Video-as-a-Service Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2021 |

| CAGR | 33.79 % |

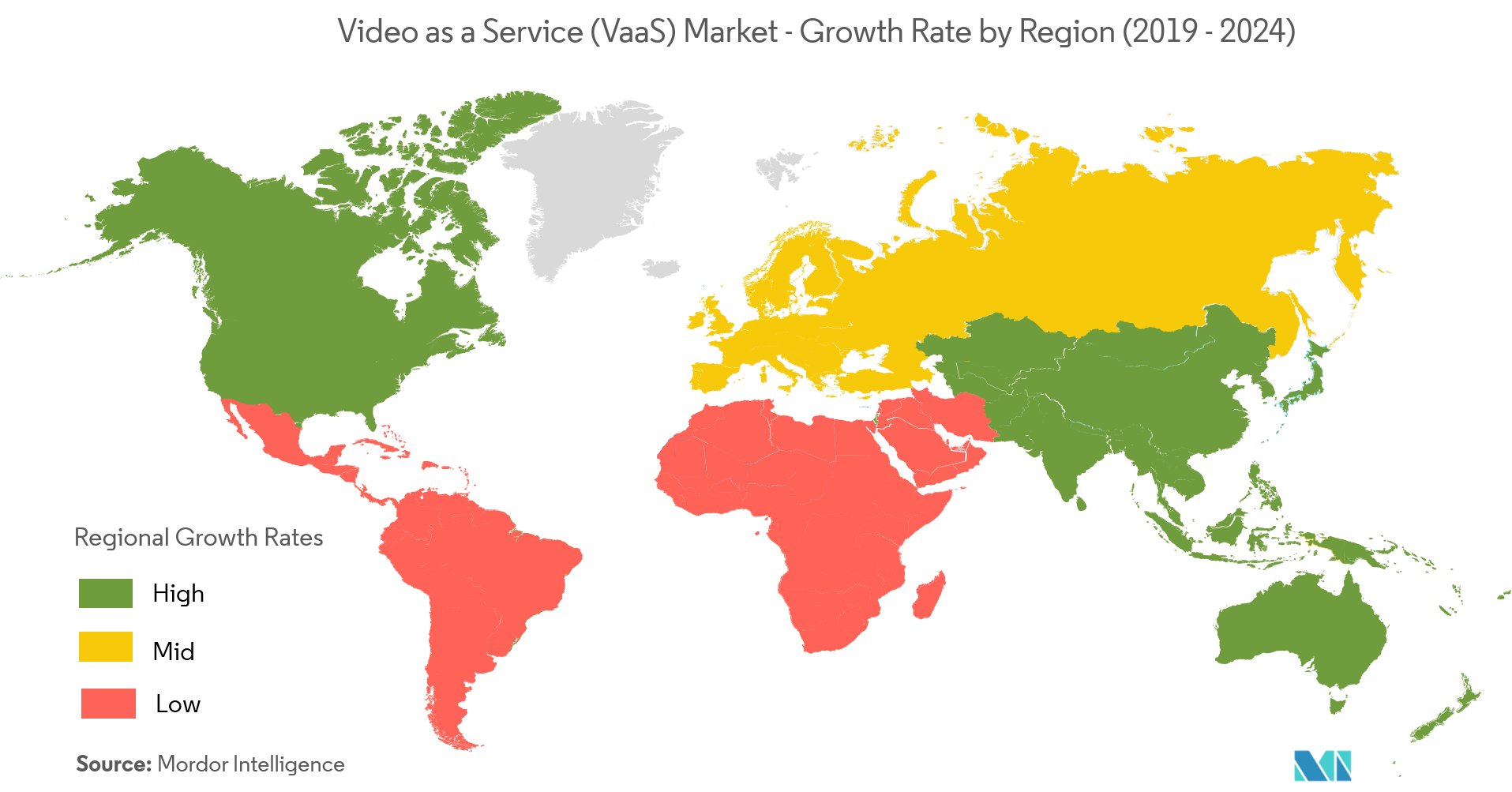

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

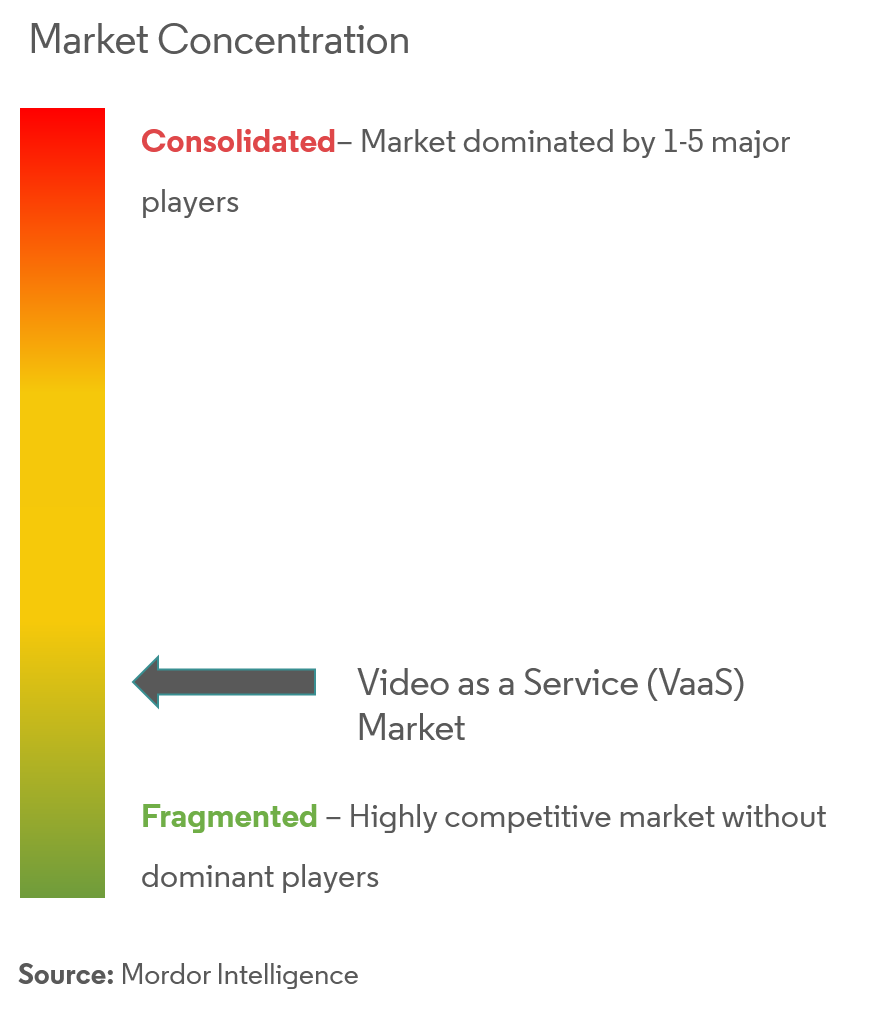

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Video-as-a-Service Market Analysis

The video as a service (VaaS) market registered a CAGR of 33.79% over the forecast period 2021-2026. As mobile working increases, employees are developing remote working skills that use Video Conferencing and Collaboration tools, to drive productivity and help achieve a better work/life balance. The collision of the BYOD and collaboration trends is paving the way for professional Mobile Video Conferencing solutions enabling employees to collaborate with colleagues on-the-go, on whatever device they choose.

