Project Logistics Market Size

| Study Period | 2019 - 2028 |

| Base Year For Estimation | 2021 |

| CAGR | 0.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

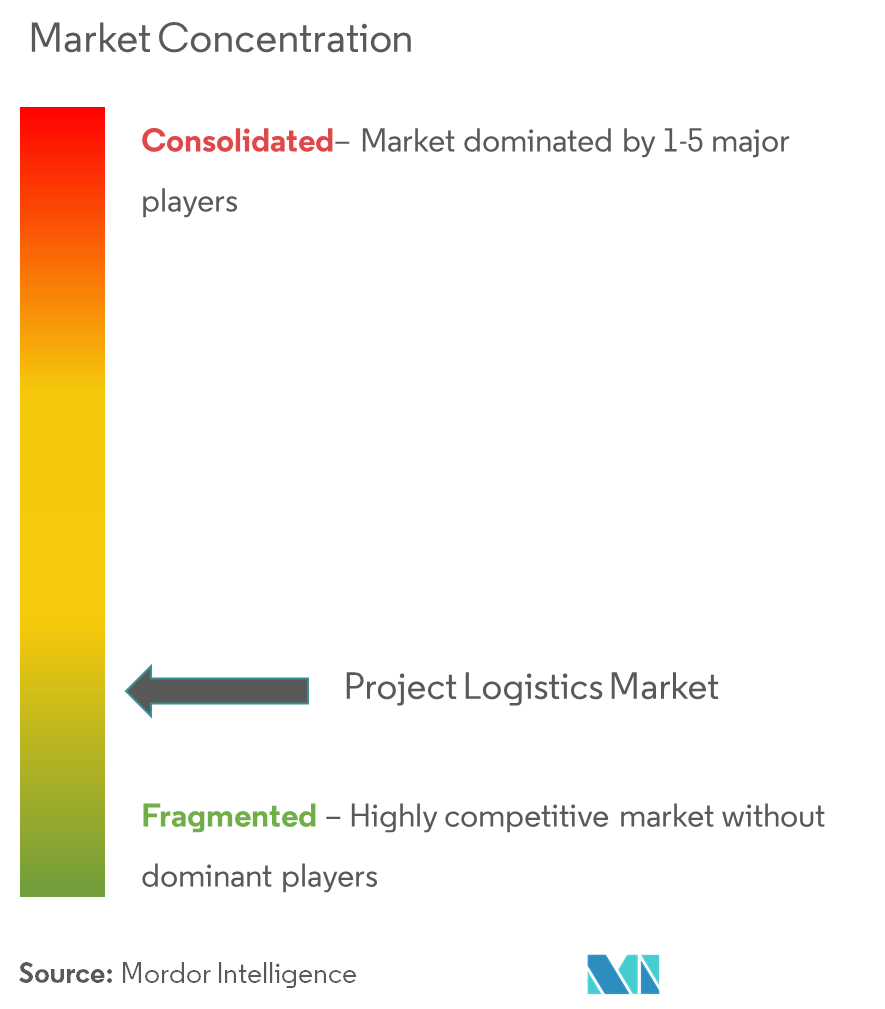

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Project Logistics Market Analysis

- Project logistics involves an integrated process of planning, organization, managing, processing, and controlling the complete flow of goods, materials, and information associated with the successful completion of a project. Cargo with larger dimensions requires a completely different set of equipment, infrastructure, and experienced personnel. Dealing with a cargo of peculiar dimensions is always a challenge for a transporter. However, shippers and service providers are becoming more sophisticated in the transportation of oversized and heavyweight shipments. Manufacturing complexity also adds to the challenge. Parts and modular packages are being produced in far-flung parts of the world, then shipped to final destinations. The packages are more critical, requiring detailed planning. Getting transportation providers more involved in the early stages of the planning process has been a trend for the past five years.

- Rising oil prices and a robust liquefied natural gas (LNG) and petrochemical construction market have been offering opportunities to the project logistics transportation industry since 2019.

