Virtual Sensors Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2021 |

| CAGR | 31.00 % |

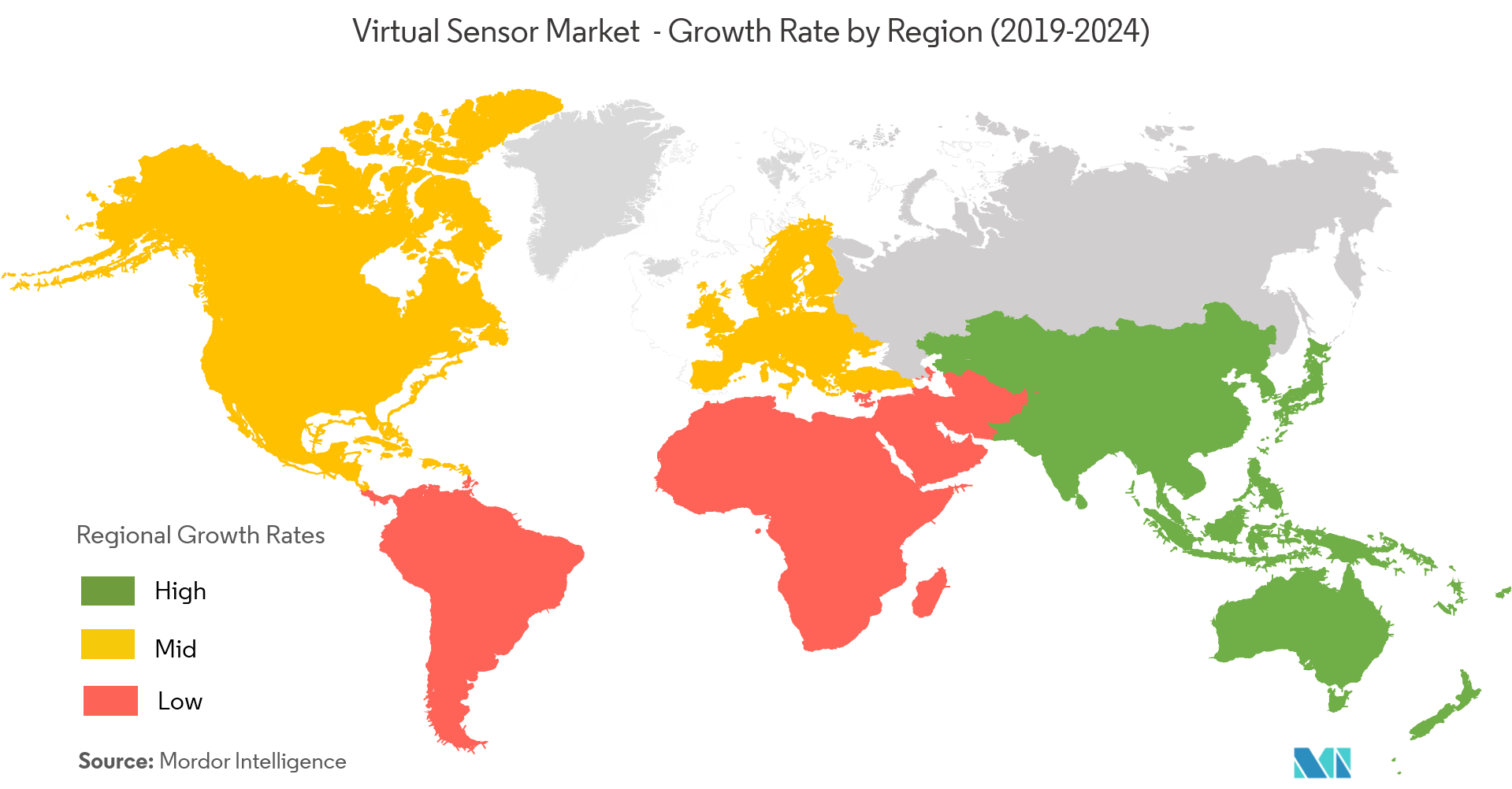

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

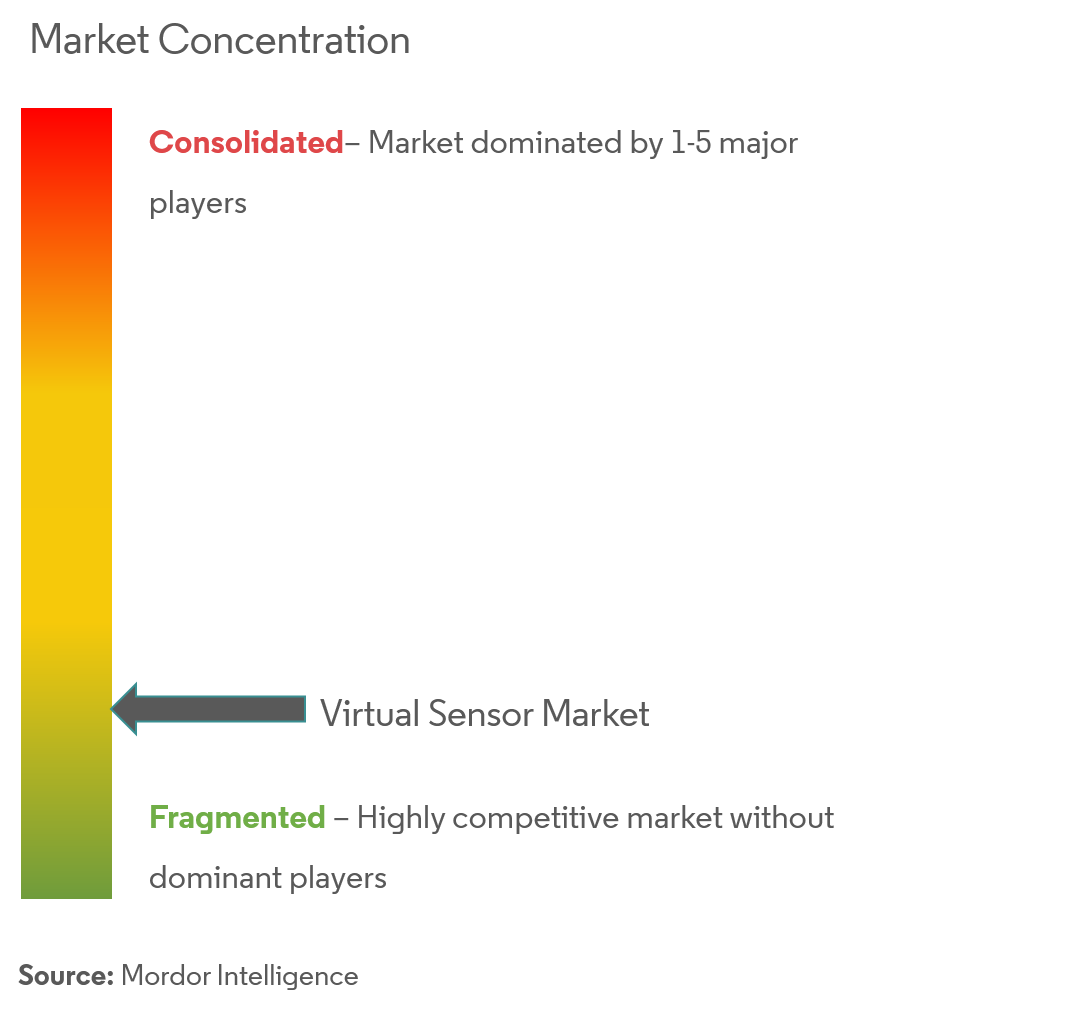

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Virtual Sensors Market Analysis

The virtual sensor market is expected to register a CAGR of 31% over the forecast period (2021 - 2026). Virtual sensing techniques are also called soft sensing, proxy sensing, inferential sensing, or surrogate sensing and are used to provide feasible and economical alternatives to the costly physical measurement instrument. A virtual sensor uses the information available from other measurements and process parameters to calculate an estimate of the quantity of interest.

