North America Protein Bar Market Size

| Study Period | 2018 - 2028 |

| Base Year For Estimation | 2022 |

| Forecast Data Period | 2024 - 2028 |

| Historical Data Period | 2018 - 2021 |

| CAGR | 6.25 % |

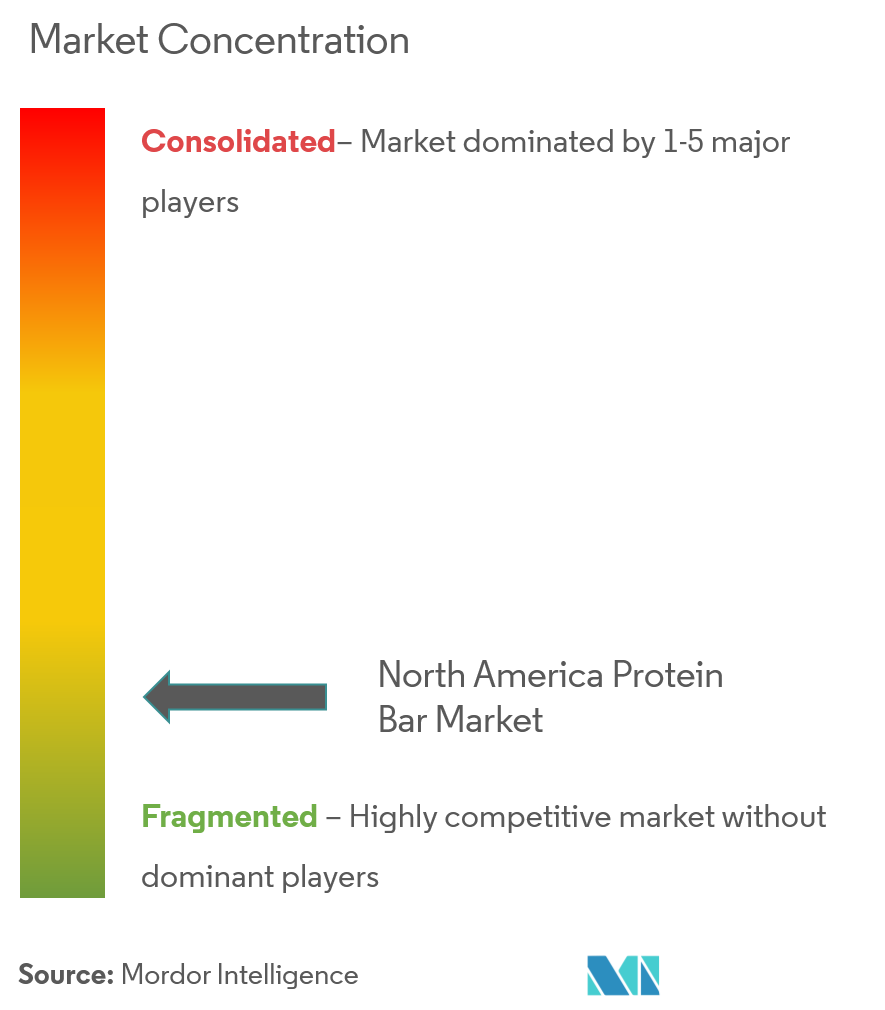

| Market Concentration | Low |

Major Players.webp)

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

North America Protein Bar Market Analysis

The North American protein bar market is expected to register a CAGR of 6.25% in the upcoming five years.

- As consumers’ interest in products that support the overall maintenance of health and wellness increased, the ambiguous situation across the world urged them to increase their nutritional intake and consume safer and healthier foods.

- Also, due to the work-from-home and stay-at-home trends, people began working out at their homes, and hence, the demand for low-sugar and carb protein bars was boosted, and companies also focused on the same. For instance, in 2021, plant-based food maker Tattooed Chef completed the acquisition of Belmont Confections Inc., a private-label co-manufacturer of snack bars, for approximately USD 18 million in cash in Paramount, California.

- The major consumers include athletes and consumers who want to have a wholesome meal without the trouble of cooking. Consumers prefer buying protein bars for various purposes, such as weight management, improving muscle mass, and increasing energy. Sedentary lifestyles and the hectic work schedules of Americans are leading them to look for healthier alternatives present in the market. As a result, consumers are replacing conventional snacks with snack bars, including protein bars.

- The North American protein bar market is growing and witnessing an ever-expanding array of flavors and healthy varieties. Many consumers are reaching for protein bars to supplement their regular eating habits, while some time-pressed consumers even substitute a bar or two for a snack.

- Moreover, recommendations by fitness clubs for protein bars acting as a substitute for regular meals have skyrocketed the sales of these products. With an increasing number of health clubs and surging awareness about protein bars, the market is expected to witness a rise in demand during the forecast period.

North America Protein Bar Market Trends

Evolving Fitness Trends in the Region Boosting Demand For Protein-rich Diets

- The United States and Canada are poised to offer promising growth opportunities in the wake of an increasing number of gyms, fitness enthusiasts, health clubs, and fitness training centers. The evolving fitness trend in the region is expected to boost the growth of associated markets, including protein bars.

- Moreover, developed countries like the United States have experienced a considerable increase in the number of consumers opting for fitness and health clubs, progressively becoming the market's target consumer. For instance, in 2022, there were around 31,028 health clubs in the United States. Since protein is an important element supporting fitness, consumers opt for weight management and energy products, such as protein bars, to remain fit and healthy.