- Some established organizations carry out project logistics activities across the world. For instance, the Global Project Logistics Network (GPLN) is a network of independent small and medium project logistics forwarders. GPLN members handle a vast range of industrial projects, from infrastructure projects to major energy projects. The members provide services like transporting, packing/crating, and lifting heavy, oversized, and out-of-gauge cargo.

Project Logistics Market Trends

This section covers the major market trends shaping the Project Logistics Market according to our research experts:

Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies

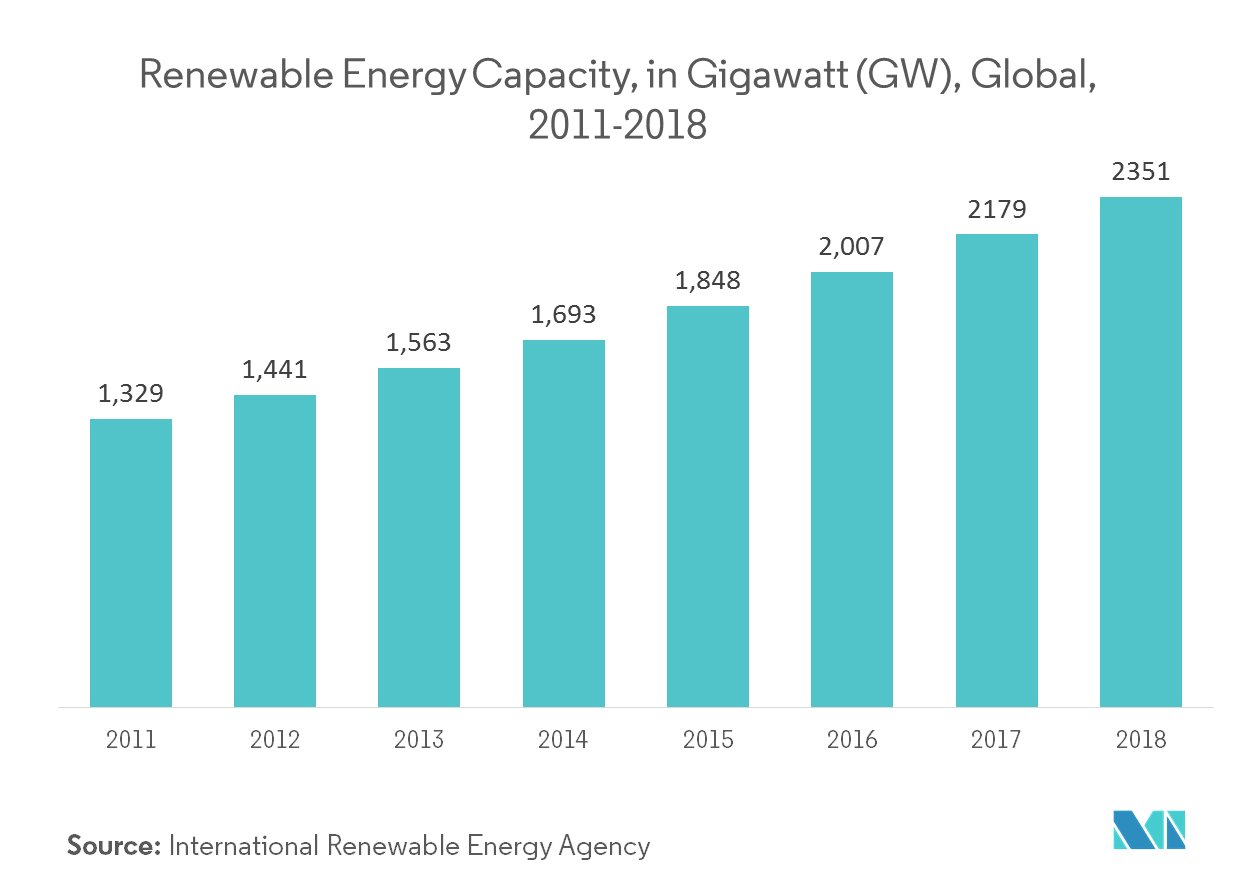

According to global energy sources, the decade-long trend of strong growth in renewable energy capacity continued in 2018, with global additions of 171 gigawatts (GW). It involves hydropower, wind energy, bioenergy, solar energy, and geothermal energy. The annual increase of 7.9% was bolstered by new additions from solar and wind energy, which accounted for 84% of the growth. Significantly, a third of global power capacity is from renewable energy. This trend is expected to continue in the coming years, in order to achieve the global climate objectives and sustainable development goals.

