Small Satellite Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2021 |

| Forecast Data Period | 2024 - 2028 |

| CAGR | > 14.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Small Satellite Market Analysis

The small satellite market is expected to register a CAGR of over 14% during the forecast period.

The COVID-19 pandemic did not significantly affect the small satellites market due to a consistent demand in the defense, government, and commercial sectors, irrespective of the impact of the pandemic. Although the small satellite launch activities witnessed delays for a brief period in 2020, they resumed, which propelled the growth of the small satellite industry.

Small satellites are developed in large numbers for applications across diverse sectors such as defense, commercial, and civil utilization. The operational dynamics of the space industry make it resistant to commercial shocks while increasing the demand from various sectors, which is projected to propel the market during the forecast period. The increase in defense expenditure globally, with a strong emphasis on the development of military-based satellite-based communications and ISR, is expected to positively impact the small satellite market during the forecast period.

However, the initial cost of research and development, manufacturing, and technology transfer may act as barriers to the growth of the small satellites market during the forecast period.

Small Satellite Market Trends

This section covers the major market trends shaping the Small Satellite Market according to our research experts:

The Military Segment is Expected to Dominate the Market During the Forecast Period

Military satellites are used for communication, surveillance, and reconnaissance mission profiles. Military satellites can provide continuous coverage of an area and can be used for early warning. Besides surveillance, military satellites can also perform strategic and tactical operations. In addition to observing enemy weapon developments, the satellites can also verify international compliance with the arms limitation treaties and aid in strategic targeting by predetermining the deployments of military assets at strategic vantage points in case of an armed conflict. The military small satellite manufacturers are focusing on cost-effective approaches to mass-produce small satellites to meet the increasing demand. The approach involves using low-cost industrial-rated passives at the development and design validation stages. The implementation of standardized satellite designs has enabled greater flexibility in choosing launch systems due to the flexibility of various small satellites. Small satellites can be fitted into multiple launch systems and reduce the launch cost.

Small military satellites can also be launched as a secondary payload. The adoption is increasing because of the increasing use of satellites in tactical warfare. Many innovative programs are in the pipeline to produce and launch small satellites for defense purposes. For instance, in July 2021, the Netherlands launched the country’s first military satellite. BRIK II, a nanosatellite by the company Virgin Orbit, into orbit around the Earth. BRIK II is an experimental project of the Royal Netherlands Air Force and marks the entry of the country’s military into the space domain. Such developments are expected to positively impact the demand for military satellites during the forecast period.

The Asia-Pacific Region is Expected to be the Fastest-growing Region During the Forecast Period.

The increasing demand for satellite data services in domains such as satellite-based network infrastructure and information technology-based services, due to increased per capita income in developing nations of the Asia-Pacific region such as China, India, and Vietnam, is expected to aid the small satellite market during the forecast period. With the growing emphasis on space research, India is expected to become a major player globally in small satellite solutions, as the Indian Space Research Organization (ISRO) diverts most of its commercial space-related activities to the industry and enhances focus on advanced research. The Government of India is also promoting initiatives to bring major private organizations in the space industry to collaborate and work together. In addition to this, another major country in the region, China, is also investing heavily in space technology. As per the China National Space Administration (CNSA), the country expects to launch about 100 satellites by 2025. Considering the increase in space-related activities in the region, satellite manufacturers are enhancing their satellite production capabilities to tap into the rapidly growing market. These developments are expected to positively impact the small satellite market in the country and the Asia-Pacific region.