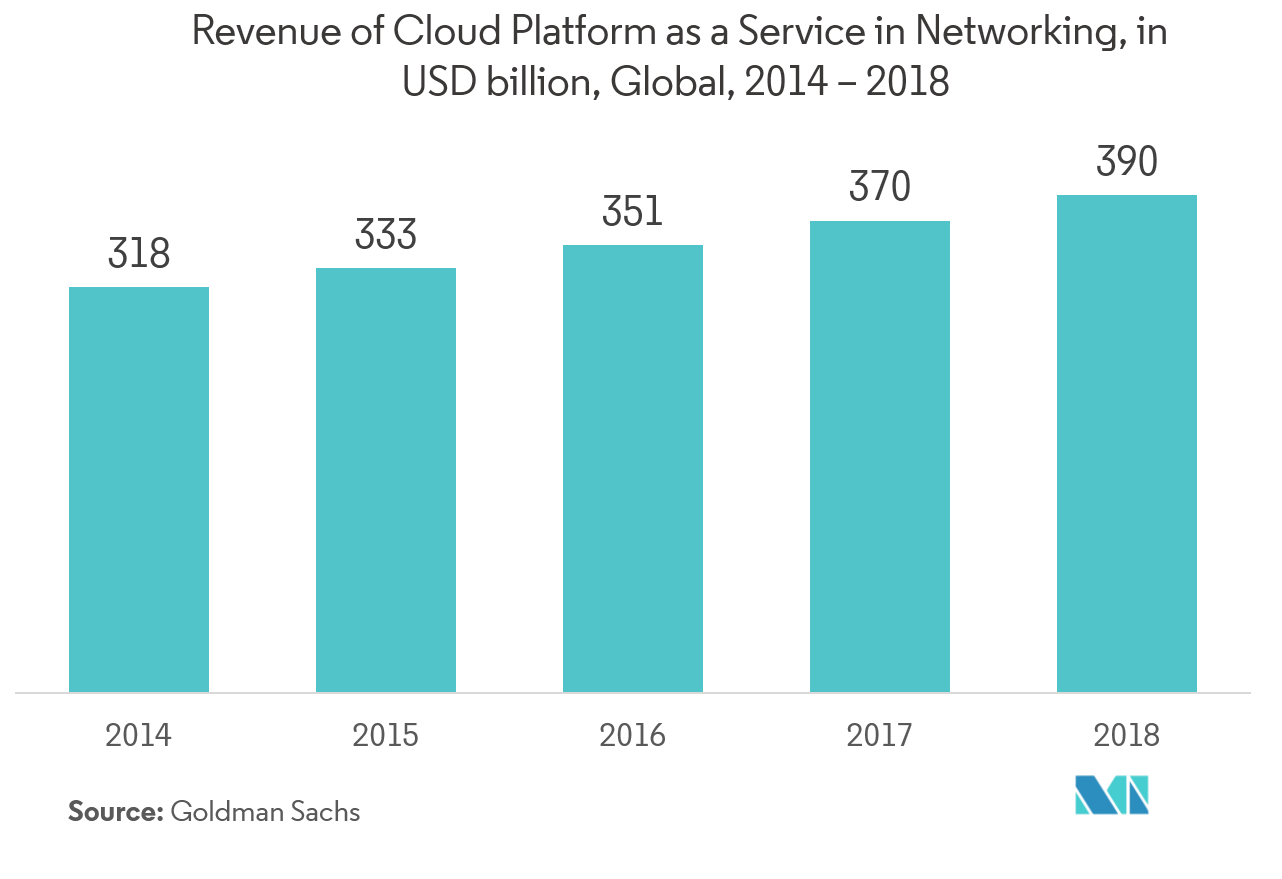

- Increasing investment on cloud-based video services is driving the market. Cloud-based ingestion systems can help automate the process of creating, organizing, and keeping track of the source video files. Also CDNs (Content Delivery Networks) that handle streaming media delivery are in fact cloud-based networks of proxy servers and data centers. CDNs are geographically optimized to provide high availability and high performance, which increases the demand in the market.

- Enabling digital workforce is driving the market. Video conferencing software not only creates a more collaborative meeting culture in the organization, it’s a foundation for enabling today’s digital workforce. Video meetings help teams maintain human connections, irrespective of physical location, which speeds up decision making and improves the ability to collaborate globally.

- High cost of video content creation and validity is restraining the market due to high end camera with professional lighting kit.

Video-as-a-Service Market Trends

This section covers the major market trends shaping the Video-as-a-Service Market according to our research experts:

Network Management Platform to Drive the Market Demand

- As the number of advanced applications continues to expand, importance of managing and monitoring the network increases. The video business is growing faster and Network Function Cloudification (NFC) enables carriers to shift their content distribution networks (CDNs), session border controllers (SBCs), storage, computing, and other functions into the cloud, where one can flexibly scale up network elements and processing to handle the sudden spikes of video services.

- Network provider provides video system health monitoring services to some of the largest retail, banking and transportation organizations in the world. Cloud-based Insight platform gives convenient online access to video network health information, network visibility, asset control, and SLA (service level agreement) performance management.

- Virtual reality, augmented reality, and holograms will become increasingly common, and they will demand even faster networks, with ultra-low latency. Huawei is innovating services and network solutions, which will help carriers build video networks that are cost-effective, high-bandwidth, and highly scalable, because Huawei want to embrace the video era together with telecom carriers.

- With Cisco Virtualized Video Processing one can coordinate virtual video functions such as encoding, transcoding, recording, packaging, encapsulation, and delivery. Service providers and media companies can easily scale video processing workflows to support the video services required for multiservice and multiscreen TV.

Asia-Pacific is Expected to Register a Significant Growth Rate

- Due to growing use of video surveillance in educational institutions, increased adoption of thermal cameras and a rise in wireless IP surveillance are some of the factors which are majorly responsible for the growth of the market.

- White-glove concierge services which is a high touch full-service video conferencing is driving the market in Asia-Pacific, especially in China and Australia. Such services usually provide endpoint management, run test calls, coordinate technical issue resolution with endpoint manufacturers or service agents, and open trouble tickets with the enterprise's network team.

- Huawei in China provides end to end operations and maintenance for high video experience and as for data traffic control, traditional QoS approaches cannot resolve the problem of data congestion when the demand for the same type of video soars. So, networks control individual users and their data flows in order to effectively manage traffic and ensure that the users who are connected have a better video experience.

- China’s three largest video operators, all of which are integrated into larger tech giants, are by far the biggest players in the Asia-Pacific market along with YouTube and Facebook, which increases the growth of the market.

