Super Hi-Vision Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2021 |

| CAGR | 23.08 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Super Hi-Vision Market Analysis

The Super Hi-Vision market was valued at USD 46.51 billion in 2020 and is expected to reach USD 161.67 billion by 2026 and work at a CAGR of 23.08% over the forecast period (2021-2026). The 8K Super Hi-Vision (8K SHV) camera is trending in market, which represents 16 times of numbers of pixels than numbers of pixels of Full HD (1920 x 1080 pixels), and 4 times of 4K Ultra HD (3840 x 2160 pixels). It means that 8K Ultra HD brings 16 times of information of image data, that is equivalent to 16 times digital zoom, which should be equal to Full HD quality This latest development is also capable of recording 8K in a camera head that is smaller and lighter.

- Rising demand for better resolution display screen is driving the market. The 8K technology is implemented in different resolutions. Furthermore, the 8K UHD (7680 × 4320 resolution) is best suited for monitors and televisions. Its high pixel count provides better viewing angles and high clarity images. This segment is expected to account for a major market share, as new technologies witness high demand, especially in case of consumer goods.

- The advancements in display technology in consumer electronics, along with the increase in demand for high-resolution TVs among consumers, create a positive response for the growth of the market. The large-screen and high-resolution TVs propound better quality and realistic images, as well as an enhanced viewing experience. For instance Sharp has developed an 85-inch LCD (7,680 horizontal × 4,320 vertical pixels). This was achieved by enhancing display quality utilizing Sharp’s proprietary UV2A technology.

- High price and prime costing of 8K product is restraining the market. Due to its advanced display technology with the miniaturization of innovative products, its price remains high.

Super Hi-Vision Market Trends

This section covers the major market trends shaping the Super Hi-Vision Market according to our research experts:

8K UHD Television Under Consumer Segment is Expected to Have Significant Growth

- Television is experiencing robust growth, especially in 8K UHD TV due to its high pixel counts, and with the support of advanced facilities, companies produce very large LCD sheets, called mother glass, from which display panels of TV are cut. As a result, bigger panels can be produced with less waste, helping to drive down costs and consumer prices.

- Samsung, which previously had an 8K model in 2018 announced the accessibility of its 2019 QLED TV's, which include the Q900, an 8K model that’s available in sizes ranging from 65 to 98 inches, with prices that start at just USD 5,000.

- The 2020 Tokyo Olympics will be a significant exhibit for 8K TV broadcast, at least in Japan, but how much of the games will be broadcast in that resolution in the United States or Europe remains to be seen.

- Going forward, Sharp wants to use its technology in other fields outside of entertainment. The company has described the 120in 8K TV's potential for use in remote art restorations, for instance, making use of the TV’s impeccable resolution and 5G connection, as well as in education. This will increase the demand of UHD 8K TV in coming future.