The positive future outlook for renewable energy is driving the current project logistics market. In order to generate the required amount of power in the future, the energy companies need to develop the necessary infrastructure, commence new projects, and install power generation equipment. This scenario is going to create demand for project logistics. Since 2012, about 70% of total turbine installations have been made in the last three months of the year. This late rush not only created huge opportunities for the project cargo companies, but also created third-quarter logistics booking bottleneck. To avoid this, construction companies are looking for multiple options. One option is to move components to installation sites early and using regional laydown facilities to marshal cargo at or near a site well before construction begins. These tactics would help developers avoid trailer shortages during peak shipping periods, allow a longer window for finding qualified heavy-haul drivers who are in short supply, and mitigate cost overruns due to driver overtime and late permitting.

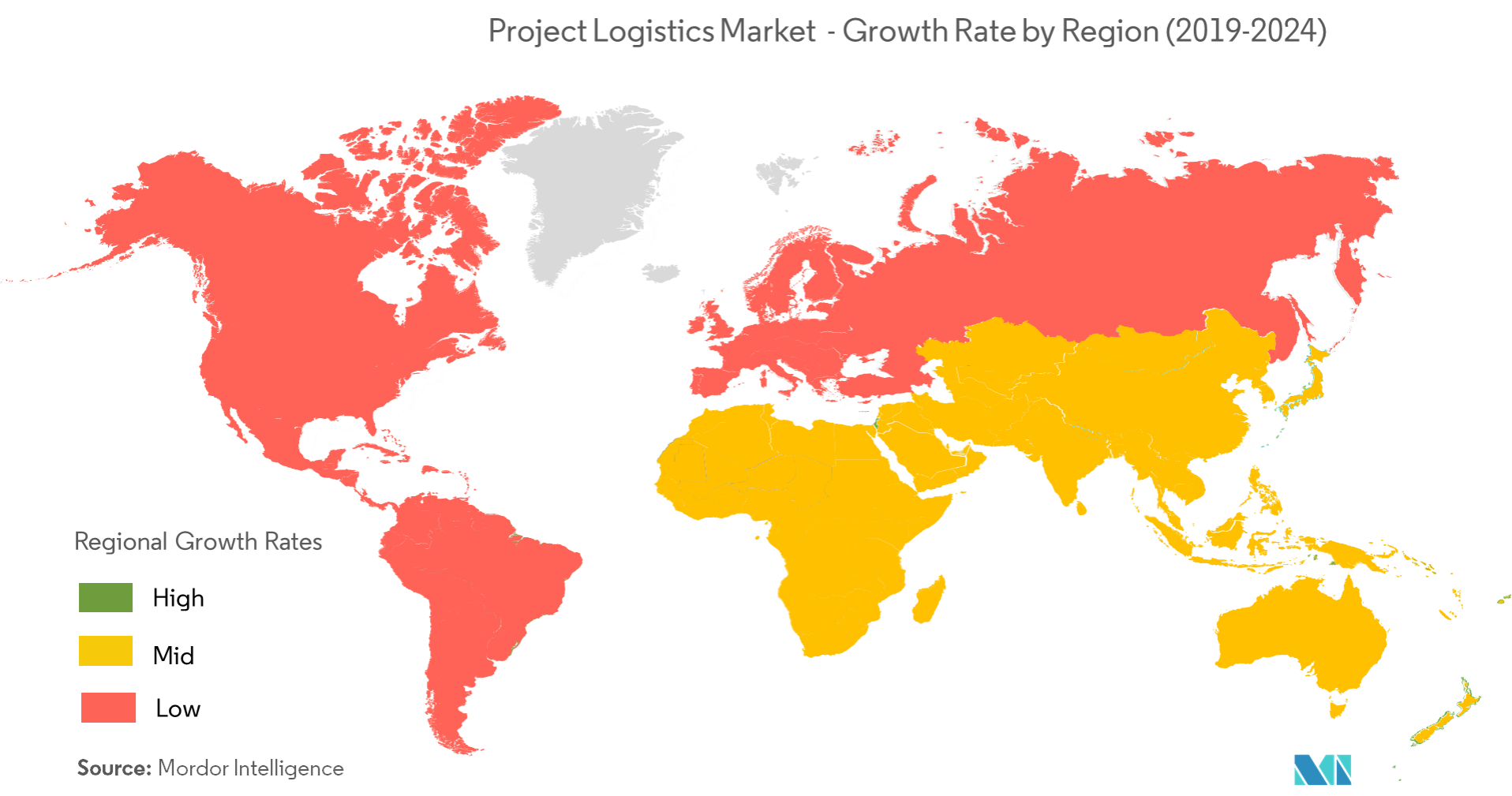

Asia-Pacific Leads the Project Logistics Market

As per the industry sources, Asia-Pacific leads the market. It is also expected to be the fastest-growing market. In recent years, infrastructure investment has been a key driver of economic development for Asia-Pacific countries. Some countries focus on accelerating the development of their domestic infrastructure (such as Australia and the ASEAN countries). China's construction industry has undergone significant transformation in recent years. Since the announcement of the Belt and Road Initiative in 2013, Chinese contractors have undertaken and invested in a vast number of infrastructure projects. According to the China International Contractors Association, in 2017 alone, Chinese contractors concluded 7,217 construction contracts along the Belt and Road and 13,267 construction contracts globally. This increasing construction activity presents a significant opportunity for the regional project cargo companies to provide logistics services to such projects in the coming years.