Small Satellite Industry Overview

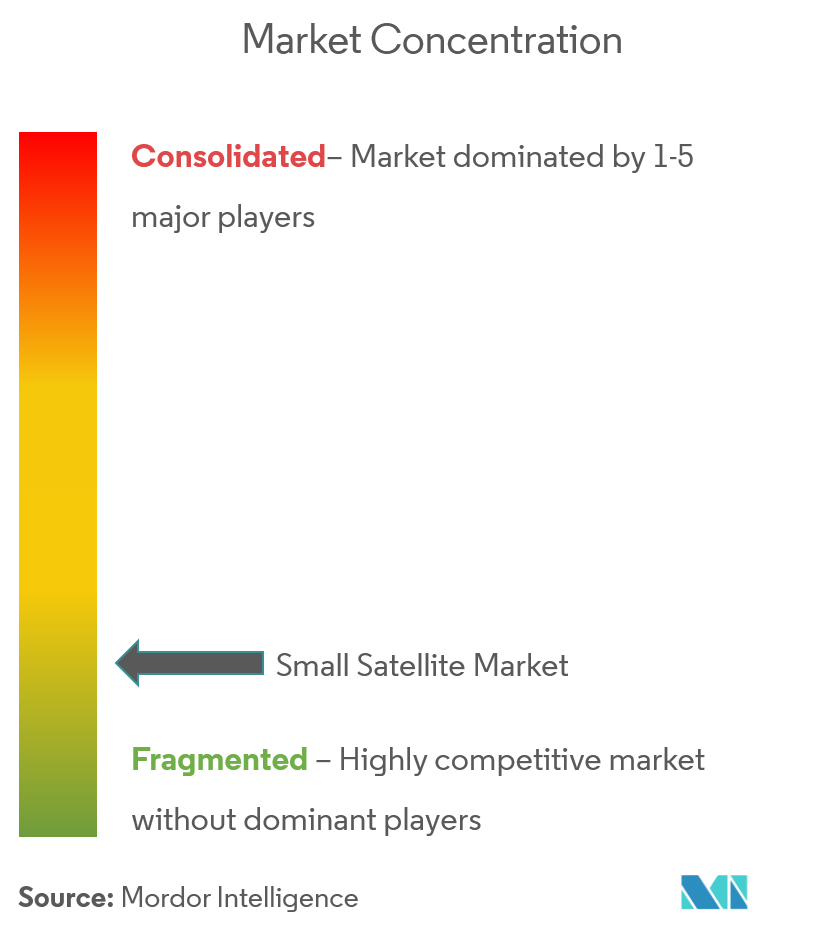

The presence of several players in the small satellite market makes it a fragmented market, with high competitive rivalry among the players having a presence in diverse sectors such as defense, commercial, and civil aerospace. The major players in this industry are based out of North America and Europe due to the presence of the necessary infrastructure required for the development of the satellite communication industry and a strong emphasis on space research and telecommunication. Companies such as Thales Alenia Space (France), Planet Labs Inc., Spire Global Inc., Space Exploration Technologies Corp., and others compete for the major share of the market. The threat of new entrants in the small satellite market is moderate due to high initial cost but competitive at the same time due to high demand potential from diverse sectors from Earth observation to communication, navigation, defense application, environmental study, and others.

Small Satellite Market Leaders

Planet Labs Inc.

Spire Global Inc.

Surrey Satellite Technology Ltd

Thales Alenia Space

Space Exploration Technologies Corp.

*Disclaimer: Major Players sorted in no particular order

Small Satellite Market News

- In January 2022, Virgin Orbit placed seven CubeSats for three customers into orbit on the third consecutive successful operational flight of its LauncherOne air-launch system. Two of the satellites were from SatRevolution, a Polish smallsat developer. One satellite was from Spire Global, which was developed with the Austrian Space Forum and Findus Venture GmbH to measure the orbital debris environment. The remaining four of satellites came through the Defense Department’s Space Test Program.

- In November 2021, SpaceX announced that the company successfully deployed 53 Starlink satellites in the launch of the broadband constellation. The satellites were launched onboard Falcon 9. The company cumulatively launched over 1,800 Starlink satellites for global coverage of satellite internet services.

