planned investments for new airport construction as well as the modernization of existing airports.

| Type | |

| Terminal | |

| Taxiway and Runway | |

| Apron | |

| Control Tower | |

| Hangars | |

| Others |

| Airport Type | |

| Brownfield Airport | |

| Greenfield Airport |

| Country | |

| United States | |

| Canada | |

| Mexico |

North America Aviation Infrastructure Market Research FAQs

What is the current North America Aviation Infrastructure Market size?

The North America Aviation Infrastructure Market is projected to register a CAGR of % during the forecast period (2023-2028).

Who are the key players in North America Aviation Infrastructure Market?

Hensel Phelps, Turner Construction Company, Skanska, Austin Industries and AECOM are the major companies operating in the North America Aviation Infrastructure Market.

North America Aviation Infrastructure Industry Report

Statistics for the 2023 North America Aviation Infrastructure market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Aviation Infrastructure analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.