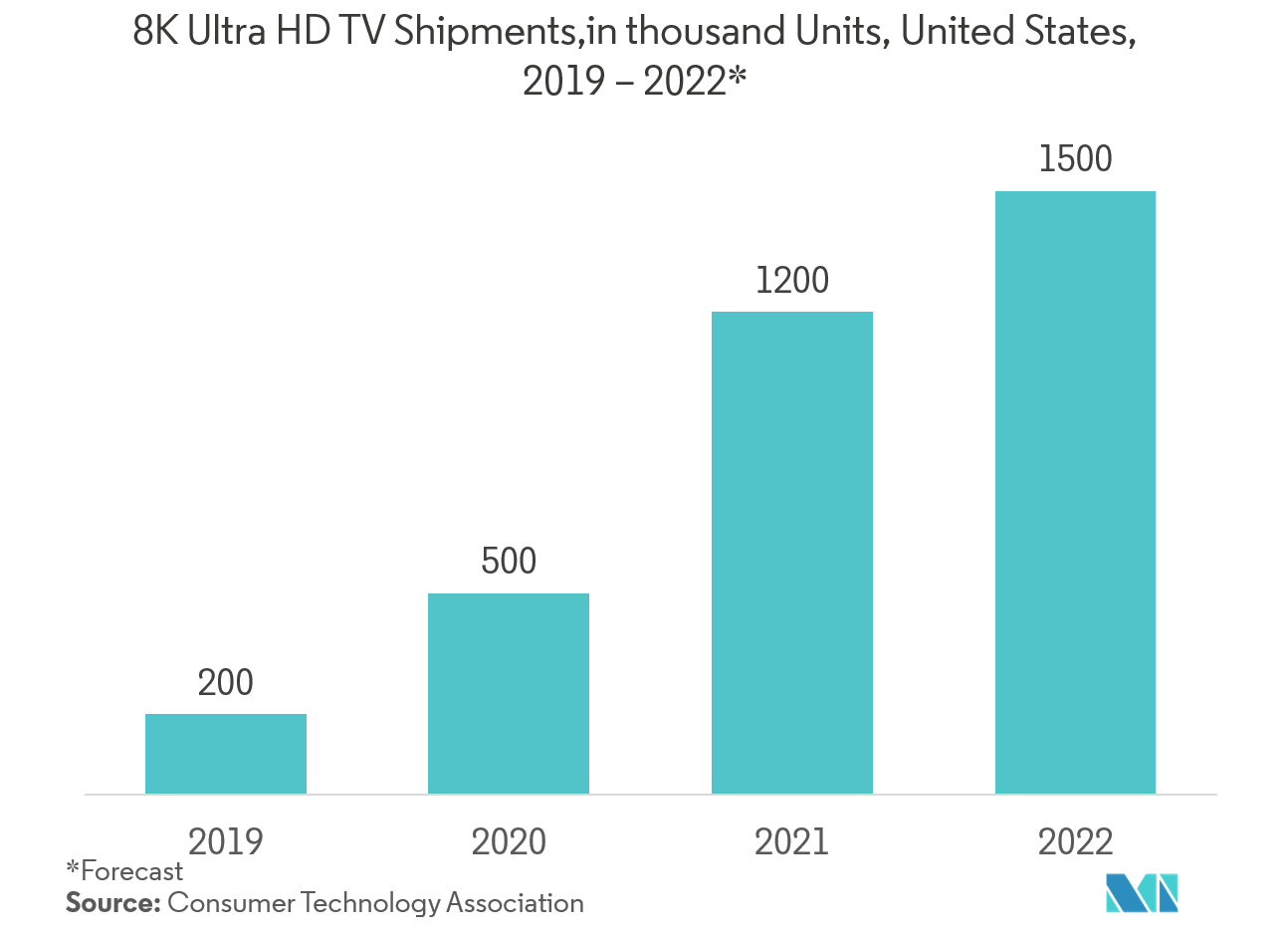

- The call for 8K Ultra HDTV, in the United States, is expanding year-on-year. They are the prior adopters of this technology and thus, the above factors are anticipated to have a positive outlook in the 8K television market.

- For instance, in Sep 2019, LG Electronics USA announced pricing and immediate availability of the world's first 8K OLED TV and the LG 8K NanoCell TV, which will be on display at the CEDIA EXPO 2019.

