UAE Home Furniture Market Size

| Study Period | 2019 - 2028 |

| Base Year For Estimation | 2021 |

| Market Size (2023) | USD 1.91 Billion |

| Market Size (2028) | USD 2.31 Billion |

| CAGR (2023 - 2028) | 3.91 % |

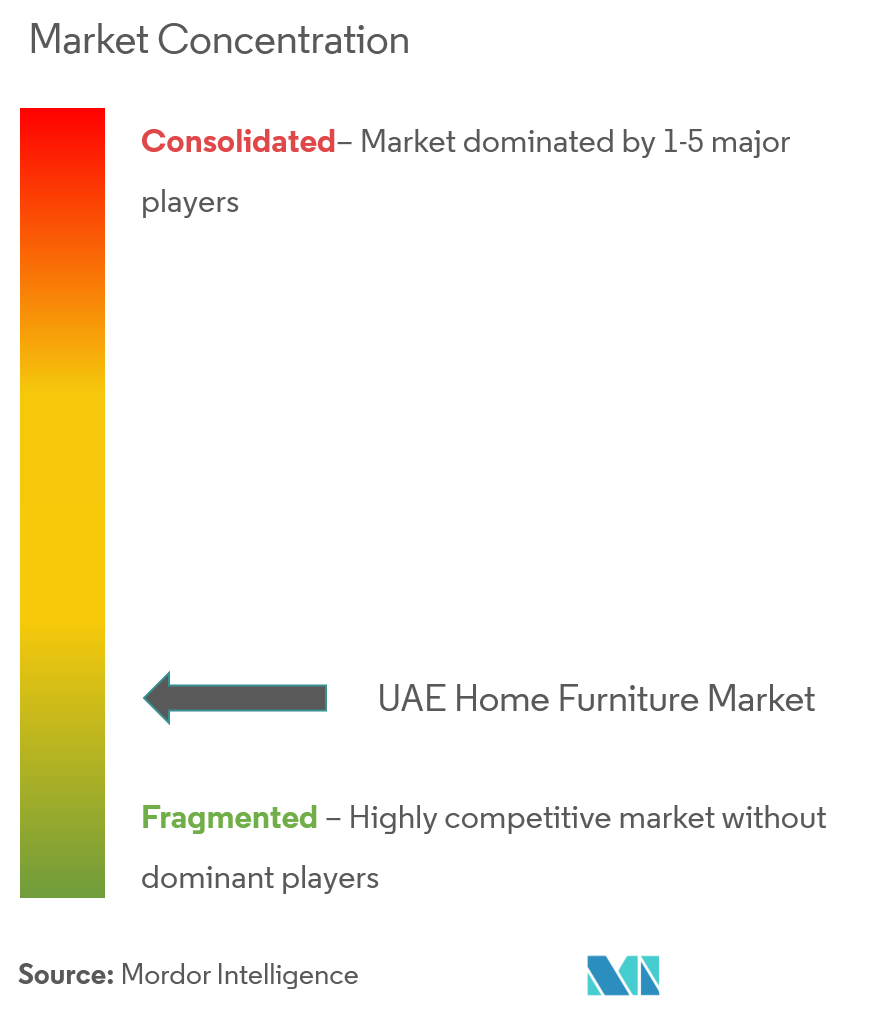

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

UAE Home Furniture Market Analysis

The UAE Home Furniture Market size is estimated at USD 1.91 billion in 2023, and is expected to reach USD 2.31 billion by 2028, growing at a CAGR of 3.91% during the forecast period (2023-2028).

In the United Arab Emirates, people are increasing their spending on renovating homes (furniture, kitchens, bathrooms, and flooring), and are investing in higher-quality products. In Abu Dhabi and Dubai, there are a large number of expats (more than 170 nationalities), therefore, the region is developing as a potential market for all types of furniture.

Major raw materials that are required for the production of furniture products are wood. Some other inputs include fittings and finishing materials.

It was observed that the demand for high-end luxury furniture items has increased over the years. Furniture items, which entail heavy fabric and leather, were more preferred by the people of the country.

This rise in demand has led to the growing domestic demand and the emergence of multiple players catering to the same target audience. Manufacturers and retailers operating in the region compete on almost the same grounds of quality of the product and the material used to manufacture the product.

Branded furniture companies are slowly starting to take over this market.

UAE Home Furniture Market Trends

This section covers the major market trends shaping the UAE Home Furniture Market according to our research experts:

Kitchen Furniture Segment

Residential kitchens have become the new living rooms in modern homes. It reflects the consumer's preference for feeling good and eating well in a hygienic setting. They have become a very important part of homes for making food in the country and are considered the hearts of the households. Consumers in the market are extensively interested in designing kitchens to their own level of preference and taste. Various factors, such as kitchen designs and type of furniture have become extremely important in the current scenario. Consumers are spending as much as AED 170,000-420,000 to revamp their kitchens. The industry is witnessing high consumer preference for German and Italian style of kitchens, owing to their high-end appeal and luxurious finishing. Homebuyers in Dubai are opting for best-looking kitchens, in order to enhance their cooking experience at homes and replicate the food items from restaurants.