Small Satellite Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions

1.2 Scope of the Study

1.3 Currency Conversion Rates for USD

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

3.1 Market Size and Forecast, Global, 2018 - 2027

3.2 Market Share by Type, 2021

3.3 Market Share by End User, 2021

3.4 Market Share by Geography, 2021

3.5 Structure of the Market and Key Participants

4. MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints

4.4 Industry Attractiveness - Porter's Five Forces Analysis

4.4.1 Threat of New Entrants

4.4.2 Bargaining Power of Buyers/Consumers

4.4.3 Bargaining Power of Suppliers

4.4.4 Threat of Substitute Products

4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size and Forecast by Value - USD million, 2018 - 2027)

5.1 Type

5.1.1 Minisatellite

5.1.2 Microsatellite

5.1.3 Nanosatellite

5.1.4 Picosatellite

5.1.5 Femtosatellite

5.2 End User

5.2.1 Civil

5.2.2 Commercial

5.2.3 Military

5.3 Geography

5.3.1 North America

5.3.1.1 United States

5.3.1.2 Canada

5.3.2 Europe

5.3.2.1 Germany

5.3.2.2 United Kingdom

5.3.2.3 France

5.3.2.4 Russia

5.3.2.5 Spain

5.3.2.6 Rest of Europe

5.3.3 Asia-Pacific

5.3.3.1 India

5.3.3.2 China

5.3.3.3 Japan

5.3.3.4 Rest of Asia-Pacific

5.3.4 Latin America

5.3.4.1 Brazil

5.3.4.2 Argentina

5.3.5 Middle East and Africa

5.3.5.1 United Arab Emirates

5.3.5.2 Saudi Arabia

5.3.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

6.1 Vendor Market Share

6.2 Company Profiles

6.2.1 L3Harris Technologies Inc.

6.2.2 Thales Alenia Space

6.2.3 Singapore Technologies Engineering Ltd

6.2.4 Blue Canyon Technologies Inc.

6.2.5 Sierra Nevada Corporation

6.2.6 Northrop Grumman Corporation

6.2.7 GomSpace Group AB

6.2.8 Surrey Satellite Technology Ltd (Airbus SE)

6.2.9 Millennium Space Systems Inc. (The Boeing Company)

6.2.10 Adcole Maryland Aerospace LLC

6.2.11 Planet Labs Inc.

6.2.12 Spire Global Inc.

6.2.13 Space Exploration Technologies Corp.

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Small Satellite Industry Segmentation

Small or miniature satellites are satellites of small size and mass under 500 kg (1100 lb). The advent of microelectronics has led to the use of small satellites for applications such as navigation, communication, surveillance for defense purposes, and others.

The small satellite market is segmented by type, end user, and geography. Based on type, the small satellite market is sub-segmented into minisatellite (150–500 kg), microsatellite (10–150 kg), nanosatellite (1–10 kg), picosatellite (0.01–1 kg), and femtosatellite (0.001–0.01 kg). Based on end users, the market is sub-segmented into civil, commercial, and military. The report also covers the market size and forecasts across the major regions. For each segment, the market sizing and forecasts have been done based on the value in USD million.

| Type | |

| Minisatellite | |

| Microsatellite | |

| Nanosatellite | |

| Picosatellite | |

| Femtosatellite |

| End User | |

| Civil | |

| Commercial | |

| Military |

| Geography | ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

Small Satellite Market Research FAQs

What is the current Small Satellite Market size?

The Small Satellite Market is projected to register a CAGR of greater than 14% during the forecast period (2023-2028).

Who are the key players in Small Satellite Market?

Planet Labs Inc., Spire Global Inc., Surrey Satellite Technology Ltd, Thales Alenia Space and Space Exploration Technologies Corp. are the major companies operating in the Small Satellite Market.

Which is the fastest growing region in Small Satellite Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2028).

Which region has the biggest share in Small Satellite Market?

In 2023, the North America accounts for the largest market share in the Small Satellite Market.

Small Satellite Industry Report

Statistics for the 2023 Small Satellite market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Small Satellite analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.