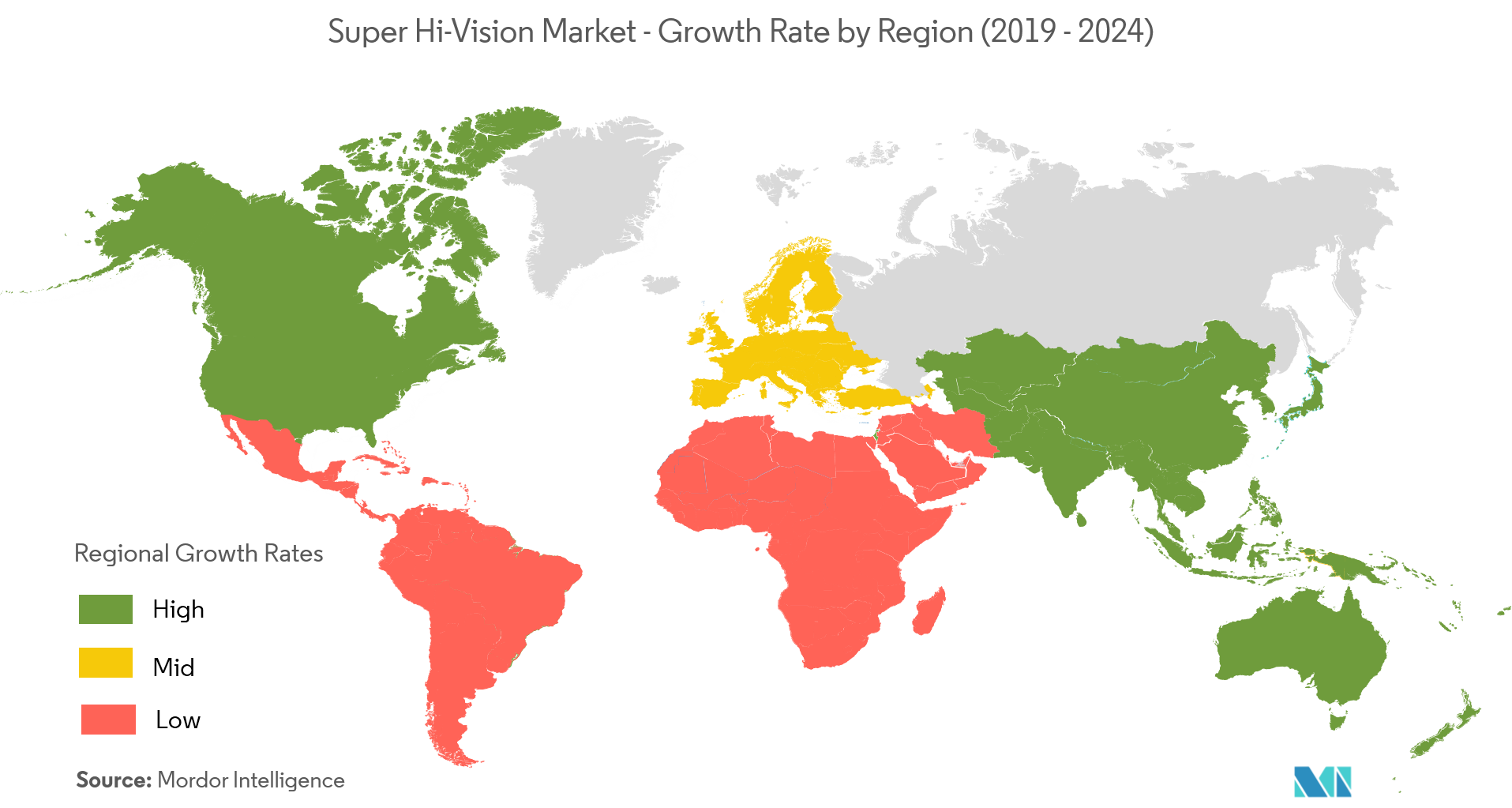

Asia Pacific Expected to be the Fastest Growing Region

- The Asia-Pacific region is a major revenue contributor to the market studied, due to the presence of a large consumer population, along with the presence of a number of players, like Sharp and BOE Japan. Since the past few years, Japan has been actively investing in the development of the super hi-vision devices, while supporting technological aspects. Thus, Japan has a stronghold for enabling and broadcasting 8K content.

- The country placed 8K experience zones, such as Tokyo 8K Theater, and Tokyo 8K Super Hi-Vision Theater, for people to experience 8K technology. Since, it is in the early stages of development, it is not affordable for all, and the demand is only from high-income individuals or businesses.

- For instance, the Japan-based broadcasting company, NHK implemented first 8K TV channel in Dec 2018. NHK has also utilized the super Hi-Vision technology for applications ranging from cameras (photos and videos, microphones) to receivers, which increases the market growth effectively.

- China is expected to emerge as the market leaders, by witnessing an increasing demand over the forecast period. China is one of the major consumers, which has the infrastructure to support mass production of 8K devices. This indicates that once the technology is set and becomes the norm, the Chinese manufacturers are likely to lower the prices and local manufactures are expected to emerge in the market.

- LG Electronics has announced the world's first rollable OLED TV, the 65" Signature OLED TV R, and the 88" 8K Z9 OLED TV, which gives a high vision effect quality. The company has planned to start shipping both TVs in the second half of 2019 in Korea.