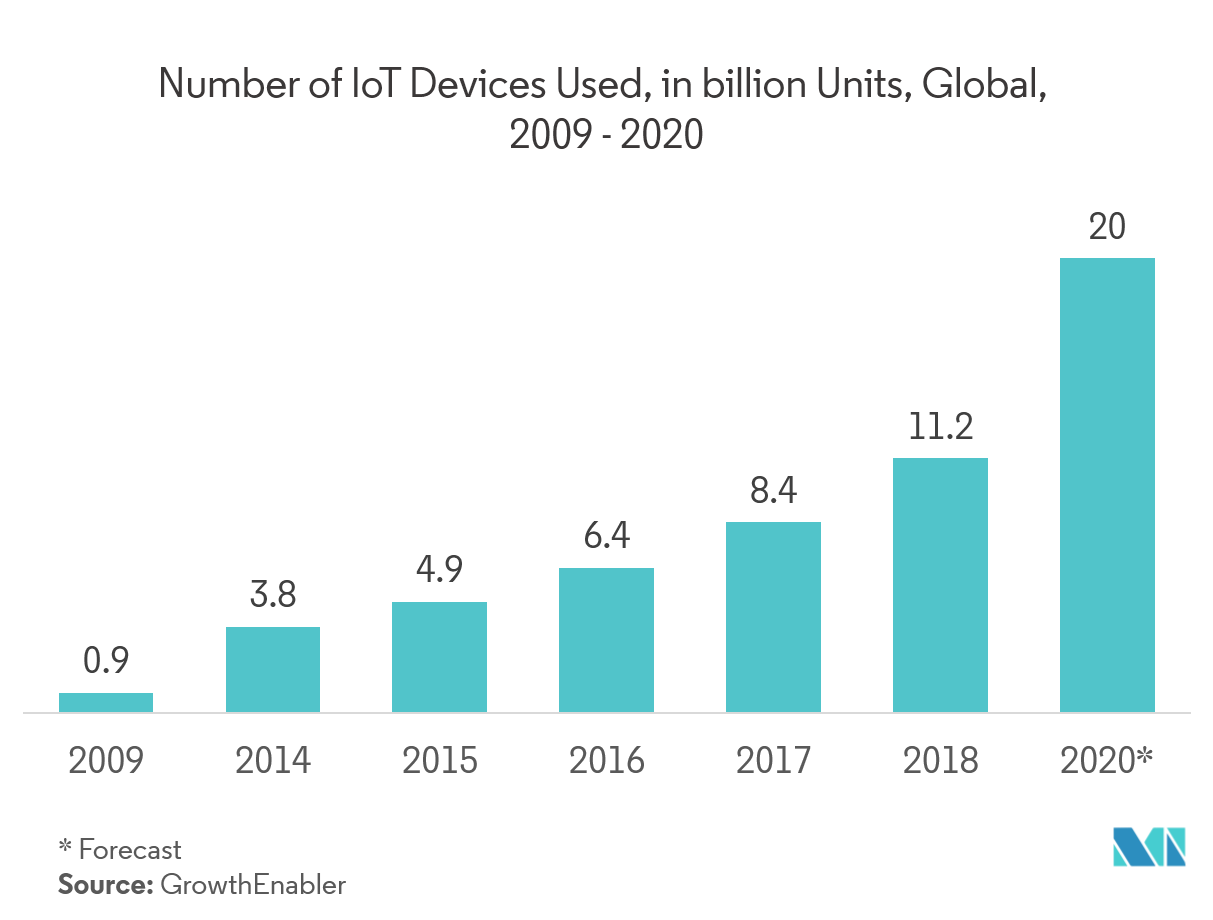

- The major growth drivers responsible for the growth of the virtual sensor market include predictive maintenance and potential reduction in the time and cost compared to physical sensors, and rising adoption of the IoT cloud platforms. There is increasing use of predictive maintenance techniques by manufacturing facilities globally. Increase in efficiency and considerable reduction in time and cost is helping companies opt for virtual sensors than physical sensors.

- The factors hindering the growth of the virtual sensor market are lack of awareness related to the costs and benefits of the adoption of virtual sensors.

Virtual Sensors Market Trends

This section covers the major market trends shaping the Virtual Sensors Market according to our research experts:

Manufacturing Expected to Have Significant Growth

- The manufacturing sector is expected to have significant growth for virtual sensor market. Industrial digitalization is considered to be one of the important criteria for optimizing the manufacturing processes of robots, industrial machines, and processing set-ups.

- Process industry-manufacturers have adopted virtual sensors along with AI and IoT or Original Equipment Manufacturers (OEMs) as the use of these technologies collectively enables machinery designing without using design prototypes, process optimization, remote monitoring, and timely data delivery in the manufacturing plants, which is an essential factor that drives the virtual sensors market for discrete industries.

North America Expected to Have Significant Market Share

- North America is expected to have a significant market share for the virtual sensor market. North America region comprises of developed countries such as the US and Canada and is considered the most advanced region in terms of adopting digital technologies.

- This region is an important hub for consumer electronics products, especially smartphones and wearable devices, in which the sensor technology is used prominently. It is an important market for medical devices for health monitoring applications. The region has the highest number of end users for healthcare wearable devices.

- Due to technological advancements and the willingness to adopt innovative technologies among enterprises, there is a growth of the virtual sensor market in the region. There is a wide presence of key industry players in this region, further offering virtual sensor solutions, and its financial position enables it to invest majorly in the leading tools and technologies for effective business operations.

Virtual Sensors Industry Overview

The virtual sensor market is fragmented with several sensor manufacturers, and they strive to maintain a competitive edge in the market, thereby intensifying the competition in the market. Various innovations are taking place in the market, thus enhancing the growth of the market.