Video-as-a-Service Industry Overview

The video as a service market is fragmented as the global players are innovating their services to provide cost benefit offers to the users, which gives a high rivalry to the market competitiors. Key players are Cisco Systems, Inc., Huawei Technologies Co., Adobe Systems, etc. Recent developments in the market are -

- Jan 2019 - Cisco announced an intent to acquire singularity networks. The Cisco Crosswork Network Automation software portfolio helps service providers automate their networks. It will help to provide reliable, timely, and actionable information about what’s happening in the network 24/7 to deliver premium networked experiences in applications like audio and video.

- May 2019 - At the 2019 World Conference on Ultra HD Video (4K/8K) Industry, Huawei released its all-optical network architecture for ultra-high definition (UHD) video services. This architecture will help build a simplified network with gigabit access, E2E optical hard pipe, and intelligent O&M. It aims to enable a premium UHD video service experience and promote prosperity in the UHD video industry.

Video-as-a-Service Market Leaders

Cisco Systems, Inc.

Huawei Technologies Co., Limited

Adobe Systems

Interoute Communications Limited

Polycom, Inc.

*Disclaimer: Major Players sorted in no particular order

Video-as-a-Service Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

-

4.3.1 Increasing Investment on Cloud-Based Video Services

-

4.3.2 Enabling Digital Workforce

-

-

4.4 Market Restraints

-

4.4.1 High Cost of Video Content Creation and Validity

-

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

-

4.5.1 Threat of New Entrants

-

4.5.2 Bargaining Power of Buyers/Consumers

-

4.5.3 Bargaining Power of Suppliers

-

4.5.4 Threat of Substitute Products

-

4.5.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Platform

-

5.1.1 Application Management

-

5.1.2 Device Management

-

5.1.3 Network Management

-

-

5.2 By Device

-

5.2.1 Mobility Devices

-

5.2.2 Enterprise Computing

-

-

5.3 By Service

-

5.3.1 Managed

-

5.3.2 Professional

-

-

5.4 By Deployment Model

-

5.4.1 Public Cloud

-

5.4.2 Private Cloud

-

5.4.3 Hybrid Cloud

-

-

5.5 By End-user Industry

-

5.5.1 Government and Defense

-

5.5.2 BFSI

-

5.5.3 Healthcare

-

5.5.4 IT & Telecom

-

5.5.5 Media & Entertainment

-

5.5.6 Manufacturing

-

5.5.7 Other End-user Industries

-

-

5.6 Geography

-

5.6.1 North America

-

5.6.2 Europe

-

5.6.3 Asia-Pacific

-

5.6.4 Latin America

-

5.6.5 Middle East & Africa

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

-

6.1.1 Cisco Systems, Inc.

-

6.1.2 Huawei Technologies Co., Limited

-

6.1.3 Adobe Systems

-

6.1.4 Interoute Communications Limited

-

6.1.5 Polycom, Inc.

-

6.1.6 Avaya, Inc.

-

6.1.7 Vidyo, Inc.

-

6.1.8 BlueJeans Network

-

6.1.9 Applied Global Technologies, LLC

-

6.1.10 AVI-SPL, Inc.

-

- *List Not Exhaustive

-

-

7. INVESTMENT ANALYSIS

-

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

Video-as-a-Service Industry Segmentation

The video as a service market is a fully managed visual communication solution complete with high capacity low latency connectivity. Majorly, managed services in small and medium business include video conferencing and video communication, which are used mostly in organizations to run day-to-day business models.

| By Platform | |

| Application Management | |

| Device Management | |

| Network Management |

| By Device | |

| Mobility Devices | |

| Enterprise Computing |

| By Service | |

| Managed | |

| Professional |

| By Deployment Model | |

| Public Cloud | |

| Private Cloud | |

| Hybrid Cloud |

| By End-user Industry | |

| Government and Defense | |

| BFSI | |

| Healthcare | |

| IT & Telecom | |

| Media & Entertainment | |

| Manufacturing | |

| Other End-user Industries |

| Geography | |

| North America | |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Video-as-a-Service Market Research FAQs

What is the current VaaS Market size?

The VaaS Market is projected to register a CAGR of 33.79% during the forecast period (2023-2028).

Who are the key players in VaaS Market?

Cisco Systems, Inc., Huawei Technologies Co., Limited, Adobe Systems, Interoute Communications Limited and Polycom, Inc. are the major companies operating in the VaaS Market.

Which is the fastest growing region in VaaS Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2028).

Which region has the biggest share in VaaS Market?

In 2023, the North America accounts for the largest market share in the VaaS Market.

VaaS Industry Report

Statistics for the 2023 VaaS market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. VaaS analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.