The Bedroom Furniture Segment

The growing population and the influx of expatriates in the United Arab Emirates have led to an increase in demand for the number of residential spaces across the region. The sales of bedroom furniture increased in the country, in order to cater to the expanding customer base. Revenue from the sales of mattresses had a major share in the total market revenue of this segment.

UAE Home Furniture Industry Overview

The UAE furniture industry is expected to register a positive CAGR during 2020-2025, With the increase in nuclear families and rise in demand for residential apartments, the country is likely to witness an increase in the expat population, owing to the stability in oil prices in the near future. The development of key projects, like Caesars Palace, Fairmont, and other projects, may lead to the development of the tourism industry in the country.

UAE Home Furniture Market Leaders

IKEA

Home Centre

PAN Emirates Home Furnishings

Danube Home

*Disclaimer: Major Players sorted in no particular order

UAE Home Furniture Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Drivers

-

4.3 Restraints

-

4.4 Opportunities

-

4.5 Value Chain Analysis

-

4.6 Porter's Five Forces Analysis

-

4.7 Technology Innovations in the Industry

-

4.8 Impacts of COVID-19 on the market

-

4.9 Insights on Imports and Exports of Furniture type

-

4.10 Insights on Demographics and Buying Patterns among Consumers in the United Arab Emirates

-

-

5. MARKET SEGMENTATION

-

5.1 By Material

-

5.1.1 Wood Furniture

-

5.1.2 Metal Furniture

-

5.1.3 Plastic and Other Furniture

-

-

5.2 By Type

-

5.2.1 Living Room Furniture

-

5.2.2 Kitchen Furniture

-

5.2.3 Dining Room Furniture

-

5.2.4 Bedroom Furniture

-

5.2.5 Other Furniture

-

-

5.3 By Distribution Channel

-

5.3.1 Home Centers

-

5.3.2 Flagship Stores

-

5.3.3 Specialty Stores

-

5.3.4 Online Stores

-

5.3.5 Other Distribution Channels

-

-

5.4 By Emirates

-

5.4.1 Dubai

-

5.4.2 Abu Dhabi

-

5.4.3 Sharjah

-

5.4.4 Others

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Market Concentration Overview

-

6.2 Company Profiles

-

6.2.1 Inter IKEA Group

-

6.2.2 Home Centre

-

6.2.3 Royal Furniture

-

6.2.4 PAN Emirates Home Furnishings

-

6.2.5 Pottery Barn

-

6.2.6 Danube Home

-

6.2.7 Marina Home

-

6.2.8 Homes R Us

-

6.2.9 Natuzzi

-

6.2.10 Home Box

-

6.2.11 Others (Al Khalid Furniture Factory LLC, Space 3, Tm Furniture Industry)

-

- *List Not Exhaustive

-

6.3 Insights on Key Online Players Operating in the Market (Ebarza, The People of Sand, The Bowery Company, Wysada and Souq.com, MarMarLand, Amazon and others)

-

-

7. FUTURE OF THE MARKET

-

8. DISCLAIMER

UAE Home Furniture Industry Segmentation

A complete background analysis of the UAE home furniture market, which includes an assessment of the parental market, emerging trends in the segments and regional markets, and significant changes in market dynamics and market overview, is covered in the report.

| By Material | |

| Wood Furniture | |

| Metal Furniture | |

| Plastic and Other Furniture |

| By Type | |

| Living Room Furniture | |

| Kitchen Furniture | |

| Dining Room Furniture | |

| Bedroom Furniture | |

| Other Furniture |

| By Distribution Channel | |

| Home Centers | |

| Flagship Stores | |

| Specialty Stores | |

| Online Stores | |

| Other Distribution Channels |

| By Emirates | |

| Dubai | |

| Abu Dhabi | |

| Sharjah | |

| Others |

UAE Home Furniture Market Research FAQs

How big is the UAE Home Furniture Market?

The UAE Home Furniture Market size is expected to reach USD 1.91 billion in 2023 and grow at a CAGR of 3.91% to reach USD 2.31 billion by 2028.

What is the current UAE Home Furniture Market size?

In 2023, the UAE Home Furniture Market size is expected to reach USD 1.91 billion.

Who are the key players in UAE Home Furniture Market?

IKEA, Home Centre, PAN Emirates Home Furnishings and Danube Home are the major companies operating in the UAE Home Furniture Market.

UAE Furniture Industry Report

Statistics for the 2023 UAE Furniture market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. UAE Furniture analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.