- Protein bars are gaining prominence among health-conscious consumers due to their high nutrition levels. In addition, including bars with meals is anticipated to boost protein intake without increasing calorie or carbohydrate intake. Due to their active lifestyles and demanding work schedules, Americans are increasingly searching the market for healthier options. As a result, customers are turning to snack bars, notably protein bars, instead of traditional snacks.

United States Accounts for the Largest Market Share

- The United States protein bar market benefits from the diversified retail distribution channel, encouraging planned and impulse purchases. The population in the United States is focusing on improving health conditions, and the protein diet is considered one of the potential solutions to serve this purpose.

- The rise of protein-enriched bars is associated with the region's between-meal-snacking cultures. Consumers seek nutritious and convenient foods that can double as an on-the-go meal. According to the International Food Information Council's (IFIC) 2020 Food and Health Survey, approximately 90% of Americans reported snacking at least once weekly.

- Furthermore, the healthy snacking trend in the United States is also increasing to address various health issues, including high cholesterol, obesity, high blood sugar, and others. As consumers' concern about their health increases, this extends beyond nutrition to clean-label ingredient bars that are perceived to be healthier.

- Thus, the demand for protein bars with no artificial flavors, colors, preservatives, and non-genetically modified organism (GMO) products is increasing. Thus, in the United States, plant-based protein bars are witnessing high demand.

North America Protein Bar Industry Overview

The North American protein bar market is highly fragmented due to the presence of a large number of prominent players. Major players include General Mills Inc., Kellogg Company, Caveman Foods LLC, Danone, Mars Incorporated, Premier Nutrition Corporation, Abbott Nutrition Manufacturing Inc., Post Holding Inc., and Atkins Nutritionals Inc., among others. These industry participants are employing strategies like business expansions, and mergers and acquisitions to expand their regional presence across the global market. The market-leading brands are increasingly focusing on product line expansions to emerge as category winners.

North America Protein Bar Market Leaders

General Mills Inc.

Kellogg Co.

Caveman Foods LLC

MARS Incorporated

Premier Nutrition Corporation

*Disclaimer: Major Players sorted in no particular order

North America Protein Bar Market News

- December 2022: Mars Incorporated launched Snickers branded protein bars called Hi Protein. The company claims that the bar tastes like a traditional Snickers bar but includes 20 grams of protein and four grams of total sugar.

- August 2022: Clif Bar was acquired by Mondelez International, Inc. With leading brands like Clif, Clif Kid, and Luna complementing the company's refrigerated snacking business Perfect Snacks in the United States and leading performance nutrition business Grenade in the United Kingdom, the acquisition is anticipated to increase Mondelez International's global snack bar business to more than USD 1 billion.

- June 2021: GenTech Holdings Inc., an emerging player in the high-end premium coffee and functional foods categories, reached an agreement to acquire NxtBar LLC, a Charlotte, NC-based maker of paleo- and keto-friendly nutrition bars in Wheat Ridge, Colorado, United States.

North America Protein Bar Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 By Distribution Channel

5.1.1 Hypermarkets/Supermarkets

5.1.2 Conventional Stores

5.1.3 Online Channels

5.1.4 Specialty Retailers

5.1.5 Other Distribution Channels

5.2 By Geography

5.2.1 United States

5.2.2 Canada

5.2.3 Mexico

5.2.4 Rest of North America

6. COMPETITIVE LANDSCAPE

6.1 Most Adopted Strategies

6.2 Market Share Analysis

6.3 Company Profiles

6.3.1 General Mills Inc.

6.3.2 Kellogg Company

6.3.3 Caveman Foods LLC

6.3.4 Mars Incorporated

6.3.5 Premier Nutrition Corporation

6.3.6 Abbott Nutrition Manufacturing Inc.

6.3.7 Post Holdings Inc.

6.3.8 Atkins Nutritionals Inc.

6.3.9 Quest Nutrition LLC

6.3.10 Hormel Foods Corporation

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

North America Protein Bar Industry Segmentation

Protein bars are nutrition bars that contain a high proportion of protein to carbohydrates or fats.

The North American protein bar market is segmented by distributional channels into hypermarkets/supermarkets, convenience stores, online channels, specialty retailers, and other distribution channels. Further, the study covers the country-level analysis of the major countries, so, by geography, the market is segmented into the United States, Canada, Mexico, and the Rest of North America.

For each segment, the market sizing and forecasts have been done on the basis of value (in USD million).

| By Distribution Channel | |

| Hypermarkets/Supermarkets | |

| Conventional Stores | |

| Online Channels | |

| Specialty Retailers | |

| Other Distribution Channels |

| By Geography | |

| United States | |

| Canada | |

| Mexico | |

| Rest of North America |

North America Protein Bar Market Research FAQs

What is the current North America Protein Bar Market size?

The North America Protein Bar Market is projected to register a CAGR of 6.25% during the forecast period (2023-2028).

Who are the key players in North America Protein Bar Market?

General Mills Inc., Kellogg Co., Caveman Foods LLC, MARS Incorporated and Premier Nutrition Corporation are the major companies operating in the North America Protein Bar Market.

North America Protein Bar Industry Report

Statistics for the 2023 North America Protein Bar market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Protein Bar analysis includes a market forecast outlook to for 2023 to 2028 and historical overview. Get a sample of this industry analysis as a free report PDF download.