Some of the regional logistics companies are successfully handling heavy cargo with enhanced capabilities. For instance, Megalift, involved in the transportation of heavy and oversized cargoes, received a contract from General Electric to transport the current largest and most efficient heavy-duty gas turbine in the world. Megalift transported the massive General Electric 9HA.02 gas turbine in Malaysia, which came from France to Pasir Gudang port, located in the southern region of Peninsular Malaysia. Since 2018, Megalift has been moving a large number of shipments for the Track 4A project.

Project Logistics Industry Overview

The project logistics market is fragmented, with the presence of global players and small- and medium-sized local players. Most global logistics players have a special project cargo division to meet the market needs and demand. Local players are also increasingly enhancing their capabilities in terms of fleet size, service offerings, industries served, and technology. Global manufacturers are making large and oversized components in the factory sites (off-site), which creates huge complexities for the heavy cargo haulage companies. Global companies with high capital and assets can invest in upgraded fleets and benefit from this scenario. On the other hand, regional and local players are also coming up with better industry solutions to support the clients' needs in executing the projects in the scheduled time.

Project Logistics Market Leaders

CH Robinson

Kerry Logistics

DB Schenker

Kuehne + Nagel International AG

Hellmann Worldwide Logistics

*Disclaimer: Major Players sorted in no particular order

Project Logistics Market News

- December 2021 - Bollore Logistics successfully transported 30,000 ton of equipment from January to December 2021 for a solar farm project in the Atacama region of Chile. The project involved delivering 10 containers per day, from Monday to Saturday, for a year from the port of Angamos to the site of Diego Almagro, approximately 500 km away. Bollore Logistics Chile contracted an exclusive agreement with a road transport company in the Atacama region to ensure this logistics operation.

- November 2021 - NMT Global Project Logistics and Fortescue Metals Group (FMG) entrusted BBC Chartering to carry heavy-lift steel module structures, ancillary cargoes, and containers for the Iron Bridge project. Once online, the modern and innovative mine development process is projected to produce 22 million metric ton per annum for export. Shipments for this project are ongoing and are expected to be completed in April/May 2022.