Super Hi-Vision Industry Overview

The super hi-vision market is highly fragmented and competitive because of the presence of major players. With new technology through R&D is giving strong competition among the players. Key players are Dell Inc., Red Digital Cinema Camera Company, Sharp Corporation, etc. Recent developments in the market are -

- Aug 2019 - LG’s new 8K model expands its scale of premium NanoCell TVs, encompassing LED/LCD components for vivid colour purity, enhanced blacks, advanced image processing and AI functionalities. The NanoCell 8K TV features Cinema HDR (HDR10, HLG, Advanced HDR by Technicolour, Dolby Vision HDR and more) enabling users to harness-compatible premium Netflix content.

- May 2019 - Japan-based Sharp confirmed that the brand will re-enter the TV business in the United States during the second half of the year under a partnership with Hong Kong-based Hisense. It will further accelerate the transformation of its business to innovate the world with 8K/4K Ecosystem + 5G and AIoT (Artificial Intelligence of Things).

Super Hi-Vision Market Leaders

LG Electronics Inc.

Red Digital Cinema Camera Company

Samsung Group

Dell Inc.

Sharp Corporation

*Disclaimer: Major Players sorted in no particular order

Super Hi-Vision Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

-

4.3.1 Rising Demand for Better Resolution Display Screen

-

4.3.2 Advancements in Display Technology in Consumer Electronics

-

-

4.4 Market Restraints

-

4.4.1 High Price and Prime Costing of 8K Product

-

-

4.5 Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

-

4.6.1 Threat of New Entrants

-

4.6.2 Bargaining Power of Buyers/Consumers

-

4.6.3 Bargaining Power of Suppliers

-

4.6.4 Threat of Substitute Products

-

4.6.5 Intensity of Competitive Rivalry

-

-

-

5. TECHNOLOGY SNAPSHOT

-

6. MARKET SEGMENTATION

-

6.1 By Application

-

6.1.1 Healthcare and Medical

-

6.1.2 Consumer Electronics

-

6.1.3 Commercial

-

6.1.4 Other Applications

-

-

6.2 Geography

-

6.2.1 North America

-

6.2.2 Europe

-

6.2.3 Asia-Pacific

-

6.2.4 Latin America

-

6.2.5 Middle East & Africa

-

-

-

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

-

7.1.1 Dell Inc.

-

7.1.2 Red Digital Cinema Camera Company

-

7.1.3 Samsung Group

-

7.1.4 Sharp Corporation

-

7.1.5 BOE Japan Co. Ltd

-

7.1.6 Canon Inc.

-

7.1.7 Hisense Co. Ltd

-

7.1.8 Ikegami Tsushinki Co. Ltd.

-

7.1.9 LG Electronics Inc.

-

7.1.10 Panasonic Corporation

-

- *List Not Exhaustive

-

-

8. INVESTMENT ANALYSIS

-

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

Super Hi-Vision Industry Segmentation

The super hi-vision is a digital video format referred to as ultra-high definition (UHD) picture quality with impressive 3D sound. Super Hi-Vision market can provide new dimensions to television broadcasting and commercial electronics, camera lenses, medical science, space science and defence sectors by high-resolution display technology.

| By Application | |

| Healthcare and Medical | |

| Consumer Electronics | |

| Commercial | |

| Other Applications |

| Geography | |

| North America | |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Super Hi-Vision Market Research FAQs

What is the current Super Hi-Vision Market size?

The Super Hi-Vision Market is projected to register a CAGR of 23.08% during the forecast period (2023-2028).

Who are the key players in Super Hi-Vision Market?

LG Electronics Inc., Red Digital Cinema Camera Company, Samsung Group, Dell Inc. and Sharp Corporation are the major companies operating in the Super Hi-Vision Market.

Which is the fastest growing region in Super Hi-Vision Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2028).

Which region has the biggest share in Super Hi-Vision Market?

In 2023, the North America accounts for the largest market share in the Super Hi-Vision Market.

Super Hi-Vision Industry Report

Statistics for the 2023 Super Hi-Vision market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Super Hi-Vision analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.