- May 2019 - Elliptic Labs launched inner beauty AI Virtual Smart Sensor, which gives the full screen and cleaner design to OnePlus 7 series smartphones. The INNER BEAUTY AI Virtual Proximity Sensor uses sophisticated software to detect proximity, erasing the need for traditional hardware components while simultaneously enhancing the design and advancing sensor capabilities.

- November 2018 - General Electric launched Predix Edge to help businesses simplify edge-to-cloud computing and enable them to secure the progress of their Industrial Internet of Things (IIoT) initiatives from pilot to production.

- February 2018 - Honeywell announced its latest smart building technology, which connects building personnel with data analytics to help drive operational improvements and efficiencies.

Virtual Sensors Market Leaders

Schneider Electric S.E.

Cisco Systems Inc.

Elliptic Labs AS

General Electric Co.

Siemens AG

*Disclaimer: Major Players sorted in no particular order

Virtual Sensors Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Overview

-

4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

-

4.3.1 Rising Adoption of IoT Cloud Platform

-

4.3.2 Reduction in Time and Cost Compared to Physical Sensors

-

-

4.4 Market Restraints

-

4.4.1 Lack of Awareness Among Consumers

-

-

4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

-

4.6.1 Threat of New Entrants

-

4.6.2 Bargaining Power of Buyers/Consumers

-

4.6.3 Bargaining Power of Suppliers

-

4.6.4 Threat of Substitute Products

-

4.6.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Deployment Mode

-

5.1.1 Cloud

-

5.1.2 On-premise

-

-

5.2 By End-user Industry

-

5.2.1 Oil & Gas

-

5.2.2 Manufacturing

-

5.2.3 Transportation & Automotive

-

5.2.4 Healthcare

-

5.2.5 Defense

-

5.2.6 Other End-user Industries

-

-

5.3 Geography

-

5.3.1 North America

-

5.3.1.1 United States

-

5.3.1.2 Canada

-

-

5.3.2 Europe

-

5.3.2.1 United Kingdom

-

5.3.2.2 Germany

-

5.3.2.3 France

-

5.3.2.4 Rest of Europe

-

-

5.3.3 Asia-Pacific

-

5.3.3.1 China

-

5.3.3.2 Japan

-

5.3.3.3 India

-

5.3.3.4 Rest of Asia-Pacific

-

-

5.3.4 Rest of the World

-

5.3.4.1 Latin America

-

5.3.4.2 Middle-East & Africa

-

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

-

6.1.1 Schneider Electric S.E.

-

6.1.2 Elliptic Labs AS

-

6.1.3 Modelway S.r.l.

-

6.1.4 Cisco Systems Inc.

-

6.1.5 General Electric Co.

-

6.1.6 Siemens AG

-

6.1.7 Exputec GmbH

-

6.1.8 Intelli Dynamics Inc.

-

6.1.9 ANDATA Ltd.

-

6.1.10 Honeywell International Inc.

-

6.1.11 Aspen Technology Inc.

-

6.1.12 Algorithmica Technologies GmbH

-

6.1.13 Tactile Mobility Inc.

-

6.1.14 LMI Technologies Inc.

-

6.1.15 Osisoft LLC

-

- *List Not Exhaustive

-

-

7. INVESTMENT ANALYSIS

-

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

Virtual Sensors Industry Segmentation

A virtual sensor helps to know product properties or process conditions using mathematical models. These mathematical models use other physical sensor readings to calculate the estimated property or condition. These sensors are made for measuring values, which can only be measured extremely hard, very expensively, or even impossible by conventional physical sensors.

| By Deployment Mode | |

| Cloud | |

| On-premise |

| By End-user Industry | |

| Oil & Gas | |

| Manufacturing | |

| Transportation & Automotive | |

| Healthcare | |

| Defense | |

| Other End-user Industries |

| Geography | ||||||

| ||||||

| ||||||

| ||||||

|

Virtual Sensors Market Research FAQs

What is the current Virtual Sensor Market size?

The Virtual Sensor Market is projected to register a CAGR of 31% during the forecast period (2023-2028).

Who are the key players in Virtual Sensor Market?

Schneider Electric S.E., Cisco Systems Inc., Elliptic Labs AS, General Electric Co. and Siemens AG are the major companies operating in the Virtual Sensor Market.

Which is the fastest growing region in Virtual Sensor Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2023-2028).

Which region has the biggest share in Virtual Sensor Market?

In 2023, the North America accounts for the largest market share in the Virtual Sensor Market.

Virtual Sensor Industry Report

Statistics for the 2023 Virtual Sensor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Virtual Sensor analysis includes a market forecast outlook to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.