Project Logistics Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Deliverables

1.2 Study Assumptions

1.3 Scope of the Study

2. RESEARCH METHODOLOGY

2.1 Analysis Methodology

2.2 Research Phases

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

4.1 Current Market Scenario

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.3 Industry Attractiveness - Porter's Five Forces Analysis

4.4 Industry Value Chain Analysis

4.5 Government Regulations and Initiatives

4.6 Global Logistics Sector (Overview, LPI Scores, Key Freight Statistics, Etc.)

4.7 Spotlight - Role of Multimodal Transport in Project Cargo

4.8 Insights - Retail Oil and Gas Logistics Sector

4.9 Review and Commentary on Heavy and Large Dimension Shipments

4.10 Focus on the Prefabrication Industry - Role of Project Logistics Companies in Transportation

4.11 Insights into Customized Trailer Manufacturers for Moving Heavy Cargo

4.12 Spotlight on the Demand for Contract Logistics and Integrated Logistics

5. MARKET SEGMENTATION

5.1 Service

5.1.1 Transportation

5.1.2 Forwarding

5.1.3 Inventory Management and Warehousing

5.1.4 Other Value-added Services

5.2 End User

5.2.1 Oil and Gas, Mining, and Quarrying

5.2.2 Energy and Power

5.2.3 Construction

5.2.4 Manufacturing

5.2.5 Other End Users

5.3 Geography

5.3.1 Asia-Pacific

5.3.2 Americas

5.3.3 Europe

5.3.4 Middle-East and Africa

6. COMPETITIVE LANDSCAPE

6.1 Overview (Market Concentration and Major Players)

6.2 Company Profiles

6.2.1 Rhenus Logistics

6.2.2 Bollore Logistics

6.2.3 Agility Logistics

6.2.4 EMO Trans

6.2.5 Hellmann Worldwide Logistics

6.2.6 Kuehne + Nagel International AG

6.2.7 C.H. Robinson Worldwide Inc.

6.2.8 Ceva Logistics

6.2.9 NMT Global Project Logistics

6.2.10 Rohlig Logistics

6.2.11 Ryder System Inc.

6.2.12 Expeditors International of Washington Inc.

6.2.13 Megalift Sdn Bhd

6.2.14 Dako Worldwide Transport GmbH

6.2.15 CKB Logistics Group

6.2.16 SAL Heavy Lift GmbH

6.2.17 DB Schenker

6.2.18 Kerry Logistics

6.2.19 Deutsche Post DHL*

- *List Not Exhaustive

6.3 Other Players in the Market

6.3.1 FLS Transportation Services, Crowley Logistics, Highland Forwarding Inc., Kinetix International Logistics, Cole International Inc., Hisiang Logistics Co. Ltd, Sea Cargo Air Cargo Logistics Inc., and Bati Group

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. APPENDIX

8.1 GDP Distribution, by Activity - Key Countries

8.2 Insights into Capital Flows - Key Countries

8.3 Economic Statistics - Transport and Storage Sector, and Contribution to Economy (Key Countries)

8.4 List of Major Global Projects (Oil and Gas, Construction, Infrastructure Development, Etc.)

8.5 Freight Statistics (Mode, Product Category, Etc.)*

9. DISCLAIMER

Project Logistics Industry Segmentation

The scope of the report offers a complete background analysis of the project logistics market, including an assessment of the sector and its contribution to the economy, market overview, market size estimation for key segments, key countries and emerging trends in the market segments, market dynamics, and key project statistics.

| Service | |

| Transportation | |

| Forwarding | |

| Inventory Management and Warehousing | |

| Other Value-added Services |

| End User | |

| Oil and Gas, Mining, and Quarrying | |

| Energy and Power | |

| Construction | |

| Manufacturing | |

| Other End Users |

| Geography | |

| Asia-Pacific | |

| Americas | |

| Europe | |

| Middle-East and Africa |

Project Logistics Market Research FAQs

What is the current Project Logistics Market size?

The Project Logistics Market is projected to register a CAGR of 0% during the forecast period (2023-2028).

Who are the key players in Project Logistics Market?

CH Robinson, Kerry Logistics, DB Schenker, Kuehne + Nagel International AG and Hellmann Worldwide Logistics are the major companies operating in the Project Logistics Market.

Which is the fastest growing region in Project Logistics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2028).

Which region has the biggest share in Project Logistics Market?

In 2023, the Asia Pacific accounts for the largest market share in the Project Logistics Market.

Project Logistics Industry Report

Statistics for the 2023 Project Logistics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Project Logistics analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.